Why Ship Intermodal? Because today it’s more than Just an Alternative to Truckload

Intermodal can be a key ingredient to any transportation strategy to move an organization toward a multimodal strategy for scalability, flexibility, mitigation of risk and business continuity.

By now you probably have heard the standard benefits of choosing an intermodal service, as compared to shipping your freight via a truck:

- Intermodal delivers transit times that are comparable to over-the-road options, along with over 98% on-time

- Reduces emissions

- Saves fuel

- Relieves highway congestion

- Reduces supply chain costs

- Enables you to reach new markets

- Expands capacity, without requiring investment in additional equipment

Some of the numbers behind the above comments include:

- One train moves 280 trucks

- For every 1.0 million intermodal loads, there are 10,000 trucks pulled off the road

- Intermodal rail can move 1.0 ton of freight nearly 500 miles with a single gallon of fuel

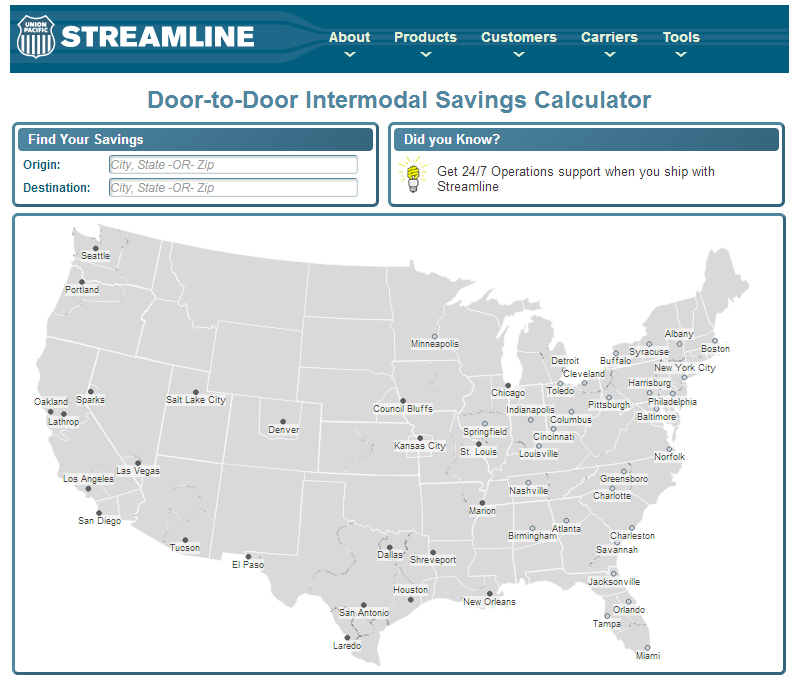

These are all great marketing lines and stats, but just as in sports, games are not won on stats, but when the game is played. (Through our UP-Streamline co-marketing partnership, IDS Transportation is able to offer the Door-to-Door Intermodal Savings Calculator).

As one of the premier IMC’s in North America, IDS Transportation Services continues to see shippers on the sidelines waiting for the “best” time to jump into the intermodal game.

Well, after attending the 2013 JOC Inland Conference last week in Kansas City, we believe there is no better time than now to embrace an intermodal strategy.

The Journal of Commerce put a number of truckload and LTL executives up on stage to share their vision on the future of the freight industry; what their companies are doing about it; and what shippers should be considering in their transportation strategy.

Below are a few of the sound bites the 400 JOC conference attendees heard, as it relates to domestic intermodal:

- From Jack Holmes, President of UPS, “the capacity crunch is just around the corner. I know, I know you are skeptical because you have heard this line for the past three years, but please listen to us now. The capacity crunch is truly about ready to reveal itself, so you need to be planning now”.

- The industry average LTL weight is increasing, which is an indication some truckload freight is being moved to LTL out of necessity.

- Intermodal is not a mode, but a strategic advantage that brings: scalability, flexibility, mitigates risk and drives business continuity.

- Any uptick in demand is going to drive serious issues in TL and LTL capacity.

- Carriers are focused more than ever on ROI. They do not want to be caught in another 2008 situation again, so building market share for the sake of market share is no longer a strategy in the freight industry. As a result, carriers are not adding capacity.

In addition to listening to the supply and capacity side stories from various asset executives, our EVP, Rick LaGore, had the opportunity to moderate a conference panel addressing price trends in the truckload and intermodal market.

The panel consisted of representatives from FTR Associates (Larry Gross), DAT (Mark Montague) and CASS Systems (Frank Cirimele). The panel brought additional light to the domestic intermodal market with the following comments:

- The slow growing economy has kept truck supply and demand in balance, which in turn, has kept rates in check.

- Trucking is in the midst of a wave of new regulations that will have a cumulative effect on being almost 1.2 million drivers short by the end of 2016, with HOS being only 1 of 27 new regulations.

- The various panel members were predicting truck rates will go up anywhere between 4% to 7% in 2014.

- Peak season for domestic intermodal is becoming less and less of an issue.

- Domestic intermodal is the fastest growing segment of the transportation market, with it expected to be up 6.4% in 2013.

- While intermodal is increasing, it is a $10.0 billion market, while truckload is a $200 billion market.

- Based on predictive truckload indexes, we can expect to see truckload rates for the next several quarters to rise faster than the economy’s rate of growth.

- Decreasing length of haul and less time sensitive freight is moving to rail.

- MAP 21 will place some pressure on brokers to raise margins.

- Transit time may add a day or match transit times of single drives, yet save 15% to 18%.

- Intermodal is not for every lane and situation, but where it does work DAT confirmed a major impact on spot market truckload pricing in rail competitive lanes.

- DAT has witnessed a downward trend in the length of haul for the 7,600 most active lanes.

- In lanes most likely to be impacted by the CSA rule change had a 4.0% increase vs. the 2.1% overall increase. The lanes not likely to have much of an impact increased 1.5%.

Overall, transportation strategy is about choosing the right mode for the situation, which provides the best service at the least cost. From what we learned at the JOC Inland Conference, the transportation industry is changing and there are challenges ahead that will test each company’s supply chain strategy.

If these challenges are looked at as opportunities, transportation professionals will make major contributions to the success of their companies.

While this particular blog is focused on intermodal, which is our strength, please do not walk away from this blog thinking intermodal is the only place to focus. Outsourced Transportation Management strategies, along with small package, LTL, truckload, air and ocean are all undergoing market changes that hold opportunities.

Intermodal can be a key ingredient to any transportation strategy to move an organization toward a multimodal strategy for scalability, flexibility, mitigation of risk and business continuity. The reason the time for intermodal is now is it is no longer an alternative to truckload.

After billions of dollars of investment by the Class I Railroads, intermodal is now a mode that stands on its own and addresses many of the freight industry challenges. As the asset carries have found, intermodal can be used to:

- Augment capacity to truckload lanes.

- Run the line hauls of LTL consolidation runs.

- Transition 100% of truckload traffic to intermodal on the lanes where it is a fit.

The asset carrier have already started the transition to intermodal, which is a clear sign the freight market is changing. With that said, shippers need to take note and respond in kind for the lanes that make sense for them.

In the end, transportation is part science and part art. The art comes into play because every business is different. There is not a one size fit all freight strategy.

Source: IDS Transportation Services, LLC Blog

Best Practices: Rail & Intermodal Continue to Improve Service and Create Value for Shippers