What Black Friday Means for Warehouse Workers

The logistics industry may be busy during the holiday season, but a USC professor finds the promise of providing middle-class wages for workers falls short.

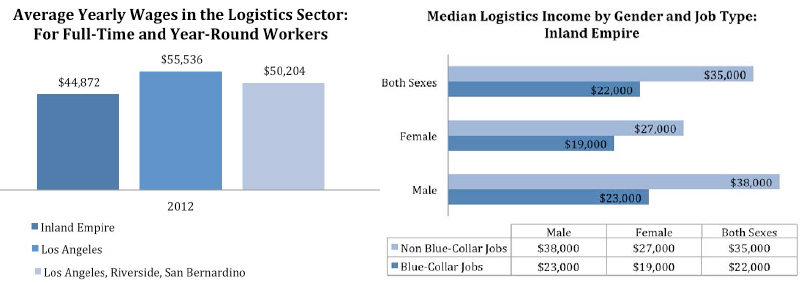

Black Friday is a busy time for big-box retailers – as well as the warehouse workers that move their products. But despite claims that the industry provides middle class wages for blue collar jobs, a recent USC study found that Inland Empire warehouse workers average $23,000 per year for men and $19,000 per year for women.

Contrast that with $45,000 per year – the figure cited by an industry model developed by the Southern California Association of Governments, said Juan De Lara, author of the study and an assistant professor of American Studies and Ethnicity at the USC Dornsife College of Letters, Arts,

It raises the question of what this means for the economies of regions like Southern California, where logistics plays a vital role and has been touted by business and government leaders as a path towards economic advancement.

The issue was raised earlier this year when President Barack Obama visited an Amazon.comshipping facility in Chattanooga, Tenn., as part of a tour entitled “A Better Bargain for the Middle Class.” It took De Lara by surprise.

“When the president gets up there and says that this is an economic model that will allow us to move forward as a country, I immediately thought – ‘Right, except there’s a huge section of the workforce that doesn’t actually make the money touted in these industry-wide wages,’” said De Lara.

He said the discrepancy can largely be attributed to the fact that many warehouse workers aren’t actually employed by major retailers such as Amazon, Wal-Mart and Target. Workers directly employed by them – which also includes large numbers of white-collar workers – might earn an average of $45,000 per year. But most warehouse workers are actually employed by third-party logistics companies. Many of them have been fined for labor law violations that appear to be systemic problems in the industry, De Lara said.

His study highlights the critical role that logistics has played in the Southern California economy. The industry employed more than 500,000 people in Los Angeles, Riverside, and San Bernardino counties in 2012, and has long been seen by policymakers as a way to create blue collar jobs in the aftermath of post-1980s manufacturing declines. Private and public investments in port infrastructure led to a booming warehouse industry. About half of warehouse space needed to meet future port capacity in Los Angeles and Long Beach was expected to be built in inland counties.

Past warehouse and residential construction has made the Inland Empire into one of the fastest growing metropolitan regions in the country during the past 30 years, De Lara said.

This growth has been largely driven by Latinos moving into the region. Nearly 80 percent of Inland Empire newcomers were Latinos. What does the future hold for this demographic group, California’s largest? “Most Latinos in the region work in blue occupations – more than 50 percent of Inland Southern California’s adult Latino population doesn’t have a college degree,” De Lara said. “So what’s the economic future for them in a region where warehouses and retail stores – both sectors with relatively low wages – are major employers?”

While policymakers certainly have a role to play, the real decision-makers may be the corporate retailers driving the industry. Wal-Mart in particular has incredible power when it comes to determining this economic structure, De Lara said. Pressure put on them by advocacy groups and the media has changed its behavior in the past. Wal-Mart has shifted to purchasing more American-made products and locally-grown food due to increased media attention, as well as increasing its energy efficiency. When $2.8 million in labor law fines were imposed on logistics contractors this year, Wal-Mart moved to distance itself from those companies.

It’s in its interest to do so, De Lara explained. “When Wal-Mart makes a decision to make these types of changes, it has a tremendous effect, not only across the industry but across the economy,” De Lara said. The question remains: “Will it turn a blind eye or take a leadership position and really have a positive effect on workers at large?”