State of Logistics 2022: Out of sync

Last year was a deeply unsettled and trying time for logistics managers, as demand for freight services in all modes surged and supply chains struggled to keep inventory on hand. To return to a more balanced, long-term growth trajectory, shippers will need to invest in the ideas and capabilities that will make the industry more resilient.

American supply chains seem to have been a representation of the country in miniature last year. They are out of sync and more expensive than ever. That’s the bottom line from the 33rd Annual State of Logistics (SoL) report. The analysts and authors conclude that “volatility and inflation defined the 2021 logistics landscape,” as logisticians struggled under “extraordinary pressure” to deliver goods, and often life-saving materials, around the country and the world.

State of Logistics report by transportation mode:

The report is produced annually for the Council of Supply Chain Management Professionals (CSCMP) by the global consulting firm Kearney and presented by Penske Logistics. It was released June 21st at the National Press Club in Washington, D.C.

“Demand in all modes and nodes surged, while the people and assets needed to move and store the goods remained scarce,” states the authors. “Under extraordinary pressures, the various parts of supply chains struggled to react in unison, leaving logistics out of sync.”

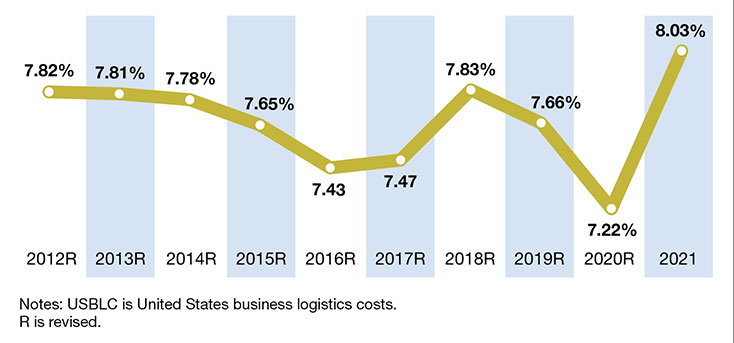

But the biggest headline shows that U.S. business logistics costs (USBLC) rose by a whopping 22.4% to $1.85 trillion last year. That represents 8% of the U.S. 2021 Gross Domestic Product (GDP) of $23 trillion. It also marked a sharp increase from 2020 when USBLC dropped 4% of GDP. “As always, logisticians proved resourceful when the going got tougher, although the numbers suggest that many of the solutions came in the form of much higher prices for constrained supply,” the report concludes.

As a result, the reports finds that shipper margins were “eviscerated” while carriers enjoyed fatter margins even in the midst of declining service levels. “Rather than rethinking logistics to get better outcomes, the priority seemed to be a rush to get any outcome at nearly any price,” say the authors.

But many lessons were learned. New strategies were developed—some very short term, others taking the long view. As Josh Garrison, head of Cisco Logistics strategy, sourcing and digital transformation, observes: “Gone are the days of the ‘dive and catch.’”

As it has for the past three decades, the SoL report seeks to rise above the fray and explore where innovation and investment may have positioned logistics players for enduring success—as opposed to honing bullet-dodging skills. What techniques are successful shippers and carriers using? What may lie ahead? Let’s take a deeper dive.

Chaotic conditions and rising costs

Turbulence associated with the COVID-19 pandemic continued to cause chaotic conditions for logistics professionals last year. Clogged ports and paltry capacity failed to meet surging and often “desperate demand,” the report says.

“Disruptions in all logistics networks effectively destroyed capacity, as ships loitered at ports,” say the authors. “Equipment waited to be unloaded. Trucks rushed out half-empty, dashing off to the next high-paying load with little regard for backhauls.”

Still, for carriers it was nearly the best of times. Private or dedicated truck revenue rose 39.3% to $415 billion, the largest chunk of the $830 billion truck marketplace. Full truckload carriers’ revenue rose 10.2% to $332 billion; less-than-truckload (LTL) carriers’ revenue jumped 13.2% to $83 billion; and parcel carriers enjoyed a 15.2% rise to $134.5 billion.

However, shippers, miffed by low service levels from overstretched motor carriers, are now increasingly developing their own “captive” private-truck fleets as a more reliable, affordable alternative. “Captive fleets rose to the occasion as they became more valued, driving an accelerated adoption that remains with us today,” says Andy Moses, senior vice president of sales and solutions at Penske Logistics. “We’ve seen shippers who have gone 10 years without a private or dedicated fleet get into them.”

USBLC rose by 22.4 percent, and came to represent 8 percent of the nation's GDP

(in $ billion)

2021 |

YoY 21/20 |

5-year CAGR |

||

| TRANSPORTATION COSTS | ||||

| Full truckload | 332.20 | 10.20% | 4.50% | |

| Less-than-truckload | 83.00 | 13.20% | 7.80% | |

| Private or dedicated | 415.20 | 39.30% | 9.60% | |

| Motor carriers | 830.50 | 23.40% | 7.20% | |

| Parcel | 134.50 | 15.20% | 11.40% | |

| Carload | 71.90 | 19.40% | 4.50% | |

| Intermodal | 16.40 | 15.90% | -1.00% | |

| Rail | 88.30 | 18.80% | 3.30% | |

| Air freight (includes domestic, import, export, cargo, and express) |

52.70 | 19.20% | -6.40% | |

| Water (includes domestic, import, and export) |

32.40 | 26.30% | -4.10% | |

| Pipeline | 67.30 | 18.20% | 8.70% | |

| SUBTOTAL | 1,205.70 | 21.70% | 6.10% | |

2021 |

YoY 21/20 |

5-year CAGR |

||

| INVENTORY CARRY COSTS | ||||

| Storage | 186.40 | 19.90% | 7.60% | |

| Financial cost (WACC x total business inventory) | 164.50 | 33.40% | 2.40% | |

| Other (obsolescence, shrinkage, insurance, handling, other) | 150.40 | 25.90% | 5.00% | |

| SUBTOTAL | 501.30 | 25.90% | 5.00% | |

2021 |

YoY 21/20 |

5-year CAGR |

||

| OTHER COSTS | ||||

| Carriers' support activities | 77.10 | 23.60% | 7.90% | |

| Shippers' administrative costs | 62.90 | 9.10% | 5.60% | |

| SUBTOTAL | 140.00 | 16.60% | 6.80% | |

| TOTAL U.S, BUSINESS LOGISTICS COSTS | 1,847.02 | 22.40% | 5.80% | |

Note: USBLC is United States business logistics costs. YoY is year-over-year.

WACC is weighted average cost of capital. Includes 5.4% inflation for 2021 numbers.

Sources: CSCMP's 33 Annual State of Logistics Report

Other modes were not far behind trucking in posting a boom economic year. Rail revenue jumped 18.8% to $88.3 billion; airfreight had a 19.2% jump to $52.7 billion; and maritime rose 26.3% to $32.4 billion. Overall, all U.S. business transport costs jumped 21.7% to $1.205 trillion. The authors say it’s safe to project that the increase in e-commerce will continue to fuel ground transport. E-commerce grew by 10% last year to $871 billion—that’s 13% of the overall U.S. commerce market.

“However, we’re anticipating some softening in demand for logistics in the second half of the year,” says Balika Sonthalia, partner in Kearney’s strategic operations practice and one of this year’s authors.

New trends

While business inventories dropped to near historic lows, costs associated with storing, handling and financing these items rose considerably. Overall, costs associated with storage, financial carrying costs and other costs (insurance, obsolescence, handling, etc.) jumped nearly 26% to $501.3 billion.

Beneath these numbers were several factors driving the steep increase in logistics costs. A big factor was the size of the North American warehousing market which is now estimated at $80 billion—and growing double-digits annually.

In an era of increased vendor lead times, uncertain supply and sharply rising customer expectations, shippers were “motivated” to rethink lean operations and keep more inventory on hand. “As a result, demand for warehousing space boomed in 2021,” says the authors.

Net absorption—a standard measure of occupancy—rose 48%. Vacancy rates fell from 5.1% in 2020 to just 3.7% last year, and the market responded strongly to this hike in demand. Warehouse rents rose by 9.5% in 2021, nearly twice as fast as in 2020, while warehouse square footage under construction grew by 54% year-over-year.

“Companies that long viewed warehousing as a sleepy backwater need to recognize it’s now an essential, strategic competency,” the report warns.

Looking ahead with agility

Relative stability may or may not soon return. So, the logistics sector must invest now in controlling the factors it can, according to the report’s authors, who add that logistics must be permanently about embedding “resilience and agility” into its capabilities before shifting its focus back to cost minimization and efficiency.

Jennifer Kobus, vice president of transportation for the beauty and cosmetics chain Ulta Beauty, says relationships are critical to keeping costs and efficiencies in line. “Continue to maintain your strategic partnerships,” she advised in a press briefing on the report.

Ulta recently revamped its carrier str

Source:ategy and is now aiming for a more continuous bid process to select specific transport lanes. “I see more mini-bids throughout the year in a targeted approach,” Kobus says.

Rob Walpole, vice president of air cargo for Delta Air Lines, says that more shippers are expanding direct relationships with carriers. “That’s an important structural change,” he adds.

In 2021, USBLC represented 8% of GDP

USBLC as percent of nominal GDP

On the brighter side, the report is optimistic on inflation. It’s predicting overall inflation to peak this year at 4.3%, dropping to 2.7% in 2023. That’s one of the lowest predictions in that space.

Technology, especially in parcel tracking and automation, is as always a huge expenditure for shippers seeking visibility and efficiencies in their freight. But shippers should be ready to make a deepening commitment to multi-shoring, or what the report calls “friend-shoring,” which may require greater long-range planning as companies coordinate a more complex array of transit modes and facilities.

All told, 2021 was what the report called “a flush year” for the logistics sector—but also a deeply unsettled and trying one. To get back in sync and return to a more balanced long-term growth trajectory, logisticians need to invest in the ideas and capabilities that will make the industry more resilient—come what may. Still, shippers should get used to higher rates.