Study: Anti-fatigue market growing through 2029

This study presents a far-reaching outlook of the anti-fatigue mats market for the time frame 2019 to 2029. The anti-fatigue mats market is envisaged to register a volume CAGR of ~3% through 2029.

According to a recent study by Fact.MR, ~3 million units of anti-fatigue mats were sold in 2018, and sales are envisaged to grow 1.3X during 2019 to 2029. The industrial settings are highly likely to account for a significant market share in 2019 but will possibly lose their market position later, to commercial as well as the residential user base, as per the report findings.

This study presents a far-reaching outlook of the anti-fatigue mats market for the time frame 2019 to 2029. The anti-fatigue mats market is envisaged to register a volume CAGR of ~3% through 2029.

Growing adoption of the active office culture in various countries has driven the applications of the anti-fatigue mats in commercial settings, which is highly likely to emerge as a lucrative sector to tap in the years to come. As the health and wellness trend continues to shape consumer lifestyle- both professional and personal, demand for safer and convenience-driven infrastructure is picking pace. Innovation-led product diversification will remain the key growth determinant for stakeholders that are targeting a wider pool of customers.

Though European and North American markets have already reached maturity, and collectively account for over half of the global market volume, penetration of advanced technology is likely to bring waves of change in the years to come. High cost of healthcare in the developed nations has driven the consumers towards adopting a healthy lifestyle, and in a bid to stay healthy and avoid treatment costs, they are increasingly spending on ergonomic offerings available on the market. However, it is pertinent to note that as an increased number of manufacturing industries and commercial firms are leveraging automation in developed region, the requirement for employees and thereby, their safety products are envisaged to witness a dip.

Extensive applications of anti-fatigue mats made of various materials, such as foam rubber, hard rubber, and gel have been fueling the growth of the market. As per the study, traction for hard rubber based variants has been creating highest revenues for the market, and is likely to account for more than half of the market volume share in 2019. The anti-fatigue mats composed of hard rubber has been appeal customers with the pricing advantage it offers over counterparts.

However, the lucrativeness of gel based variants is anticipated to grow for residential as well as commercial and industrial applications, as they are easy to clean and maintain. Moreover, gel based anti-fatigue mats are also likely to emerge as a viable option to suffice growing aesthetic prerequisites for the residential applications.

The study indicates that sales of anti-fatigue mats rely significantly on their surface compatibility. Sales of anti-fatigue mats with high compatibility for dry surface reached 1.3 thousand units in 2018, and are likely to grow at a steady pace in the forthcoming years. Extensive applications for standard, and more than 60 feet long anti-fatigue mats particularly in industrial settings will substantially drive the growth prospects for the manufacturers.

Lack of awareness and limited regulations mandating ergonomic infrastructure and workplace safety products, such as anti-fatigue mats continue to impede the growth opportunities of stakeholders. The study indicates that favorable regulations in developed regions have helped the anti-fatigue market reach a matured state, however, the struggle of stakeholders remains intact in the developing regions, especially in Oceania.

According to the study, several market players have shifted their focus towards formulating distracting and impactful strategies to spread awareness about the health as well as productivity related benefits of anti-fatigue mats to drive sales. Such initiatives on the part of stakeholders are likely to help the market make inroads in the highly unexplored areas that hold significant opportunities but are creating restrictive gains for companies due to lack of awareness. Manufacturers are exploiting all the available distribution channels to generate higher revenues. The study mentions that direct sales of anti-fatigue mats reached 2.16 thousand units in 2018, and will continue to remain the sales channel of choice, while market players focus on appealing a broader pool of customers.

The proliferating manufacturing industry in the developing regions, such as East Asia and South Asia, is likely to emerge as a hotbed of opportunities for sales of anti-fatigue mats. High regional dependency on manpower at manufacturing plants and industries continues to shape and appeal the sales strategies of leading players in the anti-fatigue mats market. The study opines that East Asia will continue to remain a key focus area for anti-fatigue mats manufacturers, and will expand by 1.4x during the foreseeable period.

Featured Safety Products:

Forewarner LED Warning Lights

Forewarner LED Warning Lights

Full-Sized Pedestrian and Vehicle Safety Warning Light

iFlex ForkGuard Kerb Guardrail

iFlex ForkGuard Kerb Guardrail

Barrier enhances safety in the loading of flatbed trailers.

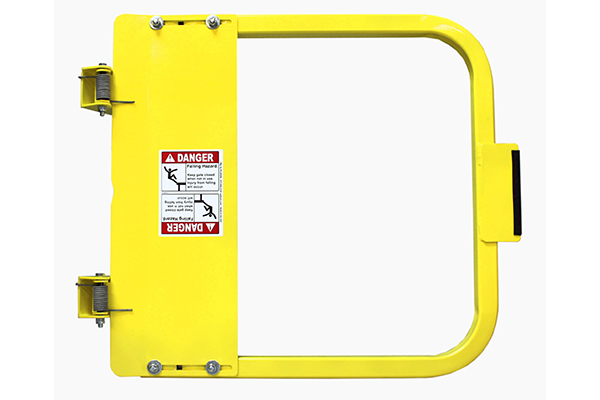

PS Safety Access Ladder Safety Gate

PS Safety Access Ladder Safety Gate

Self-closing gate improves guardrail safety.

Smart+TM line of dock products

Smart+TM line of dock products

Solution features a human machine interface for easier operation.

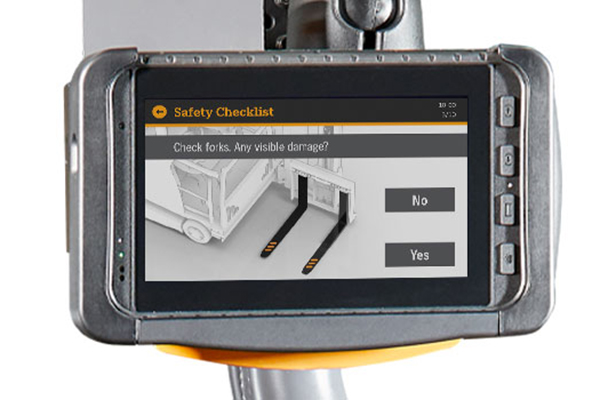

InfoLink forklift fleet management

InfoLink forklift fleet management

Touch interface provides more functionalities for forklift operators.

Flood-Gard Bearing Isolators

Flood-Gard Bearing Isolators

Extend the life of gearboxes, pumps and motors