Oil Hits Five And a Half Year Low - Bodes Well For Transportation Companies

Crude oil is now trading at about $52 a barrel - its cheapest level in years - and gasoline prices have fallen accordingly - for now, low fuel prices will benefit some transportation companies and hurt others.

Oil prices continue to fall, with the precious crude currently trading around $55.

At the current price, we are seeing oil priced at levels not seen since 2009, and there is little reason to expect a rebound any time soon. However, with the large drop it appears as though there is not much additional downside.

High supply levels have pushed prices lower, and a recent move from Saudi Arabia to keep pumping instead of cutting production creates a scenario of low oil prices for some time to come. Saudi Arabia could have pulled back on its output in hopes of driving prices higher, but the move to keep pumping is a move to let prices fall with the aim of maintaining, or gaining, market share.

Looking two or three years into the future, oil prices are expected to get back closer to $90 or $100 a barrel, but it will most likely be a long and gradual rise. Growth in China has slowed, Europe remains on the brink of another recession, and the U.S. is going through an oil boom. Any one of these factors would weigh on oil prices, but all three combined will be hard for oil bulls to overcome.

The way most of us notice lower oil prices is when we fill up our cars with gasoline. The national average price of a gallon of gasoline is now around $2.75, which is lowest since October 2010, and down 50 cents from this time last year. That leads to big savings at the pump, which is great news for retailers since consumers will have more discretionary money to spend.

While retailers are likely to benefit from lower gas prices, the sector that is best positioned to take advantage of falling oil prices is the transportation sector. Airlines and shipping companies love what has happened to oil prices. For these types of companies, energy costs represent a huge amount of their overall costs of doing business; so falling oil prices enable them to grow their earnings very quickly.

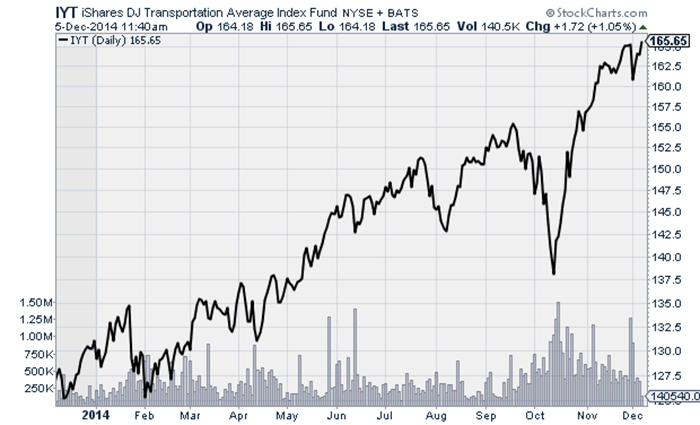

An easy way for investors to take advantage of what is taking place is with a trade on the transportation oriented ETF iShares Transportation Average (IYT).

The fund holds some of the biggest transportation-related stocks, with companies such as FedEx, Union Pacific, United Parcel Service, and J.B. Hunt Transportation among its top holdings.

Each of the above companies should do well in a low-cost oil environment, which is a big reason why IYT has been so strong in recent months.

Stifel: Shippers will benefit from lower fuel prices in the fourth quarter

In 2014, crude oil prices fell sharply. Crude oil is now trading at about $52 a barrel - its cheapest level in years - and gasoline prices have fallen accordingly. For now, low fuel prices will benefit some transportation companies and hurt others.

A recent report by a team of securities analysts at St. Louis-based Stifel Financial Corp. said fuel surcharges will benefit most transportation companies in the final quarter of 2014. Shippers often charge a fuel price surcharge to recoup the cost of fuel to move an item.

The report said the price of the surcharge is often set to previous oil prices - anywhere from a week to a couple of months prior - so rapidly falling oil prices will generally lead shippers to charge a fuel surcharge based to a price higher than it actually paid for the fuel. The larger the lag between the benchmark price and the actual price of fuel, the larger the benefit the shipper will reap.

The report said railroads and parcel carriers - carriers with long lag times between surcharge benchmarks and actual fuel prices - will see positive impacts from this phenomenon. Truckload and less-than-truckload carriers - carriers with shortest fuel surcharge lag times or flat annual pricing structures - will see negative impacts.

In general, shippers who benefit from higher consumer spending will rise in the fourth quarter. Those who benefit from growing domestic oil production will fall, the report said.

Related: Oil and Fuel Markets: A year in review and the view ahead

Download the White Paper: Truckload Fuel Surcharges: How They Work & What They Cost

Article Topics

C.H. Robinson News & Resources

Q&A: Mike Burkhart on the Recent Nearshoring Push Into Mexico Q&A: Mike Burkhart, VP of Mexico, C.H. Robinson C.H. Robinson introduces new touchless appointments technology offering C.H. Robinson President & CEO Bozeman provides overview of key logistics trends and themes at SMC3 JumpStart 2024 C.H. Robinson touts its progress on eBOL adoption by LTL carriers and shippers Retailers Pivot Supply Chain Strategy, Seek Red Sea Alternatives C.H. Robinson announces executive hire to run new Program Management Office More C.H. RobinsonLatest in Other

Trucking Industry Pushes Back on Government’s Electric Mandates Senators Take Aim at Amazon with Warehouse Worker Protection Act Maersk Sees Silver Lining in Red Sea Shipping Challenges Happy Returns Partners With Shein and Forever 21 to Simplify Returns Baltimore Opens 45-Foot Deep Channel Following Bridge Collapse El Paso Border Delays Cost Juarez $32 Million Per Day in Economic Losses Walmart’s Latest Service: Ultra Late-Night Delivery More Other