Weakest Output in U.S. Manufacturing since January

Despite slower growth of purchasing activity, average lead times from suppliers continued to lengthen in November, which extended the current period of deterioration to 17 months.

November data highlighted a further slowdown in the pace of recovery across the U.S. manufacturing sector.

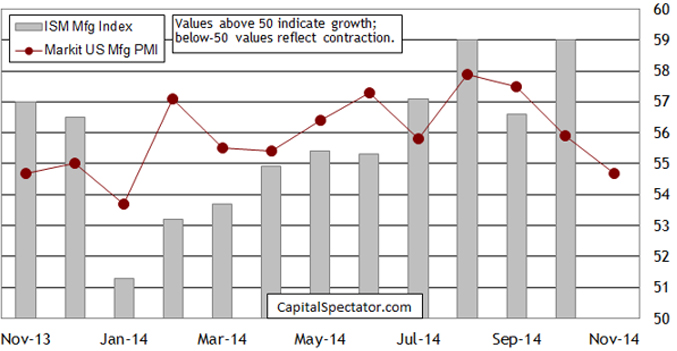

At 54.7, down from 55.9 in October, the seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) (1) indicated the weakest overall improvement in business conditions since the snow-related setback in January.

Although the latest reading remained well above the neutral 50.0 threshold, the index has now dropped for three months in a row.

Weaker rates of output and new business growth were the main negative influences on the headline PMI figure in November.

Latest data pointed to the slowest expansion of manufacturing production for ten months, with a number of survey respondents citing less favourable demand conditions.

Markit US Manufacturing PMI vs. ISM US Manufacturing Index (monthly)

Sources: Markit Economics, ISM

Incoming new work also increased at the weakest pace since January, partly reflecting a reversal in export sales volumes. Although only modest, the rate of decline in new orders from abroad was the most marked for 17 months. Some survey respondents commented on the strengthening dollar exchange rate, as well as more subdued underlying export market business conditions.

Resilient job market trends continued across the U.S. manufacturing sector in November. Latest data highlighted a robust rise in payroll numbers, and the rate of expansion was slightly stronger than seen in the previous month. However, there were signs of moderating capacity pressures, as manufacturers indicated that backlogs of work increased at the slowest pace for ten months.

In line with softer new business gains, the latest survey indicated the weakest upturn in input buying since March. Pre-production inventories increased for the fifth month running, but at a slower pace than in October, while stocks of finished goods rose only marginally.

Despite slower growth of purchasing activity, average lead times from suppliers continued to lengthen in November, which extended the current period of deterioration to 17 months.

Meanwhile, manufacturers indicated that input price inflation eased for the second month running in November. Moreover, the latest increase in average cost burdens was the slowest for a year-and-a-half. Anecdotal evidence highlighted lower raw material costs and falling commodity prices. However, factory gate price inflation accelerated slightly in November, which extended the current period of rising output charges to 27 months.

Commenting on the flash PMI data, Chris Williamson, Chief Economist at Markit said:

“The manufacturing sector is undergoing a marked slowdown in the fall after enjoying a buoyant summer. Output growth has now fallen for three straight months, taking the pace of expansion down to its lowest since the start of the year. Unlike January, however, this time the weaker rate of growth can’t be blamed on the weather.

“Export market weakness holds the key to the recent slowdown, with manufacturers reporting the largest drop in export orders for nearly one and a half years.

“There’s some reassurance from manufacturers continuing to boost their payroll numbers at a robust pace, but with backlogs of work showing almost no growth, the rate of job creation looks likely to moderate in coming months unless new order inflows pick up again.

“The manufacturing and service sector PMI data available so far point to GDP growth slowing to around 2.5% in the fourth quarter.”

(1) Please note that Markit’s PMI data, flash and final, are derived from information collected by Markit from a different panel of companies to those that participate in the ISM Report on Business. No information from the ISM survey is used in the production of Markit’s PMI.

About Markit

Markit is a leading global diversified provider of financial information services. We provide products that enhance transparency, reduce risk and improve operational efficiency. Our customers include banks, hedge funds, asset managers, central banks, regulators, auditors, fund administrators and insurance companies. Founded in 2003, we employ over 3,000 people in 10 countries. Markit shares are listed on NASDAQ under the symbol “MRKT”. For more information, please see www.markit.com

About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for 32 countries and also for key regions including the Eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to www.markit.com/economics.

Article Topics

Institute for Supply Management News & Resources

April manufacturing output recedes after growing in March April manufacturing output takes a step back after growing in March U.S. Manufacturing Gains Momentum After Another Strong Month Services sector sees continued growth in March, notes ISM Manufacturing sees growth in March, snaps 16-month stretch of contraction Services sector activity sees continued growth in February, ISM reports Services sector activity sees continued growth in February, reports ISM More Institute for Supply ManagementLatest in Business

Ranking the World’s 10 Biggest Supply Chains The Top 10 Risks Facing Supply Chain Professionals Walmart’s Latest Service: Ultra Late-Night Delivery Dollar Tree’s Oklahoma Distribution Center Decimated by Tornado City of Baltimore Files Lawsuit to Recoup Money for Collapsed Bridge The Era of Self-Driving Tractor-Trailers Set to Begin Is the Trailers as a Service (TaaS) Model Right For Your Business? More Business