US Manufacturing Increases at Fastest Rate in 4 years

Markit Flash U.S. Manufacturing PMI™ - Manufacturing PMI points to strongest improvement in overall business conditions since May 2010.

June data pointed to a robust and accelerated improvement in the performance of the U.S. manufacturing sector.

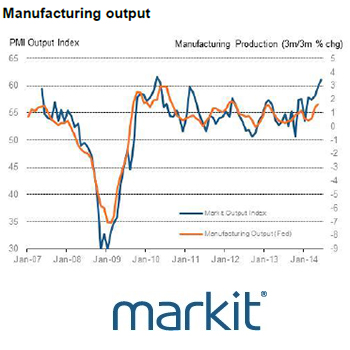

At 57.5 in June, up from 56.4, the seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1 indicated the strongest upturn in overall business conditions since May 2010.

The latest rise in the headline PMI was driven by the fastest output and new orders growth for just over four years.

Manufacturing output growth picked up for the third month running to its strongest since April 2010.

Moreover, the average pace of expansion in Q2 was the steepest for any quarter since the survey began in early-2007.

Survey respondents generally attributed rising production volumes to improving domestic economic conditions, increased client confidence and a strong pipeline of outstanding work.

In line with the trend for output, total new business volumes increased at a sharp and accelerated pace during June.

The latest rise in new work was the most marked since April 2010, despite a weaker contribution from new export order growth.

June data signalled that new business from abroad picked up at the slowest pace seen over the current five-month period of expansion.

Payroll numbers at manufacturing firms increased for the twelfth successive month in June.

A further solid upturn in employment levels was driven by greater production requirements and the fastest rise in backlogs of work for four months.

Moreover, aside from the sharp increase in unfinished work related to heavy snowfall in February, the latest accumulation of outstanding business was the steepest since the survey began in May 2007.

Manufacturers responded to stronger client demand by increasing their input buying at a robust pace in June, which extended the current period of rising purchasing activity to eight months.

However, stocks of purchases were unchanged in June, while post-production inventories decreased at the fastest rate since January.

Some survey respondents noted that stronger than expected sales had contributed to lower stocks of finished goods at their units.

June survey data highlighted strong input price inflation across the manufacturing sector.

The latest rise in average cost burdens was the fastest since January. Anecdotal evidence cited higher prices for a range of raw materials, especially metals.

Meanwhile, factory gate price inflation picked up for the first time in 2014 to date.

That said, the latest rise in manufacturers’ output charges was only moderate and remained weaker than the long-run series average.

Commenting on the flash PMI data, Chris Williamson, Chief Economist at Markit:

“US industry is booming again, with the flash manufacturing PMI hitting its highest for just over four years in June. The strong reading also rounds off the best quarter for factories for four years, adding to indications that the US economy rebounded strongly in the second quarter from the weather-related weakness seen at the start of the year.

“The survey data suggest that GDP should be set to rise by at least 3.0% after the 1.0% decline in the first quarter.

“If there’s a weak spot it’s the near-stagnation of exports, which raises the possibility that trade will have acted as a drag on the economy in the second quarter.

“Hiring also continued at a robust pace as firms boosted capacity in line with the strong demand, broadly consistent with factories taking on another 12,000 staff during the month. The job markets gains will fuel hopes that we will see yet another month of approximately 200,000 non-farm payroll growth in June.”

Editors Note

Final June data are published on 1 July 2014.

Markit originally began collecting monthly Purchasing Managers’ Index™ (PMI™) data in the U.S. in April 2004, initially from a panel of manufacturers in the U.S. electronics goods producing sector. In May 2007, Markit’s U.S. PMI research was extended out to cover producers of metal goods. In October 2009, Markit’s U.S. Manufacturing PMI survey panel was extended further to cover all areas of U.S. manufacturing activity. Back data for Markit’s U.S. Manufacturing PMI between May 2007 and September 2009 are an aggregation of data collected from producers of electronic goods and metal goods producers, while data from October 2009 are based on data collected from a panel representing the entire U.S. manufacturing economy. Markit’s total U.S. Manufacturing PMI survey panel comprises over 600 companies.

The flash estimate is typically based on approximately 85%–90% of total PMI survey responses each month and is designed to provide an accurate advance indication of the final PMI data.

The panel is stratified by North American Industrial Classification System (NAICS) group and company size, based on industry contribution to U.S. GDP. Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indictors the ‘Report’ shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the ‘diffusion’ index. This index is the sum of the positive responses plus a half of those responding ‘the same’.

The Purchasing Managers’ Index™ (PMI™) is a composite index based on five of the individual indexes with the following weights: New Orders – 0.3, Output – 0.25, Employment – 0.2, Suppliers’ Delivery Times – 0.15, Stocks of Items Purchased – 0.1, with the Delivery Times Index inverted so that it moves in a comparable direction.

Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

Markit do not revise underlying survey data after first publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series. Historical data relating to the underlying (unadjusted) numbers, first published seasonally adjusted series and subsequently revised data are available to subscribers from Markit. Please contact [email protected].

About Markit

Markit is a leading global diversified provider of financial information services. We provide products that enhance transparency, reduce risk and improve operational efficiency. Our customers include banks, hedge funds, asset managers, central banks, regulators, auditors, fund administrators and insurance companies. Founded in 2003, we employ over 3,000 people in 11 countries. For more information, please see markit.com

About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for 32 countries and also for key regions including the Eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to markit.com/economics.

Related: Manufacturing “Revival”? No, Manufacturing Transformation/Transition