Three Supply Chain Questions Supply Chain People are Afraid to Ask

Groupthink is a psychological phenomenon that occurs within a group of people in which there is a desire for harmony within the group, but the result is an irrational or dysfunctional outcome - Wikipedia.

You know the drill. The meeting is on everyone’s calendar. It has been set-up by the CEO or a board member’s assistant months in advance.

The room is big, the PowerPoint deck is large, and the coffee cups are arranged in neat rows on the counter of the side of the room. There is an abundance of pastries flowing from the basket, and the stage is set for an impactful meeting.

Even though things seem to be going well (all of the meeting details are well-executed and the speaker is giving an energized presentation), the room is eerily quiet. The speaker is speaking, the beautiful slides move quickly at the front of the room, but the audience is not engaged.

In my travels, I attend these meetings frequently. They are precipitated by a strategic relationship between a consulting company and the executive team. The consulting team pitches a theme - vision of supply chain best practices, big data analytics, or demand-driven value networks – to the executive team, and a new project is initiated.

The first step in the journey is a kick-off meeting. The second step is usually a large implementation of a technology project - Enterprise Resource Planning, Customer Relationship Planning or Analytics. I feel that the industry is engaged in ‘Group Think’. No one in this meetings is going to ask tough questions. The board has not set-up the team for success. Here are the three questions that I would like people to ask:

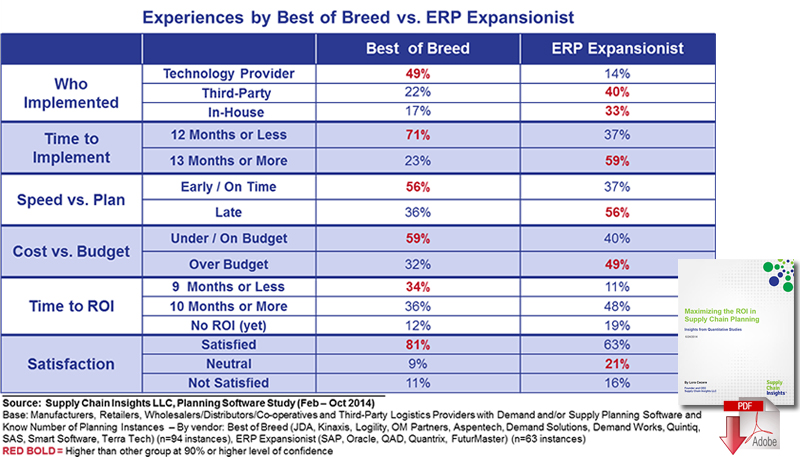

Table 1: Comparison of Results for Best of Breed Solution Providers to ERP Expansionists in Supply Chain Planning

Question 1: What drives a Successful Implementation of Supply Chain Planning? Supply chain planning is now on its third decade. The first evolution of technologies were built by best-of-breed solution vendors. These solutions were usually implemented by the technology provider by consultants with specialized skill sets. The promise was the delivery of a decision support system that would allow the organization to optimize the relationships between cash, cost and customer service against the strategy.

The second generation of solutions were built and marketed by Enterprise Resource Planning technology companies like SAP and Oracle. The promise of these solutions was that an ‘integrated planning solution with ERP would deliver greater value’. (This solution in Table 1 is termed the ERP Expansionist.) This new solution was favored by the Information Technology (IT) organization. By purchasing planning and transactional systems for a common vendor, they had one throat to choke and they were familiar with the architectural elements. It was also the preference of the consulting partners because the projects were longer, more costly and better aligned with the consulting model. But, did it add more value? The answer is no. As shown in table 1, the movement to adopt “integrated ERP and Supply Chain Planning software from an ERP vendor” moved the industry backward. Ironically, the solutions implemented by the consultants, as contrasted to those implemented by the technology vendors also produced less desirable results.

How do I know this? The results in table 1 come from a nine months research project of 120 respondents representing 183 instances of demand and supply planning. (The average company has more than one instance of both.) In the study, the respondents were asked to rate time to Return on Investment, and satisfaction. We also correlated the results to balance sheet performance. What do we find? Best of breed solutions have a higher Return on Investment and are quicker to implement. They also have higher satisfaction rates. The highest satisfaction comes when the technology vendor implements the solution. It is significantly different at a 90% level of confidence. In the data, we can also see that the implementations from the ERP Expansionists have significant gaps–requiring more planners, longer times to plan, and greater difficulties getting to data.

Why does this happen? Leadership teams struggle with the trade-offs between cash, cost and customer service. As a result, supply chain planning is often a targeted project when the strategic consulting partners talk to their clients at a board level. The strategic consulting partners are respected in these relationships and seldom questioned, and the stage is set. In parallel, there is a low-level of trust for the best-of-breed technology vendors. Many are very sales-driven and difficult to work with. The market was over-hyped at an early stage and trust eroded. Would the board deliberately select a system that takes longer to implement, with a lower Return on Investment, requiring more on-going labor and producing lower results? Of course not…. But, the industry is in a group think. No one is having a fact-based discussion. This is how we see our role

Table 2: Characteristics of those Satisfied with Supply Chain Planning

Question 2: Who does supply chain planning well? What can we learn? As shown in table 2, the companies that are the most satisfied with planning are smaller organizations with 15 or less planners and without high item complexity.

To drive maximize the value of planning, organizations need to be aligned against an operating strategy. Companies adopt planning to optimize the organization’s response from the customer’s customer to the supplier’s supplier. The supply chain planning cannot be effective if implemented by a supply chain function that is focused only on customer service, logistics and distribution. It requires the support of the organization to optimize the response for the end-to-end value chain that crosses functions.

What can we learn from this table, and the research? A successful supply chain planning implementation is about more than technology. The implementation of decision support tools needs to be a way of life. Planners need time to plan, and the organization needs to be aligned against a shared vision or operating plan. It cannot be about the optimization of vertical silos within the organization. This leads to a sub-optimal response.

The second thing that I learned from the research is that we do not have good solutions for large organizations in the market today. If you have a large number of planners and high item complexity, you are at risk. This I think leads us to the Third-act of Planning. In the third-act, I believe that the technologies are very different from those in the first two decades of evolution. In the Third Act, I believe that the processes and technologies are redesigned outside-in from the channel back to the enterprise. I think that it is a new world of cognitive learning, rules-based ontologies, concurrent optimization, and B2b Networks based on canonical infrastructures with many-to-many data models. These new technologies are evolving. (I will write more on this in my next SC24/7 blog post.)

Question 3: How do I become demand-driven? Data surrounds the company. The data in the channel is changing faster than the company can adopt processes and technologies to use it. It is piling up on the doorsteps of most major companies. Some may be used by the digital marketing teams for marketing purposes, but the average company does not know how to use it. They struggle to listen and interpret market signals. It is ironic that there has never been a time in history where customer data is more available, and the demand higher for companies to operate a customer-centric value network to sense and respond to true demand, but the solutions to use the data are evolving. Today, they do not exist.

Most consultants and technologists are guilty of bait and switch. The discussion is on becoming demand-driven, but the recommended solution is a traditional approach. When the pretty slides are over, the consultant submits a project plan to implement the traditional forecasting, order management and supply planning that does not sense market demand and translate it into usable outcomes. The audience listening to these presentations does not have the courage to raise their hands and ask the question, “How do you define demand-driven value networks?” and then follow with the question of, “Can the traditional technologies really help us to become demand driven?” The consultants are incented to recommend the solutions that they are familiar in implementing. Most know very little about the true definition of demand driven.

Tomorrow, I get to deliver this message to a large manufacturing client. I am speaking at their global kick-off. I am going to encourage them to not be guilt of industry group think. In this blog, I hope that I push you too. I want you to raise your hand and question the status quo. And, if you do not have the courage to do it directly, share the research and ask your leadership team to give me a call. I answer all emails and phone calls. I want to change the dialogue. It is tough for me to see that nine out of ten companies are stuck, and not making progress, at the intersection of operating margin and inventory turns. I grow weary of all of the consultant presentations of how supply chains can reduce inventory without looking at the form and function of inventory and the real needs for inventory to be a buffer of demand and supply volatility.

About the Author

Lora Cecere is the Founder and CEO of Supply Chain Insights, the research firm that’s paving new directions in building thought-leading supply chain research. She is also the author of the enterprise software blog Supply Chain Shaman. The blog focuses on the use of enterprise applications to drive supply chain excellence. Her book, Bricks Matter, was published in December of 2012.

Related: A Practitioner’s Guide to Demand Planning

Article Topics

Supply Chain Insights News & Resources

Talking Supply Chain Podcast: Insights on Leaders - The Top 25 CHAPTER 3: Bricks Matter Infor Aquires GT Nexus - If I Had a Magic Wand! Why Are We Letting Digital Marketers Define The Future World View of The Supply Chain? Imports & Exports Made Easier with Global Trade Management Software Maximizing the ROI in Supply Chain Planning Getting Inventory Right: Hope with Hype and Recycled Supply Chain Software? More Supply Chain InsightsLatest in Supply Chain

A Look at Baltimore’s Key Bridge Collapse—One Month Later European Parliament Passes New Law Requiring Supply Chain Accountability Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season Apple Accused of Multiple Human Rights Violations South Korea Finally Overtakes China in Goods Exported to U.S. UPS Struggles in First Quarter With Steep Earnings Decline More Supply Chain