2024 Air Cargo Update: Cleared for take off

Despite ongoing geopolitical headwinds, the majority of airfreight analysts say that 2024 may herald the start of a new economic growth cycle for the global air cargo industry.

Geopolitical events and world economy concerns continue to present hurdles to global trade. However, experts at Xeneta, a provider of a real-time market intelligence and benchmarking platform for global freight, surmise that 2024 may herald the start of a new economic growth cycle for the global air cargo industry.

According to its data, 2023 ended with a +9% year-on-year rise in demand, and the general air cargo spot rate reached its highest level in nine months. In fact, some market observers have been expecting the Houthi attacks on ocean carriers in the Red Sea to have an upbeat ancillary effect on air cargo.

“The predictability of air cargo means the industry stands to benefit from escalating international disruption,” says Niall van de Wouw, Xeneta’s chief airfreight officer. But he notes that it has produced only modest gains in volumes with the exception of APAC and Middle East to Europe routes.

However, the impact has been minimal to North American carriers. “Delta Cargo has not seen a direct impact from the Red Sea, but also has less exposure than other global carriers,” says Drake Castañeda, a spokesman for Delta Air Lines. “But we will continue to monitor the impact of the situation, as well as the overall cargo environment, over the next few months.” He notes that air cargo has remained relatively strong post-peak season through January.

Roger Samways, vice president, commercial at American Airlines Cargo, stresses that, economically, AACargo is seeing signs of more positive trends, including inflation slowing as well as a likely relaxation of monetary policy in key markets.

“We hope that this will further stimulate consumer demand,” says Samways. “Beyond market and economic trends, our 2023 accomplishments—which included upgrading our cargo platform (iCargo) to the latest version and further expanding our network—have provided us with a strong foundation to excel in this new year.”

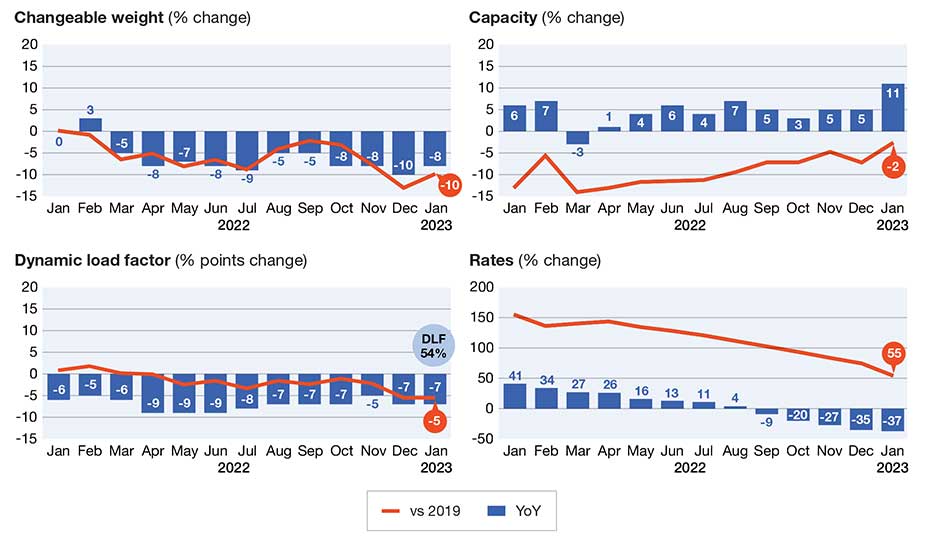

Year-on-year air cargo rate stabilized in January

(Global air cargo volume, capacity, load factor and rate developments)

Positive directions

Like the analysts at Xeneta, most analysts have high hopes for the air cargo industry in 2024. In fact, the International Air Transport Association (IATA) reported in early January that it expects all regions to experience air cargo growth this year.

The Middle East is set for the biggest rise at 12.3%, while Africa will see a more modest 1.5% growth. On average, air cargo is forecast to grow 4.5%. IATA projects yields will decline in 2024, although it expects yields will still be above pre-pandemic levels.

“Yields will likely decline in 2024, but they will still be above their 2019 levels,” says Rachel Yuting Fan, a senior economist at IATA. “Cargo revenue will also be about 11% above 2019 and comprise 12% of total industry revenue. In other words, 2024 will see sustained revenue growth and the sector will outperform pre-pandemic levels.”

IATA indicates that the relevant economic markers are also positive, with 3.5% growth in global trade projected for 2024.

“To say 2024 is a ‘new dawn’ is perhaps a little too optimistic,” comments van de Wouw. “However, I certainly think that it’s the start of a new cycle for airlines and forwarders. Shippers are likely to also appreciate the stability returning to the market so they can more accurately predict the transportation costs for the products they are selling.”

WorldACD Market Data reports that overall worldwide air cargo capacity remains significantly up on last year’s levels (+16%). The average worldwide rates of $2.33 per kilo during the fourth week of January are -20% below their elevated levels this time last year. They remain significantly above pre-pandemic levels (+31% compared to January 2019).

In the meantime, WorldACD Market Data reports that global air cargo tonnages continued to build in the final full week of January, well above their levels the same time last year. Its preliminary figures for January showed a +14% increase compared with January 2023, based on the more than 440,000 weekly transactions covered by WorldACD’s data.

Although these figures are skewed by tonnages related to the Lunar New Year that occurred this year on Feb. 10, WorldACD notes that for several months the trend has been for higher year-on-year tonnages. It attributes this to strong e-commerce traffic demand ex-Asia Pacific since the fourth quarter of 2023.

Other factors making an impact on the air cargo industry include the reduction in delivery times, and the robust performance of high-value specialized products, such as pharmaceuticals, which seem resilient to the industry’s usual volatility, say IATA.

Adding to the positive outlook, Mordor Intelligence estimates that in 2024 the airfreight market will be worth around $151.22 billion. The research firm projects the market will reach $201.57 billion by 2029, growing at a compound annual growth rate of 5.92% between 2024 and 2029.

Despite the historic shock of the pandemic and geopolitical events, airlines have demonstrated remarkable innovation and agility, displaying resilience.

Indeed, the industry has faced a host of challenges such as the substantial gap between jet fuel and oil prices, which limits most airlines from benefiting from potential oil price declines, unlike other industries.

Limited refinery capacity might sustain this issue into 2023, says analysts at Mordor Intelligence.

“Tight labor markets lead to higher wages, and unsustainable pricing power within the downstream aviation value chain is likely to persist in 2023,” Mordor adds in its report.

Carrier efforts

Carriers are working hard to maintain their competitive position in what they see as a promising market.

Carriers are expanding their belly capacity by adding new aircraft and expanding routes. IATA notes how “preighters”—also known as cargo in cabin, which became widely used during COVID—have disappeared entirely. “Meanwhile, dedicated freighters will maintain their usual share of the market,” adds IATA.

Last year, Emirates SkyCargo leased two Boeing 747-400Fs to add immediate additional cargo space in response to high customer demand. These join its fleet of 11 Boeing 777Fs and 251 passenger aircraft. In 2024, the carrier expects to add four new 777-200Fs and a fifth aircraft in 2025.

This order is in addition to 310 wide-body passenger aircraft that Emirates has on order, which will see deliveries of new aircraft, and new cargo capacity, through to 2035.

Lufthansa Cargo has been expanding its fleet and announced in November its fourth A321 freighter. The carrier has especially been expanding and optimizing its existing A321F network throughout Europe and Jordan.

Delta recently announced a new addition to its widebody fleet, the A350-1000. “With nearly double the cargo capacity compared to the B767 it replaces, we look forward to offering the optimal solution for efficient cargo transportation,” Castañeda says.

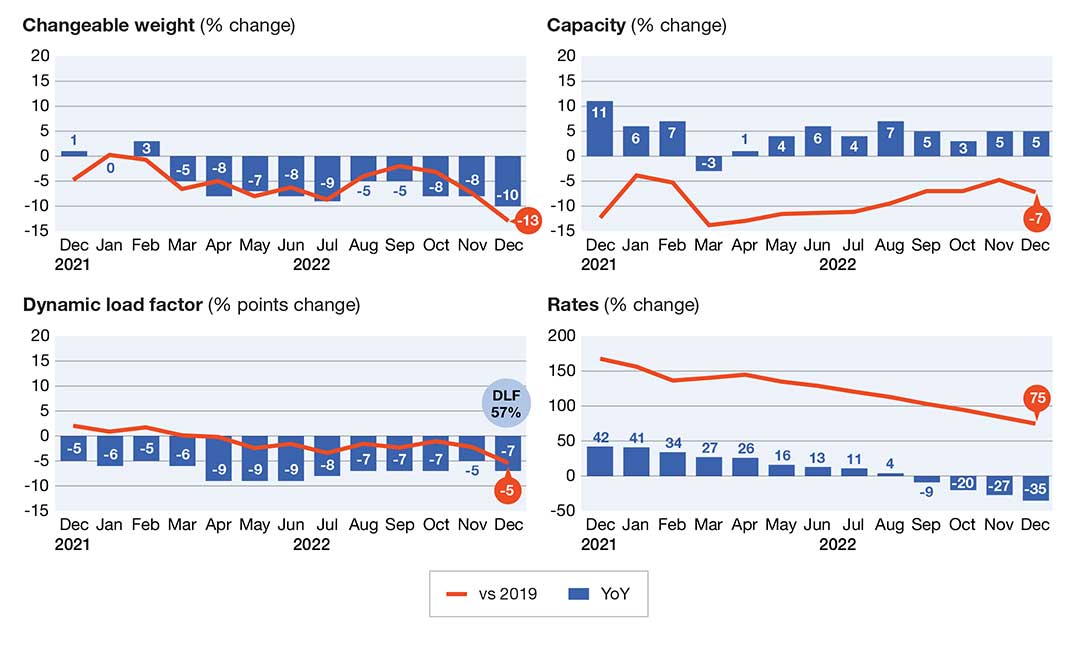

Transatlantic market, a rare sighting of a peak season

(Global air cargo volume, capacity, load factor and rate developments)

Future growth markers

Market analysts especially note that a catalyst for air carrier investment and advancement is e-commerce. It continues to be one of fastest growing sectors within the industry, and has fueled much of the industry growth—largely due to retail moving online and changing consumer expectations.

IATA reports that 80% of international e-commerce relies on air transport. Projections anticipate a substantial expansion in the e-commerce sector, potentially soaring to a value of $4.4 trillion by 2026. In fact, IATA’s 2021 e-commerce monitor revealed that 18% of air cargo comprised e-commerce shipments and expects that figure to rise as consumer behaviors evolve.

“The air cargo industry, boasting global networks, adaptable capacity, and digitalization initiatives, stands well-equipped to bolster e-commerce growth,” say IATA analysts. “These initiatives promise to augment operational efficiency and shipment visibility throughout transit.”

Lastly, IATA emphasizes that digitalization and sustainability will continue to be critical to air cargo’s progress—with the problem being the varied data in air cargo, which covers different functions, stakeholders, and formats. “This makes any streamlining attempts extremely complex,” it says. “Digitalization will give air cargo not only the ability to serve e-commerce growth and smooth capacity fluctuations, but also provide the analytics to boost sustainability.”

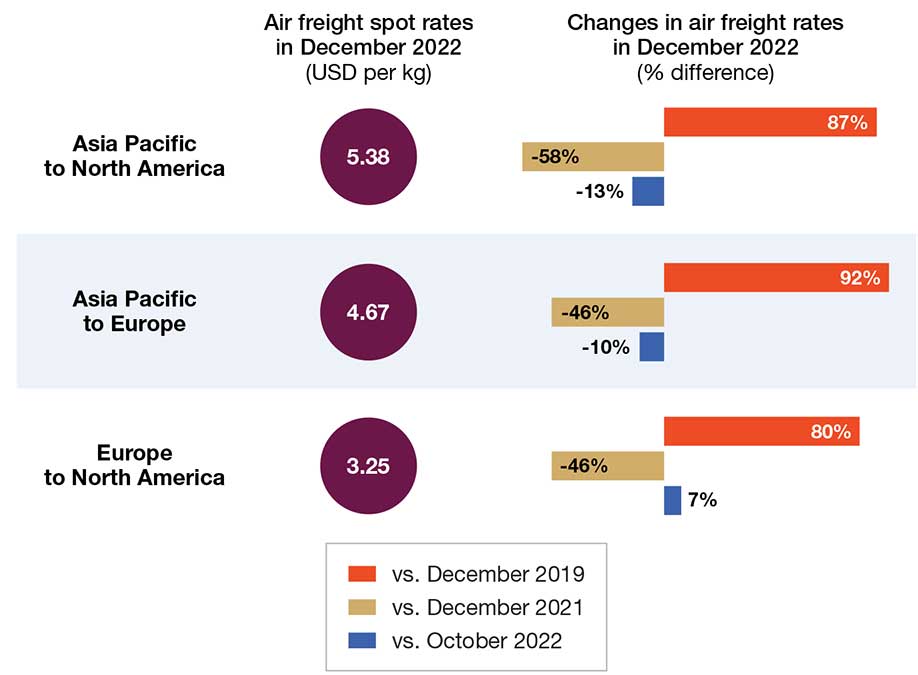

Air cargo rate in December records largest year-on-year fall

Samways reveals that AACargo is primarily focused on operational excellence and providing an industry-leading experience for its customers. “This enables us to reinforce our place at the top of the industry for customer experience,” he says. “Our plans to deliver in these key areas revolve around leveraging digital capabilities, be it providing tools for our teams or offering direct connections with our customers, that ultimately make it easier to do business with us.”

Delta Cargo recently launched its e-commerce solution, DeliverDirect, in collaboration with SmartKargo.

“DeliverDirect is a door-to-door delivery service for the U.S. market, offering a competitive and customizable solution for e-commerce retailers seeking to optimize their direct-to-consumer shipping solutions,” says Castañeda. “Small package shippers will benefit from increased shipping speeds, an uncomplicated pricing structure, proactive alert management, transparent tracking and reporting, and access to Delta’s vast domestic network.”

Emirates SkyCargo has also expanded online booking beyond its own platform to CargoAi and WebCargo with plans to further expand its digital footprint in early 2024. In October, Emirates SkyCargo launched a landmark host-to-host connection with global freight forwarder Kuehne+Nagel.

Lufthansa Cargo has also invested in digital capabilities, such as its e-booking system, and aims to make its booking systems accessible through application programming interfaces (APIs). In November, the carrier launched td.Zoom to offer its shortest transit times for time critical cargo. The new platform complements its td.Pro and td.Flash.

“To give an example: A shipment from Shanghai via Frankfurt to Zurich usually takes 45 hours with td.Pro, 35 hours with td.Flash, and only 23 hours with td.Zoom,” explains Ashwin Bhat, CEO of Lufthansa Cargo.