What Does ‘On-Time, In-Full’ in the Consumer-Goods Supply Chain Sector Mean?

McKinsey & Co., and Trading Partner Alliance outline some of the key considerations that should go into developing and using the on-time and in-full delivery metric.

The “On-Time, In-Full” Delivery Metric

Supply chain complexity is increasing as customers demand a wider selection of products, a broader choice of channels, and more promotional offers.

With expectations of higher on-shelf availability and lower inventory costs, the pressure on delivery performance has intensified - as has the need for manufacturers, retailers, and carriers to work together to create efficient, reliable, and responsive supply chains.

The global pandemic has accelerated this trend, and along the way unveiled some major gaps in the world’s supply chains.

To fill these gaps, a growing number of companies operating in the consumer sector have adopted the “on-time in-full” (OTIF) delivery metric.

What is “On-Time, In-Full” (OTIF)?

According to McKinsey & Co., OTIF measures the extent to which shipments are delivered to their destination according to both the quantity and schedule specified on the order.

“In theory, OTIF should be the ideal mechanism to align the objectives of retailers and manufacturers,” the global consultancy points out.

The problem is that there is no standard definition for OTIF.

Because of this, supply-chain participants may interpret the metric differently. For example:

- Does “on-time” mean on the date requested by the retailer, or the date promised by the manufacturer?

- Does it mean within the specific delivery slot allocated to the shipment, or any time inside a broader, agreed-upon time window?

- Should “in-full” be measured at the level of complete orders, line-items, or individual cases?

“These differences matter,” McKinsey says in its report, noting that effective supply-chain collaboration depends upon a precise, common understanding of delivery-performance expectations.

“Today’s diversity of approaches means partners waste time arguing over the figures, rather than addressing the root causes of delivery issues.”

Survey Says…

To get industry perspectives on OTIF, the Trading Partner Alliance (TPA) and McKinsey surveyed major retailers and manufacturers of North American consumer packaged goods (CPG).

Ninety-two percent of those companies agreed that an industry standard for OTIF would create value.

“They noted that a standard definition would significantly reduce discrepancies and confusion and promote collaboration among trading partners,” McKinsey states.

“Collaboration would help partners resolve supply problems more efficiently and effectively - creating value for all supply-chain participants as well as for consumers.”

A Common Definition for OTIF Would Also:

- Create a common view. A common view of supply-chain performance would support consumer-goods supply chains by aligning service expectations; enabling joint performance management; and supporting performance benchmarking.

- Streamline data complexity. “Retailers and manufacturers end up devoting significant time to explaining and reconciling differences in reported data,” McKinsey points out. “Carriers are often caught in the middle, as both retailers and manufacturers push them for improved performance based on inconsistent data and requirements.”

- Reduce supply chain complexity. Because each retailer has a different definition of OTIF, manufacturers must meet a variety of different delivery standards and keep up with each retailer’s changes to its individual definition. “Even the major retailers use different definitions, and their definitions keep evolving,” McKinsey notes.

So what’s the solution? A viable working definition of OTIF, which McKinsey says would look like this: “Case quantity that is delivered to the destination by the requested delivery date, calculated as a percentage of the ordered quantity.”

Other OTIF Parameters Would Include:

- Any over-delivered quantity or inaccurate product shall be disregarded.

- Arrival at the destination facility (rather than when checked in or unloaded, which may be subject to delays outside the manufacturer’s control).

- The requested delivery window should be the delivery date requested at the time of order placement, adjusted for any retailer-caused appointment delay, measured to the end of the working day and with a one-day early allowance.

$15-$20 Billion in Lost Sales

As the industry works toward a common definition for OTIF, the complexities of running the world’s supply chains will increase exponentially. “Consumers expect products to be on the shelf,” McKinsey points out, noting that the U.S. food retail industry loses an estimated

$15-$20 billion in sales (2%-3% of its total sales) every year due to out-of-stock or unsaleable merchandise.

“The main operational challenge for the consumer sector is to achieve high levels of on-shelf availability, while keeping supply chain costs down and inventories under control.”

Related Article: Keeping Your Inventory Moving During the COVID-19 Pandemic

Related Resources

Defining ‘On-Time, In-Full’ In the Consumer Sector

This paper also shows how the OTIF metric can improve an individual company’s supply chain performance and, through increased collaboration, generate significant value across industry participants. Download Now!

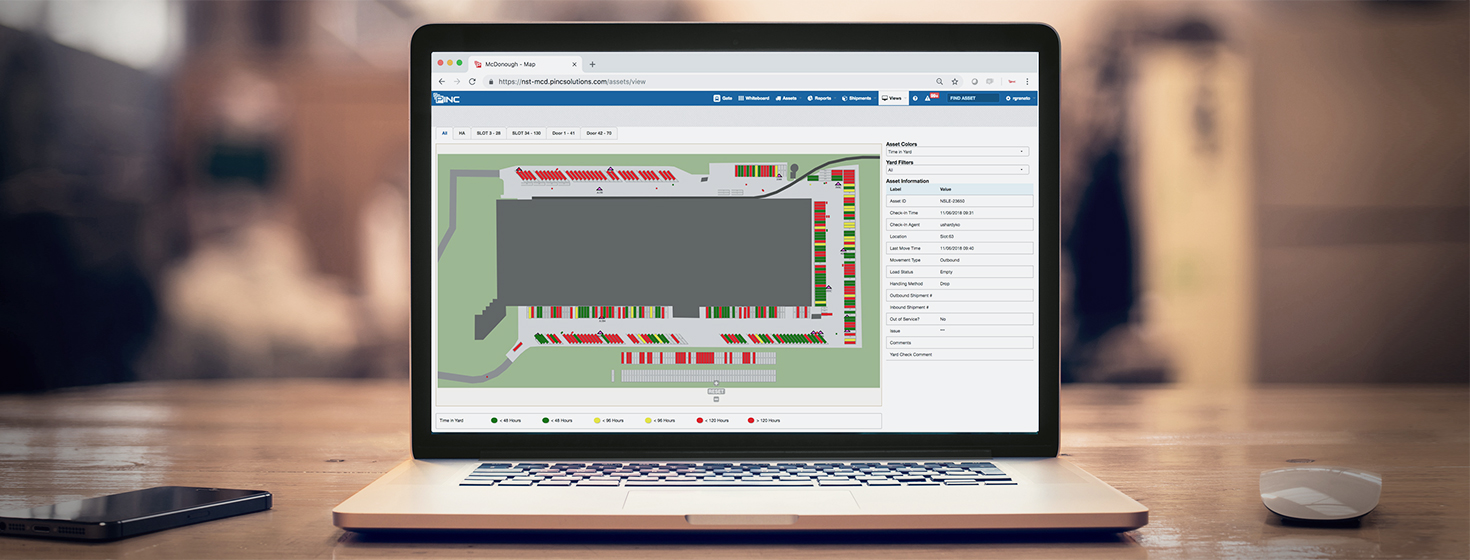

PINC Yard Management Systems: 4 Case Studies

In these 4 Yard Management System case studies, we detail how Pactiv, Batory Foods, Cost Plus World Market, and East Coast Warehouse & Distribution Corp. implemented PINC's Yard Management solutions to increase productivity, reduce expenses, eliminated trailer detention fees, and maintain control and visibility over yard operations, and more. Download Now!

The Four Forces Driving Supply Chain Innovation

When supply chain professionals discuss supply chain execution, their focus is typically put on transportation management systems and warehouse management systems, the yard management systems capability and importance is mistakenly undervalued. Download Now!

The Rise of the Digital Yard

In this white paper, we explore the rise of the digital yard and show how technology is enabling significant efficiencies, productivity gains, and cost containment in a world where every penny added to the bottom line positively impacts organizational success. Download Now!

Solution Brief: Yard Management System

Yards are the intersection between warehouses and transportation, they are a critical linkage in logistics management practices and have a significant impact on the overall efficiency of the supply chain. Download Now!

More PINC Resources

Article Topics

PINC News & Resources

Transport Analytics for Enterprise Rail Visibility Mobile Device Procurement, Service, and Support for Industrial & Finished Goods Shippers Merger of Best-in-Class Supply Chain Companies PINC, ShipXpress, and RailCarRX Providing Enhanced Yard Management Services and Solutions to Enterprise Customers 2020 State of Yard Management Report: Identifying a Truckload of Savings Across Your Network The Impact of Digital Yard Management on Enterprise Transportation Costs and Capacity The Increasing Demand for Digital Yard Management Systems More PINCLatest in Supply Chain

Is There a Next Generation of Truckers? Data Reveals Grim Outlook A Look at Baltimore’s Key Bridge Collapse—One Month Later European Parliament Passes New Law Requiring Supply Chain Accountability Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season Apple Accused of Multiple Human Rights Violations South Korea Finally Overtakes China in Goods Exported to U.S. More Supply Chain