State of Logistics 2022: Third Party Logistics (3PL)

Third Party Logistics (3PLs) march onward.

Third Party Logistics (3PL) operators continue to experience challenges. Nevertheless, demand for their services over the past year has skyrocketed, resulting in record profits.

Armstrong & Associates, Inc. (A&A) estimates U.S. 3PL market gross revenues grew 50.3% in 2021 to $347.9 billion. C.H. Robinson realized $22.3 billion in global gross revenues in 2021 compared to $15.5 billion in 2020, and its global forwarding division more than doubled last year with gross revenues of $6.7 billion, resulting in 117.1% growth.

C.H. Robinson’s revenue increased by 41.9% rising to $6.8 billion in the first quarter of 2022 versus the first quarter of 2021. It attributes this to higher adjusted gross profit per transaction and higher volumes across most business segments.

A&A reports that Expeditors’ 2021 gross revenue increased 67.7% to $16.5 billion and net revenue grew 39.7% to $4.5 billion. Growth primarily came from ocean freight, where gross revenue grew 137% to $5.5 billion from $2.3 billion in 2020.

Expeditors reported gross profits for the first quarter of 2022 at $1.15 billion, a 20.67% increase year-over-year despite a cyber-attack in February that impacted all products. Its gross profit for the twelve months ending March 31, 2022, was $4.66 billion, a 42.83% increase year-over-year.

“Our air and ocean businesses both outperformed strong year-ago results, as rates remained elevated due to ongoing supply chain bottlenecks and capacity constraints, while tonnage and volumes declined principally as a result of the cyber-attack,” says Jeffrey Musser, Expeditors president and CEO. “Airfreight continues to be affected by the extreme imbalance between capacity and demand, particularly with exports out of Asia.”

Overall, the Global 3PL market, worth some $1 trillion in 2020, is estimated to reach more than $1.75 trillion by 2026, reports Mordor Intelligence. This translates to a growth rate of 8% for 2021-2026. Factors affecting that growth are the increasing number of companies that use 3PLs for major transportation and logistics services—while 3PLs are also increasingly being used to grow e-commerce.

As a result, third-party providers continue to find creative solutions and increase services. C.H. Robinson, for one, helps shippers manage ocean shipping delays by shifting some freight from full-container-load services to less-than-container-load services. J.B. Hunt Transport Services and BNSF are jointly working to improve capacity for inland intermodal freight movements.

Some of the biggest 3PLs are expanding their value-added services and geographic reach. CEVA Logistics, for example, acquired most of Ingram Micro’s Commerce & Lifecycle Services business, including Shipwire and the CLS activities in North America, Europe, India and certain countries in Latin American. The move enables CEVA Logistics to strengthen its capabilities in contract logistics and e-commerce.

Merger and acquisition activity is expected to continue. The Asia-Pacific region particularly has seen a high concentration of activity. Last year, Maersk announced plans to purchase Hong Kong-based LF Logistics to shore up its omnichannel fulfillment capabilities in the region. In the meantime, Kuehne+Nagel acquired Apex, a leading air freight forwarder in Asia, to offer customers “a compelling proposition in the competitive Asian logistics industry, especially in e-commerce fulfillment, hi-tech and e-mobility.”

Mordor Intelligences also notes a shift in technology among 3PLs with the development of Artificial Intelligence, the Internet of Things (IoT), and blockchain, among others. “The introduction and implementation of these new technologies have further intensified the market competition,” Mordor says. “Additionally, technology adoption has also helped reduce operational costs and improved efficiency.”

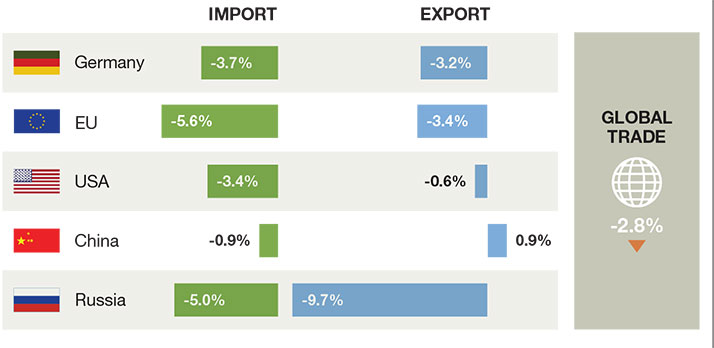

Kiel trade indicator

(March 2022*)

*Change month-on-month, price and seasonally adjusted.

Source: Own calculations based on data from fleetmon.com; updated as of 6 April 2022

Source: Kiel Institute