LTL and Freight Transportation Overview with Old Dominion Freight Line

Logistics Management Group News Editor Jeff Berman recently spoke with Dave Bates, senior vice president of operations, for Thomasville, North Carolina-based less-than-truckload services provider Old Dominion Freight Line (ODFL).

Dave Bates, senior vice president of operations, Old Dominion Freight Line provided Berman with a detailed overview of the LTL and freight transportation markets, including the freight economy, how e-commerce continues to impact the LTL market, and 2021 Peak Season prospects, among others. Their conversation follows below.

LM: How you describe the current state of the freight economy?

Dave Bates: I would start out by saying there is a big-time boom, in terms of a real strong freight economy right now. This is my 35th year of being in LTL trucking, and I have never seen anything like this before.

When we talk about capacity, we talk about it in three different ways. We look at our people, our equipment, and the number of doors we have in our service centers. All of those are being challenged right now?

LM: In what ways?

Bates: One factor is that everybody else is busy and needing to hire people, from a people standpoint. From an equipment standpoint…everybody needs additional equipment, and that is putting a lot of stress on the tractor and trailer manufacturers, and forklift manufacturers, too.

We are seeing some tight capacity there as well and are getting what we need, but shortages of certain types of things—whether it be aluminum or metal, or computer chips—is delaying some of the equipment we are trying to get.

And then, of course, the [dock] doors, too. We are wide open with our real estate investments and have always been at the forefront of doing that.

We have never really taken the foot off of the gas, knowing that we want to keep expanding our network to be able to build our service center and door capacity.

The challenge we are running into now is that in select markets, where it is harder to find commercial real estate, and if you do find something, it often seems like someone does not want a trucking company near them so they kind of push back. We are facing that challenge as well.

Most of ODFL’s decisions as they relate to where and when to open up a service center are based on metrics included in what a door pressure report, which measures the [number] of shipments pushing across each dock door over a period of time.

As we see those numbers escalating in certain markets, that triggers the movement for some type of expansion or spin-off of a certain service center in that market.

That is how we gauge what we have done over the years, however, with things as tight as they have been with finding real estate, we have had property come available, or even a vacant service center come available, and we may not be ready today to expand in that market, but we might in the next four-to-five years so we will jump on something just to be able to have that resource when we need it.

LM: How do you view the impact of e-commerce on the LTL market?

Bates: We are not a big player in that space, unless it is a heavyweight-type shipment. Most of this stuff is made up of packages deliveries handled by the USPS, FedEx, or UPS small packages or delivery. As it affects the LTL market, we are seeing our business going to the distribution centers of companies like Walmart, Target, and Amazon.

That business is really strong for us. I know it is strong for us in those big box DC-types of places. The other part of that—and maybe this is more reflective on the specific DC or region where these DCs are—is that we are seeing them get extremely backed up with being able to get us our trailers back.

So, we will load a full trailer for a certain DC and send it over there today, and we might have ten trailers there waiting to be unloaded and it might take us ten days or up to two weeks to get them back, and that become a real strain on our equipment. What we are hearing from them is that they are backed up because they cannot find warehouse help to get the trucks unloaded in a timely manner.

LM: How would you describe some of the key lessons learned from the pandemic, from an LTL perspective?

Bates: Well, like every other carrier, at the onset of the pandemic, it was new to all of us, and we had no idea how long this thing was going to last. So, we had to make some drastic decisions, specifically as it related to headcount to right-size our business to the huge drop in business we experienced immediately.

Most of that, of course, happened because other businesses were forced to shut down and there was so much unknown about it. We had to furlough more than 2,000 employees and covered their health benefits for 90 days, because, at some point, we knew we would need them back.

We really wanted to keep them engaged with the company and let them know we cared about them and want them back. This way it could be a smoother transition when they came back rather than cutting them off of the payroll.

That was challenging for us, and, looking back, we may not be as aggressive with the headcount if something was to happen again with the pandemic…it has been a struggle to get people. Most of those people did come back.

We were aggressive and needed to be and we absolutely needed to right-size the headcount for our business but maybe next time we don’t do it as deep as we did. It was challenging to get people back on board, when the business levels picked up.

LM: How are you viewing the 2021 Peak Season, given that the pandemic created a “Peak Season all of the time” type of situation?

Bates: We are coming off of 2020, which was a disaster, for the most part, due to the pandemic. In 2021, we are seeing extraordinary amounts of percentage growth both from a tonnage standpoint and a shipment count standpoint, and revenue.

As it relates to operations, we are looking at tonnage and shipments, because that is how many people we need and how many trucks we need to move our freight.

We are seeing freight levels I have never seen before in my 25 years at ODFL. That is super-challenging for us, and I am afraid we are not quite there yet.

I think the peak is still ahead of us. We have had a real strong summer, and I think we are still looking at some peak levels coming up in the next couple of months.

LM: Given all the supply chain issues, at the moment, how long would you say it will take for all of these issues to work their way through, if you had to make a cautious guess?

Bates: Very cautiously, I think we will see a peak in the fall, and I think we will see things level out, as we get through the holiday months and into the first quarter or second quarter of next year. But there are so many factors that are going to come into play like: What is going to happen with Covid? Do we stop paying people to stay at home and force them back into the workforce?

How much will inflation affect consumer spending? All of these factors that are hanging out there, what is going to happen? When we get into the second quarter of next year, that will be the start of the political cycle for mid-term elections, which will be a factor as well.

Coming off of 2021, 2022 is going to be interesting, to say the least, because there are so many things that are going to be in play next year.

LM: How do you view the current LTL pricing environment?

Bates: I think that because we have so much demand for carrier services, that rates are as strong as they have ever been for carriers. At ODFL, we have always felt like we have offered the best value for the price of freight in the industry. We know we charge a premium price, but we also know we charge that because we offer a premium service.

Our rates have been strong. When the industry loosens up, customers become a little bit thrifty in what they want to pay with freight charges…maybe they give up a little bit of service to save a little bit on freight costs.

We would lose business sometimes because customers want to save money on freight, but we are not seeing that right now. We are having customers come to us and say:

“in this tight capacity, ODFL, you are still offering the best service and are still giving us claims-free service, making our pickups timely, and we will pay what we have to pay to use your services.”

LM: How do you view the current state of the spot market, given the high level of activity it is seeing on the truckload side, as it related to securing capacity?

Bates: We are tight now, there is no doubt about it right now. We still feel like we are doing everything our customers are asking us to do. And we also tell our customers that because things are tight, we cannot take your truckload business because you cannot find a truckload carrier. We find that happening every day, and we have customers that we spot multiple trailers that they load their LTL shipments for us on.

Every day, we are seeing them slip a 35,000- or 40,000-pound shipment on, trying to get it in our network because they cannot find truckload carriers. So, we have to find a carrier to pick it up at our dock or we have to bring it back to the shipper. We cannot add that truckload capacity into our LTL network. For certain lanes on shorter-haul stuff, we can sometimes mix it into our normal operations.

LM: What are your shipper LTL customers telling you, in terms of what their biggest pain points are, or needing most from a carrier like ODFL?

Bates: In our industry, over the past few years, there has been a big push towards big box retail receiving DCs, with on-time deliveries and things like Walmart’s on-time in full (OTIF), and other retailers using a required arrival date (RAD) or an MABD (must arrive by date).

There is a big push for vendors to meet their customers’ expectations of having a shipment deliver on a specific day or at a specific time. And there is a charge back, if the vendor does not get it there. Regardless of who is at fault, there is a charge back as a percent of the invoice.

A lot of times we are seeing that in the 3%-to-3.5% range. If a vendor has a $100,000 invoice for a shipment it is moving, and it is late, 3% of that is taken right off of the invoice and not paid back to the vendor. Those customers have come to us, asking us for help in managing through the dynamic this has become in this type of business we are hauling.

We have actually put together a whole project team here in our corporate office that does nothing but manage projects or certain customers’ business that has this requirement of [a shipment] that must arrive at a certain time.

We have had customers swarm us to handle this type of business, because we give it the extra attention and they pay a little bit more for it, but we give it the extra attention and get it there on time and we are saving their vendor charge backs.

Related White Paper

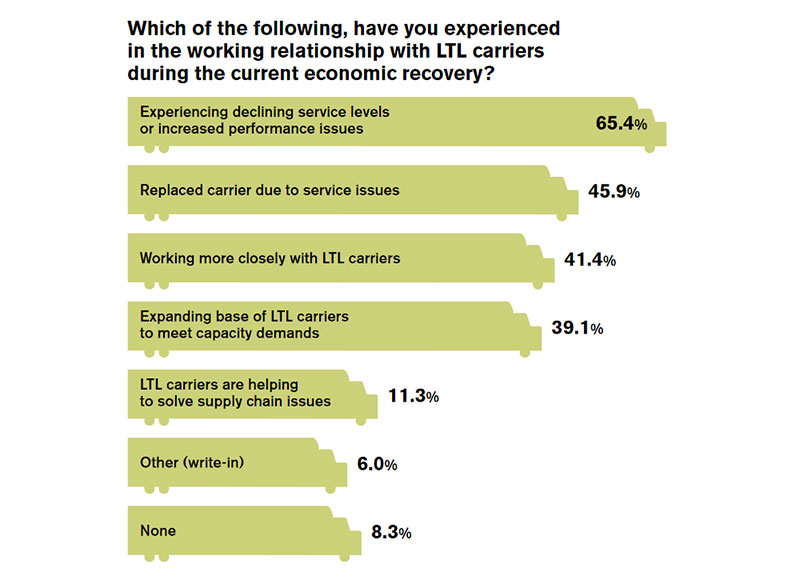

How Carrier Performance is Impacting Transportation Operations

New survey explores the key freight challenges that shippers are dealing with and the various ways that carrier performance affects supply chains across different industries. Download Now!

Article Topics

Old Dominion Freight Line News & Resources

Ranking the Top 50 Trucking Companies of 2024 Top 50 Trucking Companies 2024: Accept the challenge and adapt Old Dominion Freight Line issues February operating metrics LTL Update: Enter the post-Yellow world ODFL issues November operating metrics Estes’ $1.52 billion bid beats ODFL’s bankruptcy offer for Yellow terminals Old Dominion Freight Line issues third quarter operating metrics update More Old Dominion Freight LineLatest in Transportation

Ranking the World’s 10 Biggest Supply Chains The Top 10 Risks Facing Supply Chain Professionals Walmart’s Latest Service: Ultra Late-Night Delivery City of Baltimore Files Lawsuit to Recoup Money for Collapsed Bridge The Era of Self-Driving Tractor-Trailers Set to Begin Is the Trailers as a Service (TaaS) Model Right For Your Business? Why Grocery Shoppers are Leaving Stores to Buy Their Food Online More TransportationAbout the Author