State of Logistics 2016: Air cargo

New trade agreements may drive long-term recovery

While the 2016 “State of Logistics Report” recognizes that the global air cargo sector is troubled by overcapacity and weak rates, recent research by Sandler Research predicts that the worldwide air cargo logistics market will experience a 5.97% compounded annual growth rate through 2019.

According to the Sandler report, one of the major factors driving the growth of the global air cargo market is the increase in the number of online retail stores. Sandler analysts also note that the Asia Pacific region is another driving force behind the forecasted recovery.

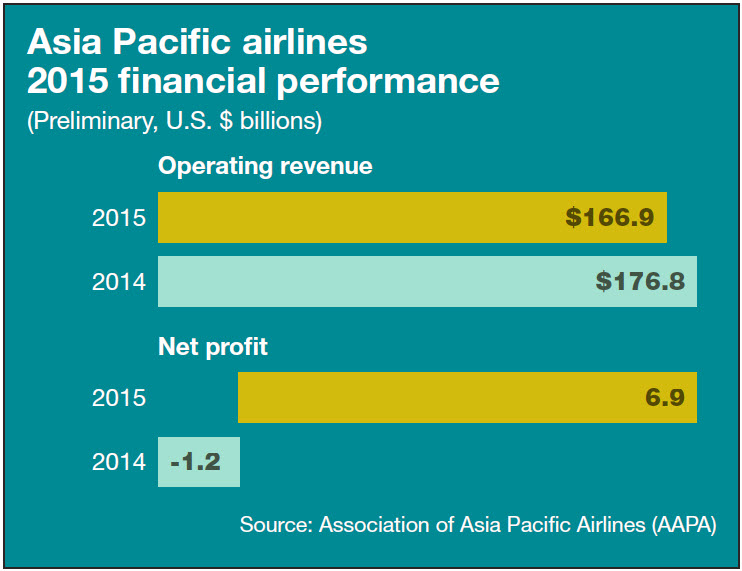

This is echoed by the Association of Asia Pacific Airlines (AAPA), which notes that Asian air cargo carriers are encouraged by the sustained growth in demand, but continue to face a challenging operating environment characterized by intense competition, cost pressures and volatile currency markets.

“Air cargo markets remain weak as a result of the slowdown in global trade,” says Andrew Herdman, AAPA’s director general. “Nevertheless, taking a positive view of the future, Asia Pacific airlines are continuously reviewing their fleet and network development plans in line with evolving market trends. They’re also introducing new customer service initiatives, while continuing to focus on disciplined cost management efforts.”

While the SoL report acknowledges some of the more dismal statistics cited by the International Air Transport Association (IATA), it’s important to note that airlines in Asia-Pacific are expected to post a $7.8 billion profit in 2016, up from $7.2 billion in 2015.

According to Tony Tyler, IATA’s director general and CEO, capacity is forecast to expand by 9.1% in 2016 ahead of demand, which is likely to grow by 8.5%. Asia-Pacific carriers have a 40% share of global air cargo markets.

“As a result, they continue to feel the brunt of stagnation in this sector, which is holding back the improvement in financial performance,” says Tyler. “Challenges include intense competition, restructuring in the Chinese economy and continuing infrastructure and cost difficulties in the Indian market.”

Meanwhile, the Airforwarders Association (AfA), representing 360 companies and more than 300,000 employees who move air cargo through the supply chain, were cheered by the conclusion of the Trans-Pacific Partnership (TPP) agreement at the ministerial meeting in Atlanta.

The agreement includes a series of member agreements to lower tariffs, modernize their customs border clearance and ensure a level playing field for competition.

“Lowering tariffs and streamlining customs border clearance operations are music to our ears, as this will spur increased trade both to and from the United States,” says Michelle Halkerston, CEO of Hassett Express and AfA board president. “As freight forwarders, we recognize that liberalized trade agreements are critical to business, both large and small, that seek to expand their markets,” she adds.

Once approved by the Senate, TPP will cover approximately 40 percent of the global marketplace and will substantially accelerate the flow of goods through supply chains in a region with the world’s fastest growing economies.