Antitrust Bill Could Drive Amazon to Sell Logistics Division

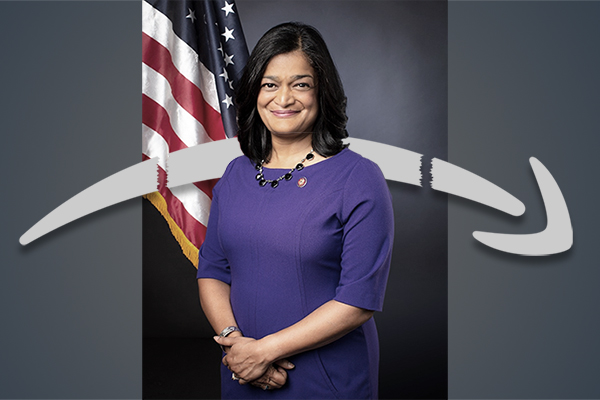

The logistics industry could see a significant shakeup, as congresswoman Pramila Jayapal proposes new legislation focused on antitrust and accountability for anti-competitive practices.

Proposed Bill

Amazon could be forced to sell its valuable logistics services division - the network of warehouses and delivery hubs around the country that power quick delivery of online orders - under antitrust legislation proposed by a congresswoman from Amazon’s hometown of Seattle.

- Washington Democrat Pramila Jayapal has proposed a bill with bipartisan support that would prevent Amazon from luring sellers to use its logistics services in exchange for preferential treatment on its busy web store

- Nearly 85% of Amazon’s biggest sellers use its Fulfillment by Amazon service, paying the online retailer fees for warehouse storage, packing, and shipping of their products, according to a report last October from Democratic staff on the House Judiciary Committee’s antitrust panel.

Jayapal’s bill was introduced on June 11 and will be considered on Wednesday by the Judiciary Committee along with five other bipartisan antitrust reform bills, with votes to advance the measures to the House floor expected this week. There’s no Senate companion for the legislation, and support in that chamber is unclear, clouding its prospects.

While the bill may never become law, it’s the clearest indication yet how lawmakers are gunning to rein in the market power of Amazon, where U.S. shoppers will spend $386 billion this year and which captures 41 cents of every dollar spent online, according to eMarketer. Amazon’s promise of fast delivery helped it become the dominant online retailer in the U.S., Amazon also rakes in more US e-commerce sales than the next 9 biggest US etailers combined.

Amazon’s Logistics Business

Amazon’s logistics business will be worth as much as $230 billion in 2025, more than Coca-Cola Co., according to a research note last year from Bank of America Corp.

Referring to the House Democrats’ investigation and report, Jayapal spokesman Chris Evans. said;

“The bipartisan Ending Platform Monopolies Act requires dominant platforms including Amazon to divest lines of business - such as Fulfillment by Amazon - where the platform’s gatekeeper power allows it to favor its own services,” said Jayapal spokesman Chris Evans. “Numerous third-party sellers reported feeling that they had no choice but to pay for Fulfillment by Amazon in order to sell their products.”

Jayapal’s legislation shows how some lawmakers want to blunt Amazon’s rapid growth in the logistics industry, which poses a threat to United Parcel Service Inc. and FedEx Corp. Amazon has been reducing its reliance on its longtime partners, including the U.S. Postal Service, in favor of delivering products on its own.

More than half of the products sold on Amazon come from independent merchants who pay Amazon a commission on each sale. Merchants can handle packing and shipping items on their own, but many say they use Amazon’s service and pay Amazon additional fees because that gives their products better placement on the site and boosts their sales, according to the Democrats’ report. Amazon’s third-party seller service revenue, which includes commissions and logistics, exceeded $80 billion in 2020, nearly double the $45 billion in sales from its cloud-computing division Amazon Web Services.

Amazon uses algorithms to determine which products appear most prominently on the site in response to keyword search terms entered by shoppers. Much of the most visible space goes to paid advertisers. Mixed in are products that Amazon believes are preferred by consumers. Exactly how the algorithm works is a well-kept secret. It includes factors like price, the reputation of the merchant, and whether Amazon can deliver it to the customer quickly. Merchants have said they use Amazon’s logistics services as a way to get better visibility on the cluttered site.

Search SC24/7: Amazon Logistics

In a 2019 letter to federal lawmakers, an online merchant accused Amazon of forcing him and other sellers to use the company’s expensive logistics services, which in turn forces them to raise prices for consumers. The letter accused Amazon of “tying” its marketplace and logistics services together, a potential antitrust violation in which a company uses dominance in one market to give itself an advantage in another market where it’s less established.

Sellers said in interviews that delivering products on their own was potentially less expensive than Amazon’s services. But most said they used Fulfillment by Amazon anyway to avoid being punished for late deliveries and other performance issues and because doing so meant their products had more visibility on the site. In the letter, the merchant said Amazon had raised its fees by 20% over the preceding four years until they were 35% more than competing services. Amazon disputed the allegations.

Per Bloomberg:

- Jayapal’s bill was introduced on June 11 and will be considered on Wednesday by the Judiciary Committee along with five other bipartisan antitrust reform bills, with votes to advance the measures to the House floor expected this week. There’s no Senate companion for the legislation, and support in that chamber is unclear, clouding its prospects.

- The legislation is part of a larger push in Washington to curb what critics describe as anti-competitive practices in the tech industry. The Justice Department and several state attorneys general have sued Google, while the Federal Trade Commission is suing Facebook and is investigating Amazon. President Joe Biden named Lina Khan, who rose to prominence criticizing Amazon’s business practices, to chair the FTC.

“Not only is self-regulation by Big Tech patently ineffective, but it also comes at the direct expense of workers, consumers, small businesses, our local communities, and the free press,” said House Antitrust Subcommittee Vice Chair Pramila Jayapal.

“From Amazon and Facebook to Google and Apple, it is clear that these unregulated tech giants have become too big to care and too powerful to ever put people over profits. By reasserting the power of Congress, our landmark bipartisan bills rein in anti-competitive behavior, prevent monopolistic practices, and restore fairness and competition while finally leveling the playing field and allowing innovation to thrive.”

Breaking News: Tech industry pushes for delay in antitrust legislation

Related 'Amazon' White Papers

Amazon’s Move into Delivery Logistics

Many industry players and experts are waiting anxiously to see what innovations Amazon will come up with next – and above all, whether Amazon will enter into delivery logistics under its own banner. Download Now!

Chasing Amazon: Building a Dynamic Warehouse Network

Most of Amazon’s competitors are feverishly playing catch-up, and if your company is among them, reassessing your supply chain design, particularly pricing and quick delivery, is a good place to start. Download Now!

Amazon: Yet Another Massive Market on the Horizon

Amazon has “powerhouse potential” in the large transportation and logistics market, dominated by global enterprises such as DHL, FedEx, and UPS. Download Now!

Home Delivery and Same-Day Delivery for Retailers

Retailers are struggling to respond to the new threat of online giants like Amazon, who are siphoning off the customers of traditional retailers, what is driving this and what can retailers do to retaliate against this threat? Download Now!

How Industrial Distributors Should Compete with AmazonSupply

Companies that recognize and respond to the shift in power to the customer are winning hearts and wallets, the key is not to get hung up on trying to save a penny. Download Now!

Global E-Commerce Logistics

Regardless of who is winning the race for volumes and profits, consumers continue to spend and the e-commerce logistics market continues to grow. Download Now!

State of Online Freight Sales

While many business-to-business sales industries continue to expand sales online, the logistics industry has been slow to adopt online freight sales and booking, leaving ample space for ambitious forwarders to expand sales with new channels. Download Now!

Supply Chain 24/7 Coverage of Amazon

Article Topics

ProShip News & Resources

Banyan Technology and ProShip announce strategic partnership Advanced Date Shopping Extends Beyond Just Shipping Cost to Fine Tune Which Carrier Service to Use Tips for Cutting Parcel Shipping Costs during this Peak Season Optimizing Transportation Spend and Improving Customer Experience with a Mix of Carrier Services 2021 Virtual ProS Who Know Day Two Recap 2021 Virtual ProS Who Know Day One Recap Antitrust Bill Could Drive Amazon to Sell Logistics Division More ProShipLatest in Transportation

A Look at Baltimore’s Key Bridge Collapse—One Month Later Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season UPS Struggles in First Quarter With Steep Earnings Decline FedEx Announces Plans to Shut Down Four Facilities The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency More Transportation