Ranking the Best Countries for Private Business in EMEA

Switzerland, Sweden, and Germany are tops among 33 countries in Europe, the Middle East and Africa

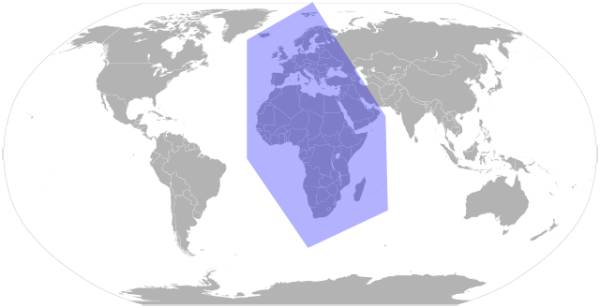

PwC released its third annual Private Business Attractiveness Index, with Switzerland claiming the top spot among 33 countries in Europe, the Middle East, and Africa (EMEA).

The rankings are based on scores obtained across 64 metrics across nine different data categories including private business landscape, tax and regulatory regime, sustainability and climate, technology, education, and more. Scores ranged from 'emerging' to 'leading,' indicating a country's attractiveness to private businesses in each category.

Switzerland ranked No. 1 for the third straight year, while Sweden ranked second (up from third in 2022) and Germany took the No. 3 slot. The UK dipped from second in 2022 to sixth in 2023. Ireland also slipped from No. 7 in 2022 to No. 9 while Croatia, Kenya, and Nigeria took up the final three spots.

“The Attractiveness Index reveals that in the face of ongoing macroeconomic uncertainty, traditional indicators like GDP growth don't offer a full picture of a thriving private business environment,” said PwC partner Peter Englisch. “Financial metrics, while essential, are only part of the equation. The Index emphasizes the need to focus on long-term fundamentals.”

“This includes fortifying resilient infrastructure, fostering a thriving start-up landscape with varied funding paths, committing to clear Net Zero objectives legally, and advocating for forward-thinking gender policies combined with strong public governance. It's clear that private businesses value jurisdictions not merely for their financial strength but for their sincere commitment to sustainable and holistic growth.”

The Top 10

- Switzerland (73.1)

- Sweden (72.1)

- Germany (70.1)

- Netherlands (67.3)

- Denmark (66.9)

- Norway, United Kingdown (tie, 65.9)

- Finland (63.6)

- Ireland (62.4)

- Spain (61.7)

- France (60.2)

Other key findings

- As economic uncertainty persists, countries are struggling with rising prices and living costs. The Attractiveness Index shows that even though people expected economies to grow, the reality is not as good, especially in richer countries where the cost increases are hitting hard.

- The countries that focus on being green and tackling climate change are making strong promises to reduce their carbon emissions to zero. They leverage renewable resources to power their business and maintain high recycling rates.

- Even with tough economic times, countries that are best for start-ups stand out because they have research funding and support from business incubators.

- Switzerland has topped the overall ranking each year – and continues to do so – thanks to its top rating on its private business landscape, and on education, skills, and talent.

- Despite being characterized as the “sick man of Europe” over the past months, Germany improved from fourth place to third. This is because it rates highly on many of the key elements that private businesses value most – including its private business landscape, start-up ecosystem, and technology/infrastructure.

Article Topics

PwC News & Resources

Ranking the Best Countries for Private Business in EMEA Tech Expectations Are Not Matching Reality For Many Companies Drone Technology: Clarity from Above Supply Chain Strategies under the Impact of COVID-19 of Large American Companies Operating in China Supply Chain: Your Brexit Competitive Advantage Digitization and Autonomous Driving to Halve Logistics Costs by 2030, finds PwC Study The Era of Digitized Trucking: Charting Your Transformation to a New Business Model More PwCLatest in Supply Chain

Is the Trailers as a Service (TaaS) Model Right For Your Business? Why Grocery Shoppers are Leaving Stores and Buying Their Food Online Is There a Next Generation of Truckers? Data Reveals Grim Outlook A Look at Baltimore’s Key Bridge Collapse—One Month Later European Parliament Passes Law on Supply Chain Accountability Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season More Supply Chain