Refining Our Thinking for a Circular World

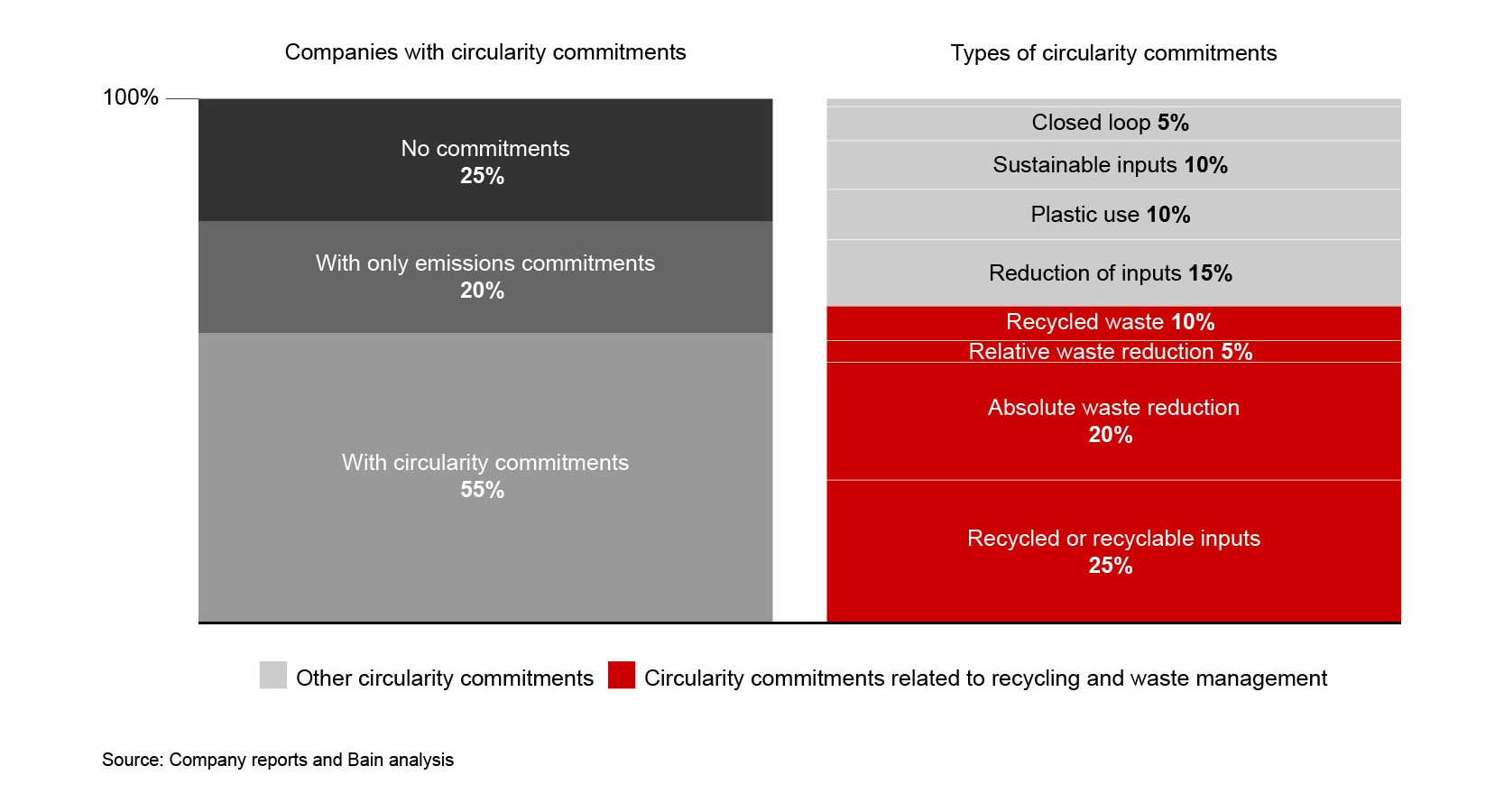

A Bain study found that while 55% of organizations had made commitments to circularity, more than half of the initiatives were confined to recycling or waste management

For many leadership teams, the transition to circular strategies and business models is a daunting prospect. They know it’s important, but progress is painfully slow. Initiatives remain narrow in scope, have limited impact, and are difficult to scale.

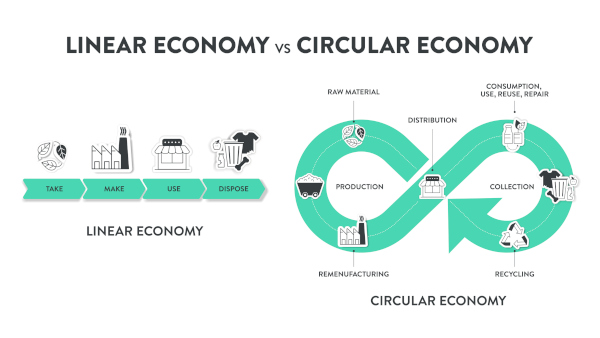

Part of the problem is that senior executives operate with a linear mindset. That’s understandable since today’s businesses were designed for a linear world. But to make the most of circular solutions, executives need to rethink how they run the business and decouple growth from resource consumption. That requires operating models and business models designed to preserve materials, increase product utilization, and extend product life spans (see Figure 1).

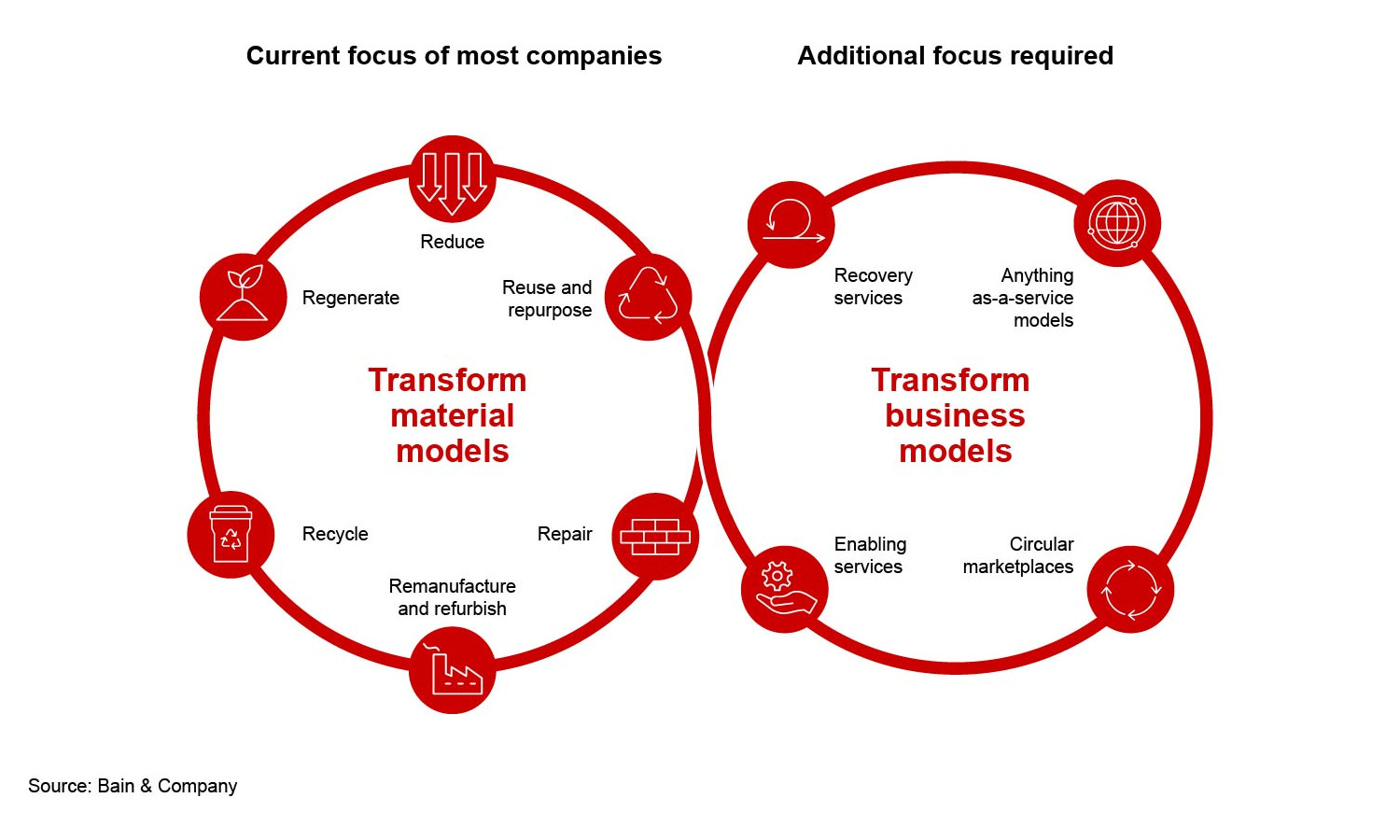

It’s a huge break with industry norms and best practices in the past century. Without new business models and reconfigured value chains, operations will remain linear and progress toward circularity incremental. A recent Bain study of 400 leading organizations found that while 55% had made commitments to circularity, more than half of the initiatives were confined to recycling or waste management (see Figure 2). Such efforts are laudable, but they will not spark a circular transformation.

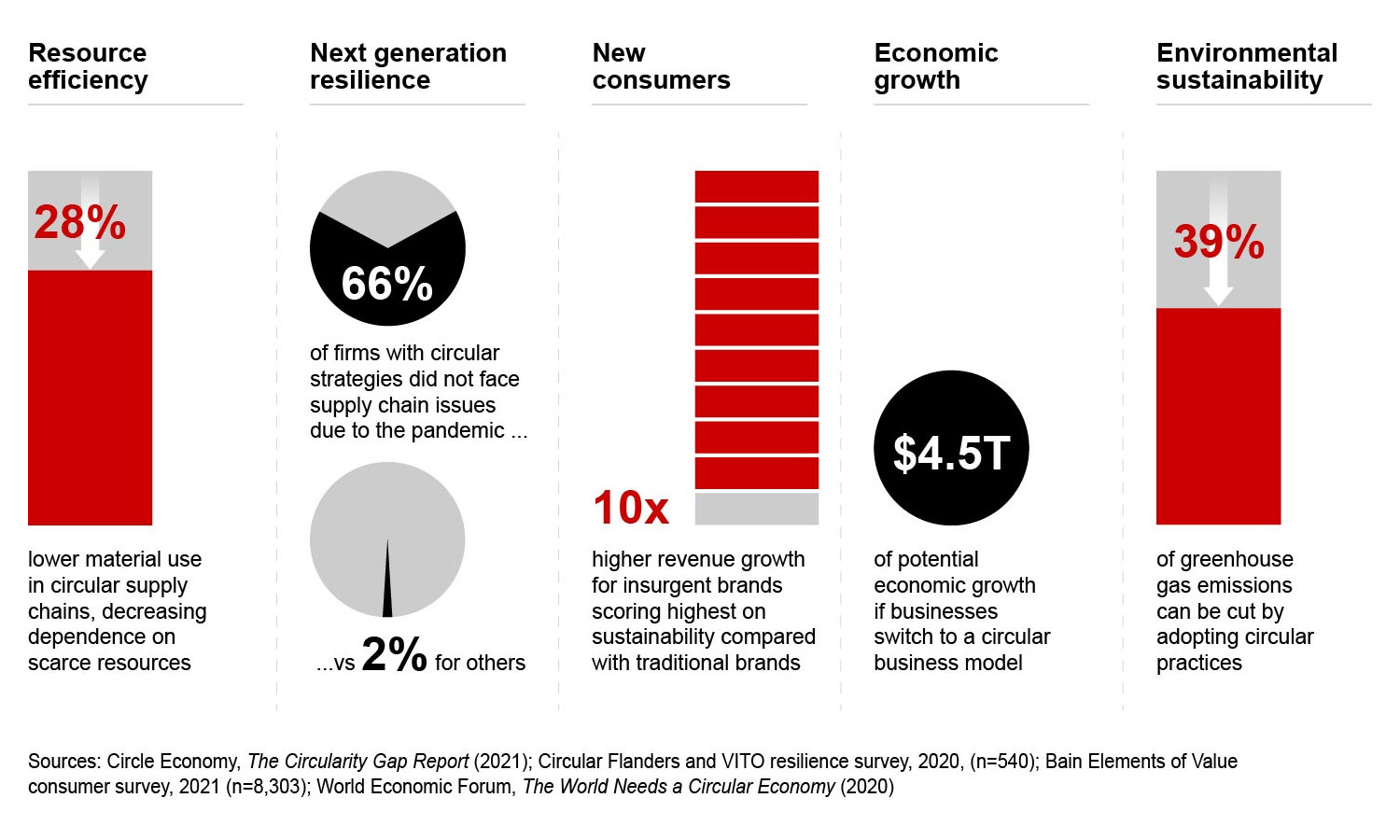

To move beyond such narrow gains, some leaders are setting bolder ambitions, linking circular strategies to business objectives. Those objectives may include efficient use of resources, supply chain resilience, new market entry, revenue growth, and environmental sustainability.

These firms start by analyzing how and where the industry’s profit pools are likely to evolve. That allows executives to identify strategic opportunities and reimagine products, services, and value chains for a circular future. Shifting profit pools provide critical context for developing a circular strategy and for sequencing future investments based on signposts.

New sources of value

How can leadership teams learn to think about their business with a circular mindset when most executives have spent decades optimizing linear supply chains? The most effective approach is to view circularity as the foundation of long-term value creation as well as a short-term business goal. Leading companies are changing their mindset by imagining their industry as circular 15 to 20 years from now. That allows them to develop new strategies and business models for a circular world and launch concrete actions today that are stepping stones to the future.

Macroeconomic trends including scarcity of raw materials, trade tensions, environmental regulations, and global supply chain disruptions also are prompting leadership teams to pursue circular solutions with closed material loops. In the future, companies will design products for longevity, sell products as a service, and build on the sharing economy. These new business models can boost innovation, generate new sources of revenue, and reduce costs. They will also help firms manage material scarcity and increase supply chain resilience (see Figure 3).

Leadership teams that anticipate circular disruption will gain a significant first-mover advantage. By investing early, they will be able to influence how profit pools shift and shape them to their advantage. For example, companies investing in recyclable PET (polyethylene terephthalate) bottles also are investing in recycling infrastructure to improve their access to circular feedstock. Quicker and cheaper access to such feedstocks will give companies an edge in a circular industry.

Three sources of circular value can help executives assess a company’s efficiency in using virgin materials and a product’s circular performance: the virgin material consumption rate (relative to total inputs), product life span, and product capacity utilization. These elements have been widely used in environmental, social, and governance (ESG) research. They also represent the areas of greatest potential profit pool growth—an optimum starting point for building a circular strategy.

Companies making disposable or short-life products, such as plastic bottles, or products containing scarce materials, such as smartphones, can create circular value by reducing the use of virgin materials and ensuring raw materials are recycled at the end of the product life span. For example, several fast-fashion companies are investing in new regenerative and recyclable fibers and fabrics to achieve these goals. Companies that aim to reduce virgin resource consumption may find growth opportunities in reverse logistics and infrastructure businesses or supplying circular feedstock.

The Coca-Cola Company partnered with local bottle recyclers and people collecting waste in Mexico to create a closed-loop ecosystem for recycled PET. Coca-Cola and its partners invested in critical technologies for extruding and decontaminating plastic so used bottles can be easily reused. That work enabled Coca-Cola to launch a 100% recycled PET bottle for its water brand Ciel.

Leaders are also applying circular strategies for products containing scarce resources. Apple, for example, developed disassembly robots to recover scarce materials like gold, cobalt, tungsten, and rare earth elements from used iPhones and other products. The company redeploys the collected materials in Apple products or sells them to other manufacturers. By 2025, Apple aims to use 100% recycled rare earth elements in all the magnets in its devices.

Extending a product’s life span is an effective strategy for high-value premium products that are both durable and easy to disassemble. For instance, Michelin is developing a tire retread business and tire-based services. It plans to offer fleet management companies retread tires with a range of services including on-site managers to perform health, safety, and maintenance checks.

Schneider Electric has used a modular design process to create Altivar process drives that can be refurbished, upgraded, reused, and recycled at the end of the first life cycle. According to Schneider, the modular design increases the life span of the product up to 20 years. Longer product life spans, in turn, will expand profit pools for specialized design firms, secondary marketplaces, and product authentication technologies.

Companies that make high-value products that require fast upgrades (or have short life spans) can increase product utilization by exploring different uses, sales models, and business models. Increasing product utilization can create growth in enabling services and platforms, reverse logistics and infrastructure, and service-and-leasing models.

Dell APEX, for instance, offers customized packages of hardware, software, and cloud storage as a subscription service. Dell says the program generates cost savings, digital resilience, and efficiency for the firm and its customers. A recent study by IDC found APEX customers’ three-year cost of operations declined by as much as 39%.

Changing market dynamics

Companies at the forefront of the circularity shift have begun identifying and investing in the new structures and processes required to replace linear business models. As these new market dynamics develop, industries will be able to go circular at a faster pace.

The dynamics of circularity will alter profit pools, negotiating power, and sources of control throughout the value chain, creating new winners and losers. A truck company that shifts to a leasing model, for example, will gain control over vehicles in the middle and at the end of their life span, while dealers and service providers lose control over those parts of the value chain.

Each source of circular value requires different structures and processes to be cost-effective. Companies aiming to significantly reduce the use of virgin materials, for example, will need steady access to recycled feedstock materials. They will also overhaul their design process to make recyclable products.

Companies seeking to significantly extend a product’s life span will develop business models that engage customers after the product purchase. One option is to develop modular product designs that allow customers to make easy upgrades over time. Cloud service providers, for example, are asking equipment makers to design modular servers so components can be replaced more easily. Companies looking to increase product life spans also will develop economical repair options, including right-to-repair guarantees.

To increase product utilization, some leaders are shifting to product-as-a-service business models, leading to changes in asset ownership and new financing structures. Technology OEMs that decide to lease hardware instead of selling it, for instance, will require more capital to support bigger balance sheets.

Cross-industry communities such as the Circular Transformation of Industries launched by Bain & Company and the World Economic Forum are helping companies expand their circular ecosystems. These communities leverage the expertise and negotiating power of multiple value chains to develop the technologies, operating models, and policies needed for a circular economy.

Over the next decade, the shift to a circular economy will reconfigure profit pools in almost every industry. First movers will gain valuable competitive advantage by envisioning the change ahead of other companies, developing a circular strategy, and rapidly launching circular business models when the turning point comes.

About the authors:

Josh Hinkel is a member of Bain’s Supply Chain, Advanced Manufacturing, and Technology practices and our global solution leader for Digital Operations. He has a particular focus on Sustainability in Circularity.

Tessa Bysong is a member of Bain’s Energy & Natural Resources and Performance Improvement practices and has over a decade of consulting experience.

Article Topics

Bain and Company News & Resources

Explaining Supply Chain’s Role in Building Brand Identity Refining Our Thinking for a Circular World Supply Chain Control Tower Technology and the Promise of Real-Time Visibility Beyond the Economic Downturn: Recession Strategies to Take the Lead Now! Focus On Solutions Not Products When It Comes To Digitizing Procurement Operations The Most Telling Leadership Quality of a Great Leader is How Well They Treat Others Building a Digital Supply Chain Ready for the Future More Bain and CompanyLatest in Supply Chain

Is the Trailers as a Service (TaaS) Model Right For Your Business? Why Grocery Shoppers are Leaving Stores and Buying Their Food Online Is There a Next Generation of Truckers? Data Reveals Grim Outlook A Look at Baltimore’s Key Bridge Collapse—One Month Later European Parliament Passes Law on Supply Chain Accountability Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season More Supply Chain