2023 State of Logistics: Ocean cargo

More choppy waters ahead for ocean carriers.

The second half of 2023 could be a challenging time for the ocean freight industry, given high expectations of a recession in the United States.

Christian Roeloffs, co-founder and CEO of Container xChange, sums it up like this: “Despite avoiding a global recession until now, the shipping industry is experiencing a freight recession mainly because overstocked retailers are postponing inventory replenishment cycles—a point that is underscored if you look at freight lanes that are mainly focused on capital goods and that are holding up much better.”

U.S. import volumes are predicted to remain low in both the second quarter and the third quarter of 2023 when compared to volumes a year ago, “although they might rise in the summer months compared to the first quarter of 2023,” Roeloffs adds. “As a result, liners have cancelled services, which has raised the falling spot rates to an extent. This has not, however, improved demand.”

Add to this, the negotiations between the International Longshore and Warehouse Union (ILWU) and Pacific Maritime Association (PMA) to renew their labor contract has continued since May 2022. “The West Coast dockworkers are currently operating without a contract, and cautious shippers want to avoid any pressure on cargo flow because of it,” Roeloffs adds.

Stefan Verberckmoes at Alphaliner observes that the market is changing constantly. “We’re still in the situation where the market has normalized to pre-pandemic levels,” he says. But he notes that the outlook remains grim given the many new ships that are to be delivered along with the fact that cargo demand is not increasing at the same pace.

“We currently see carriers absorbing additional tonnage by sailing at slower speeds and deploying more ships per service, but this is only a temporary solution. Overcapacity will become an issue later this year and next year. We see a gloomy scenario: a new rate war cannot be excluded. Carrier’s pricing discipline will be tested.” - Stefan Verberckmoes

Roeloffs anticipates a subdued rebound in demand as retailers begin to deplete their excess stock in the coming months leading up to the peak season.

Supply chain disruptions that will impact shipping industry

“The vicious circle of increasing interest rates, rising instability in the banking sector, tightened access to credit, falling commercial real estate values and eventual recession is underestimated by the overall market, and has significant implications for supply chains,” comments Roeloffs.

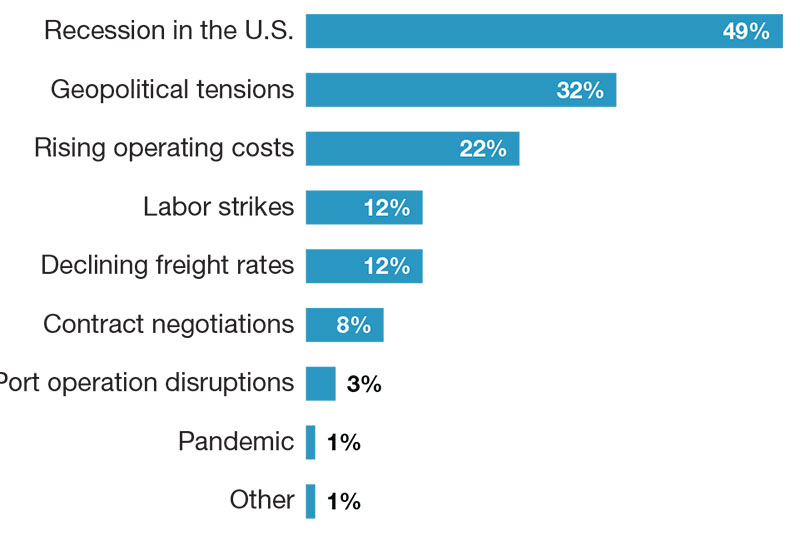

The most interesting findings were the biggest fears and challenges that the industry expects from the second half of 2023. The majority foresee recession in the U.S., geopolitical tensions and rising operating costs thinning margins as the key struggles for the second half of 2023.

The profit margins reported in the first quarter of 2023 by shipping lines were still strong because of the pre-negotiated contract rates. But Roeloffs expects these will slide significantly. “With contract negotiations underway, we will soon see revised rates which will then impact the profitability of the shipping lines in the second half of 2023 and into the year 2024,” he says.

Container xChange research does see some positive news in the container shipping industry, particularly in Asia where freight rates and container prices appear to have stabilized. This, it says, could be good news for businesses that rely on container shipping as it means they can anticipate more predictable shipping rates and potentially more stable supply chains.