E-commerce Logistics: An endless array of challenges

While this year may be a close copy of 2023 in terms of supply chain execution as it relates to e-commerce moves, forecasting is more precarious. The instability and conflict have no upside, only more disruption—which inevitably leads to service and cost impacts across the board.

Go back to July 5, 1994, when Jeffrey Preston Jorgensen—now known as Jeff Bezos—began selling books from this garage in Bellevue, Wash.

The company was named Amazon because Bezos thought naming the company after the world’s largest river was meaningful in terms of his growth goals. In fact, this has been borne out by the expansion of the Amazon footprint to include an almost endless array and flow of products.

There’s absolutely no doubt that e-commerce is driving significant change in the economy as well as every mode of supply chain operations. As an example, go searching for a particular product on-line and you’re just as likely to see responses from Walmart, Target, or Home Depot that say: “On-line orders only. Not available in stores.” Of course, from an inventory management and control standpoint as well as the cost of moving stuff around, there’s a lot of sense in this.

This reality has made for substantive change in the patterns of freight handling and has ushered in more B2C sales, which shifts modes from truck to parcel across a much broader geographic footprint. This can also be viewed, despite some naysayers, as a benefit to the United States Postal Service (USPS).

By law, USPS must go to every address every day. Of course, this is economically impractical for the parcel carriers in light-density areas where there may only be a shipment or two with a stem-time of an hour or more. Shifting volume to USPS for last-mile delivery also helps relieve the light-density burden and improve package volume on routes USPS must service anyway.

Paradoxically, this new world order has not dented brick and mortar installations, but rather seen that arena grow in recent years, with more stores opening than closing—just a different variety of retail experiences as older brands (e.g., Sears, K-Mart, et al) fade and new ones (Warby-Parker, Lululemon) invade.

On the packaging front, a critical component in the e-commerce trade, rising cardboard prices may signal better times ahead for the goods economy. Producers are lifting prices for the first time since the Federal Reserve began raising interest rates early last year.

At the same time, companies are already putting into action the supply chain strategies they applied during the upheaval of the pandemic. And with that, global supply chains are entering 2024 roiled by urgent disruption at the Suez Canal and longer-term concerns at the Panama Canal.

During the pandemic, warehouse space became extremely tight and expensive. That trend is now changing. The pandemic-fueled boom in warehousing demand looks to be over, for now. The average warehouse vacancy rate across the United States reached 5.2% in the fourth quarter, according to Cushman & Wakefield, a steep rise from 4.6% the previous quarter and a big jump from the 3.1% vacancy rate the year before.

And, we can’t forget the back-end of supply chain—reverse logistics. As the shift to e-commerce increases, so does the demand for capabilities for the efficient handling of returns and re-stocking.

Americans are estimated to buy more than $5 trillion of goods this year, making the retail sector a crucial piece of the economy. Yet shoppers last year returned 16.5% of items they purchased online and in stores, valued at nearly $817 billion and double the percentage of goods returned in 2019, according to the National Retail Federation.

With the added shipping, warehousing, and labor costs, Inmar Intelligence estimates it costs merchants about $27 to handle a return for a $100 online order. According to Gartner analysts, companies lose some 50% of their margin on returns when accounting for the cost of initially selling the item plus processing the return.

And according to Cass Information Systems, destocking and declining goods consumption have been key features of the freight recession, but both cycle drivers seem to be starting to reverse course. Real retail sales recently turned positive after a year of declines, and after 18 months of destocking, a restock is drawing near, likely spurred by ocean risks, which we will address in the ocean segment.

Finally, the turbulence roiling international waters, from the Panama Canal to Suez Canal and Red Sea are disrupting trade flows, which will inevitably impact delivery times and cost. Transit times are about 10 days longer to avoid the Suez Canal and container rates have risen from about $1,500 to more than $4,000 as a result.

Throughout all of this, e-commerce continues growing and, according to Boston Consulting Group, the market is poised to capture 41% of global retail sales by 2027—up from just 18% in 2017.

Parcel

Satish Jindel of Pittsburgh-based freight analyst firm SJ Consulting says that the impact of e-commerce has played out for the most part over last five years. The main impacts are:

- the rapid development of Amazon’s private fleet for its online deliveries;

- changes in supply chain, with more products being stocked closer to the consumers for faster delivery;

- new opportunities for small carriers and courier companies to compete with FedEx and UPS for last-mile delivery of e-commerce parcels; and

- residential deliveries made seven days a week, not five, as well as labor challenges for the parcel carriers charged with staffing the operation for seven days per week deliveries to homes.

Jindel adds that artificial intelligence (AI) will have a role in the future of parcel management, such as streamlining the fulfillment process to combine multiple online orders into one parcel delivery for convenience of the consumer; lower the delivery cost for the parcel carrier; and to reduce returns of orders, which is an ever-expanding issue.

The general softness in the e-commerce market has had an impact on the parcel business, probably more than any other segment. Representative of this is the recent WSJ report on UPS cutbacks: “United Parcel Service is shedding 12,000 workers and possibly its Coyote Logistics brokerage unit because of weak demand. The Atlanta-based company is trying to save $1 billion following declines in domestic and international parcel volumes. UPS said it expects small-package volume growth in the U.S. to be less than 1% this year.”

According to parcel industry veteran and consultant Brian Sternberg: “Moving into 2024, the parcel carriers will continue to extract revenue as they have every year since the late 80s. A year ago, it was more of a seller’s market, negotiation was off the table and the 2023 parcel general rate increases were listed at an ‘average’ increase of 6.9%—the highest stated average increase in history. In turn, 2024 has shifted to more of a buyer’s market.”

One of the challenges with parcel is data management and reporting in the context of overall supply chain operating costs. The majority of major shippers have implemented transportation

management systems (TMS) in one form or another, but the focus is typically on truckload (TL) freight and sometimes less-than-truckload (LTL).

Outliers, like rail and parcel don’t fit into that box. There, shippers typically rely on systems provided by the integrator (UPS or FedEx) for tendering and billing, which falls outside the realm of conventional transportation management.

As Mike Reiss, managing director for EY’s supply chain practice, says, “incorporating and equipping TMS to handle parcel shipments will pave the way for a more efficient analysis of shipping rates [rate-shopping], superior business intelligence, label generation, and enhanced visibility for parcel tracking.”

Reiss also points out that this not only prevents value leakages, but also improves the customer experience. Furthermore, it aids freight audit procedures and invoice reconciliations to create a more seamless money-management process. “A well-integrated TMS equips businesses with a more robust mechanism for handling claims, further fortifying operational efficiencies and customer trust,” he adds.

According to EY, the global parcel delivery market is anticipated to grow from $466.87 billion in 2022 to $648.84 billion by 2030, at a CAGR of 4.2%. The rapid shift to parcel, particularly in the B2C space, is making a more integrated transportation management capabilites progressively more critical for effective supply chain management.

Trucking

As previously reported, the impact on trucking has been mainly on middle-mile and last-mile delivery, as B2C grew and the pressure for rapid turn-around time on order-to-delivery has ratcheted up.

John Larkin, strategic advisor at Clarendon Capital and senior partner at Venture 53, says “e-Commerce now accounts for just over 15% of retail sales in the United States. With that market share expected to grow in coming years, the trucking industry will continue to undergo major changes. Last-mile delivery companies, whether using delivery trucks, drones, or bicycles, will continue to proliferate, and those with density and good pricing strategies will survive and prosper.”

Larkin and others contend that LTL carriers will continue to leverage the e-commerce phenomenon as retailers operate out of smaller warehouses/fulfillment centers located close to urban areas that require more frequent, smaller shipments to replenish inventories. This facilitates same-day and next-day delivery. Longer-haul TL carriers will struggle as deliveries to smaller, close-in urban DCs/fulfillment centers can’t accommodate single truckloads of a SKU or two.

Air cargo

E-commerce has certainly been good for the airfreight business, although the glow of pandemic demand has diminished. David Cyrus, former vice president of air for Exel and long-term industry veteran, expects 2024 volumes to rise, but he believes revenues will fall from 2021-2022 pandemic levels.

In step with Cyrus, the International Air Transport Association (IATA) is forecasting volume growth of 3% to 4% for 2024, with most growth stemming from the B2C sector. Air cargo operators carry only 1% of reported world trade tonnage, but it accounts for 35% of its value. While only 8% of commercial jet aircraft are freighters, they carry 54% of air cargo traffic.

However, with the expansion of passenger routes, capacity is forecast to increase by 3.5%, particularly in the Asia Pacific region. According to IATA, capacity distribution will be roughly 50/50 between freighter and passenger belly space, so a buyer’s market should continue, at least through a good part of 2024.

Express carriers—integrators—FedEx, DHL, UPS, SF Express, and China Postal account for about $65 billion of revenue, or 38% of the total, which is where a large portion of B2C e-commerce moves.

Chuck Clowdis, one of our most veteran and trusted airfreight resources, says that as e-commerce continues to gain share in the consumer’s buying schemes—from replaceable daily goods to electronic systems and new innovative devices—air cargo services will play a role in supporting the ever-increasing demand for fast delivery.

“Goods purchased via e-commerce now moving with ocean carriers may not be able to tolerate the longer times on the water, now exacerbated by the Middle East/Red Sea-Suez turmoil,” says Clowdis. “This will likely lead to an increased shift to air cargo, at least until some of these issues are resolved.”

Clowdis adds that e-commerce has now expanded to larger items: furniture, durable and white goods, can all be found and purchased through e-commerce sources. Amazon Air continues to grow in select lanes, and now, even an automobile may be purchased on Amazon, although the auto must be picked-up at a dealer—however, this enables avoiding a car salesperson.

Ocean

Ocean rates have been in free-fall for a number of months now, with Asia Pacific to the U.S. West Coast dropping 51% and 55% to the East Coast since peaking in late 2021. However, events in the Red Sea and Panama are changing all that.

The price of sending goods around the world is spiking after six weeks of disruptions in the Red Sea, where Iran-backed Houthi militants are attacking commercial shipping vessels. The disruptions pose a threat to the global economy nearly four years after the pandemic woke the world up to the existence—and fragility—of supply chains.

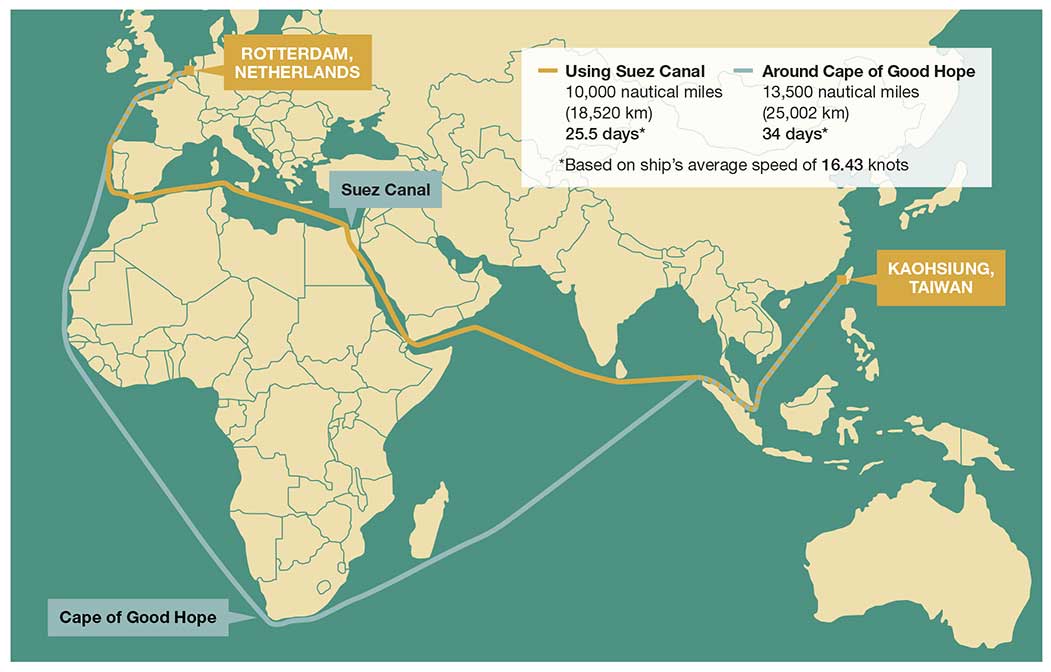

Alternative route for shipping while Suez Canal blocked

About 30% of global container ship volume moves through the Suez Canal, which links the Red Sea with the Mediterranean Sea, says Jonathan Colehower, managing director of the global supply chain practice at UST.

Spot rates for shipping goods from Asia to Northern Europe are up 173% compared to before shippers started rerouting shipments, and rates to North America’s East Coast are up 52%, according to a report from Freightos, a booking and payments platform for international freight.

Global ocean shipping disruptions will likely add to air and land freight movements in 2024. The two primary routes from Asia to the U.S. East Coast have been snarled by conflict in the Red Sea and low water in the Panama Canal, which is essentially a perfect storm restricting access to the U.S. East Coast. The West coast ports and intermodal network will likely continue to experience elevated demand as a result.

The Red Sea disruptions are causing diversions of marine traffic around the Cape of Good Hope, adding about 10 days and 3,500 miles to supply chains. Clearly, this will affect price and service, particularly for e-commerce freight and will likely result in diversions to air and land where possible.

As reported in the WSJ and Logistics Management, “billions of dollars’ worth of goods have shifted away from the channels leading to the Suez Canal as carriers divert ships to avoid Houthi rebel attacks.” As a result of such supply chain disruptions, average worldwide costs to ship 40-foot-long containers have nearly doubled since late November, according to Drewry Shipping Consultants.

The increases have also accelerated in the past two weeks on routes that traditionally use the Suez. The higher costs are hitting even importers that negotiate longer-term contract rates, because operators are imposing surcharges amounting to hundreds of dollars per box on some traffic.

So, while 2024 looks like it may be a fairly close copy of 2023 in terms of supply chain execution and cost in e-commerce moves, forecasting is even more precarious, given the instability and conflict that has no upside—only more disruption. This inevitably leads to service and cost impacts.