A Renewed Look at Doing Business in Latin America

The Greatest Supply Chain Challenges and Opportunities for Companies Operating in Latin America May Surprise You.

There is no doubt that Latin America holds enormous promise for manufacturers across a wide variety of industries that are looking to expand their supply chain depth and breadth.

As they look beyond their previous offshore sourcing models, which focused heavily on the Asia-Pacific region, they are finding fertile and profitable ground in Mexico, Central America and South America.

Perhaps nowhere is this trend more visible than in the automotive industry, with Toyota, Honda, Volkswagen and Nissan among the companies recently investing in large Mexican production facilities.

In fact, industry experts anticipate Mexico’s auto output to hit a record 2.86 million vehicles when the 2012 figures are tallied, making Mexico the eighth-largest automotive producer worldwide. Further, this trend is expected to continue, with analysts predicting 34 percent growth in Mexican auto production by 2017.(1)

The growing popularity of Latin America as a supply chain partner makes sense, given the region’s close proximity to large North American markets, its rich natural resources, attractive labor costs, liberal trade policies, and companies’ reputations for delivering high-quality products quickly and reliably.

While this growth is creating excitement among the region’s executives, it is also presenting them with new challenges. Today, there is special pressure on Latin American businesses to adopt leading-edge supply chain practices and tools in order to collaborate with their new global partners, compete successfully in international markets and increase profitability.

While the needs of every company are different, in general Latin American businesses are seeking supply chain improvements in the areas of demand, inventory replenishment, transportation, and sales and operations planning (S&OP). Retailers add category and space management to this list of top concerns.

The adoption of advanced supply chain solutions has been slower in Latin America than in the U.S. and Europe, with many companies struggling to leverage outdated and overloaded enterprise resource planning systems to tackle complex new challenges.

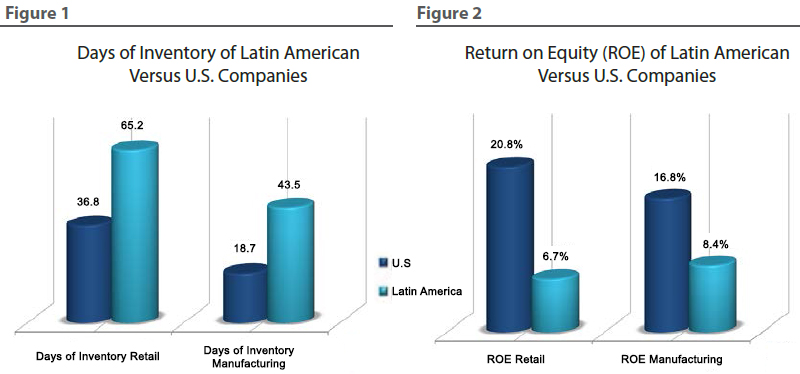

When comparing supply chain metrics of Latin American manufacturers to those of their U.S. counterparts, the effects of being a late technology adopter are significant.

For instance, leading U.S. beverage manufacturers average 18.7 days of inventory, whereas the average in Latin America is 43.5 days. And while the average return on equity in the U.S. is 16.8 percent, it is only 8.4 percent for Latin America’s manufacturers (Figures 1 and 2).

The charts above compare one of the top retailers in Chile, Columbia and Mexico versus two top retailers in the U.S., as well as leading beverage manufacturers in Chile, Peru, Columbia and Mexico versus two large U.S. beverage companies. The charts reflect publicly available 2012 data.

With so many Latin American businesses experiencing dramatic growth as the international business landscape has changed, it may be difficult for executives to pause and think beyond their traditional business processes and supply chain models.

This is completely understandable. But, for those Latin American companies willing to embrace change, they may find themselves with a significant competitive advantage as regional growth continues.

Embracing a New Business Model

In many ways, Cementos Argos — a leader in the Colombian cement industry — typifies the growth challenges faced by many Latin American businesses. It is the fifth-largest cement producer in Latin America, with investments in Panama, Haiti and the Dominican Republic. It is also the fourth-largest concrete producer in the U.S. and exports products to 40 countries.

Cementos Argos has expanded its use of JDA Supply Chain Strategist to model supply, demand and capacity across its sophisticated global network, helping it make intelligent decisions that match shifting customer demand with available regional capacity. As a result, the company is better able to analyze decisions such as the construction of new distribution centers, strategic investments, and optimized sourcing based on quantities, cost and requirements. By using JDA Supply Chain Strategist, Cementos Argos has achieved a return of investment of more than 500 percent, with several projects resulting in more than $1 million in savings.

Special Hurdles for Retailers

It is not just Latin American manufacturers who are faced with the challenges of rapid expansion. Retailers in these countries also face unique hurdles as both procurement and demand continue their dramatic growth.

While socio-economic conditions vary dramatically across the countries of Latin America, in general a rising middle class presents retailers with promising opportunities for revenue growth, especially in such discretionary categories as home decor and luxury goods.

According to a 2011 study by the United Nations, 56 million Latin American households rose to the status of middle class between 1995 and 2010. About 50 to 60 percent of Latin American consumers are considered emerging, and they may wield up to 40 percent of the region’s overall purchasing power.2 Increasingly, retailers’ strategic efforts are focused on understanding and meeting the needs of these upwardly mobile consumers.

While the Latin American retail landscape is still dominated by smaller stores — in part because of a large geographic footprint that makes serving remote regions difficult — the growth in middle-class consumers has brought corresponding changes to the retail picture. A global retail index published by A.T. Kearney in 2012 ranked Brazil and Chile at the top in retail growth.(3)

Supermarkets and hypermarkets are becoming a dominant force in large urban markets. Internet retailing in Latin America is also increasing rapidly, growing by 300 percent in the five-year period between 2005 and 2010. Shopping malls are being built across the region, with luxury retailers such as Lacoste and Burberry increasing their presence.(2, 4)

Despite this growth, many retailers are struggling to capitalize on new opportunities for profitable expansion. They have been lagging in gathering and applying consumer data, hesitant to compete with Internet giants such as Amazon, and slow to make investments in supply chain efficiencies that would increase their everyday profitability.

In fact, when compared to their U.S. counterparts, the supply chain metrics of leading Latin American retailers are surprising — and demonstrate significant room for improvement. While U.S. big-box retailers average 36.8 days of inventory, the leading Latin American retailer is a staggering 65.2 days. In the U.S., the average return on equity is 20.8 percent, but for Latin America’s largest retailers it is only 6.7 percent (See Figures 1 and 2). Based on these statistics, it is obvious that the Latin American retail industry could benefit from adopting new supply chain practices and advanced technology tools.

Dramatically Expanding Production Scope

Grupo Flexi is another example of a Latin American business that has had to adapt its supply chain capabilities to support its recent business expansion. Flexi owns and operates Flexi Shoe Stores in Mexico, as well as distributes its shoes throughout Mexico, the U.S., Canada, Japan and Central America. It is also the leading leather footwear manufacturer in Mexico, producing more than 13 million pairs of shoes per year, in a painstaking process that includes up to 30 different components.

In order to meet growing consumer demand, the business decided to dramatically expand its production capacity and product assortment. Not only would this growth plan create new pressures for its complex production network, but it would also make forecasting much more complicated. Since lead times for leather may be as long as three months, Flexi needed to embrace new supply chain solutions that would streamline and support its expanded operations.

Since implementing new technologies in demand management and supply chain planning, Flexi has been able to successfully achieve 40 percent manufacturing growth, while improving service levels from the 70-82 percent range to a new range of 87-90 percent. Inventory turns have improved by 17 percent, even while the company’s supply base has expanded to include 35 percent more factories. Advanced planning capabilities ensure that Flexi’s production facilities have almost 95 percent average capacity utilization.

Learn From the Leaders

Latin American manufacturers and retailers seeking profitable growth can learn valuable lessons from the supply chain leaders who are getting it right.

A key lesson is the importance of customer knowledge. While it might seem daunting to understand a consumer population as large, varied and geographically scattered as the Latin American market, traditional tools such as demographics and point-of-sale data — combined with emerging tools like 3D retail aisle studies — make this goal attainable for every Latin American manufacturer and retailer. By gathering demand data at an exacting level of detail, and feeding it back through the supply chain, companies can make strategic, profit-driven decisions at every critical point in production and distribution.

Another important lesson is the willingness to abandon traditional supply chain models that are no longer profitable in today’s ever-shifting Latin American economy. Growth almost always necessitates change. Those companies that embrace supply chain change will seize a competitive edge over those businesses that cling to outmoded sourcing, manufacturing and distribution models.

The question is not whether to innovate, but which areas of the business will bring the highest return on investment. Wherever individual business strategies point, one thing is certain: It will be exciting to observe the continued economic growth in Latin America as more and more companies adopt best-in-class supply chain practices.

Notes

(1) B. Case, A. Ohnsman and C. Trudell,”Automakers Boost Investing on Vehicle Factories in Mexico,” Bloomberg.com, November 14, 2012.

(2) M. Capizzani, F. Javier Ramirez Huerta and P. Roche e Oliveira,”Retail in Latin America: Trends, Challenges, and Opportunities,” IESE Business School, University of Navarra, Formacionretail.com, April 2012.

(3) H. Ben-Shabat, M. Moriarty, H. Rhim and F. Salman,”Global Retail Expansion: Keeps On Moving,” A.T. Kearney, Atkearney.com, June 2012.

(4) G. Castro-Fontoura,“The Retail Sector in Latin America: Some reflections on the A T Kearney 2011 Global Retail Development Index,” Sunny Sky Solutions, Sunnyskysolutions.co.uk, May 2012.

About the Author

Antonio Boccalandro is JDA Software’s group vice president, Latin America. He has more than 12 years of supply chain experience and is responsible for leading customer engagements in Latin America.

More on Latin America

- A Renewed Look at Doing Business in Latin America

- América Latina: Opportunities Abound, but Proceed with Care

- Focus on Latin America: Transportation and Regulatory Infrastructure

- Focus on Latin America: Brazil, Argentina, Chile

- Focus on Latin America: The Seaborne Advantage

- Doing Business 2014: Latin America (paper)