March Cass Freight Index shows signs of freight slowness

The March edition of the Cass Freight Index, which was issued this week by Cass Information Systems, showed further signs of slowing freight momentum.

Many freight transportation and logistics executives and analysts consider the Cass Freight Index to be the most accurate barometer of freight volumes and market conditions, with many analysts noting that the Cass Freight Index sometimes leads the American Trucking Associations (ATA) tonnage index at turning points, which lends to the value of the Cass Freight Index.

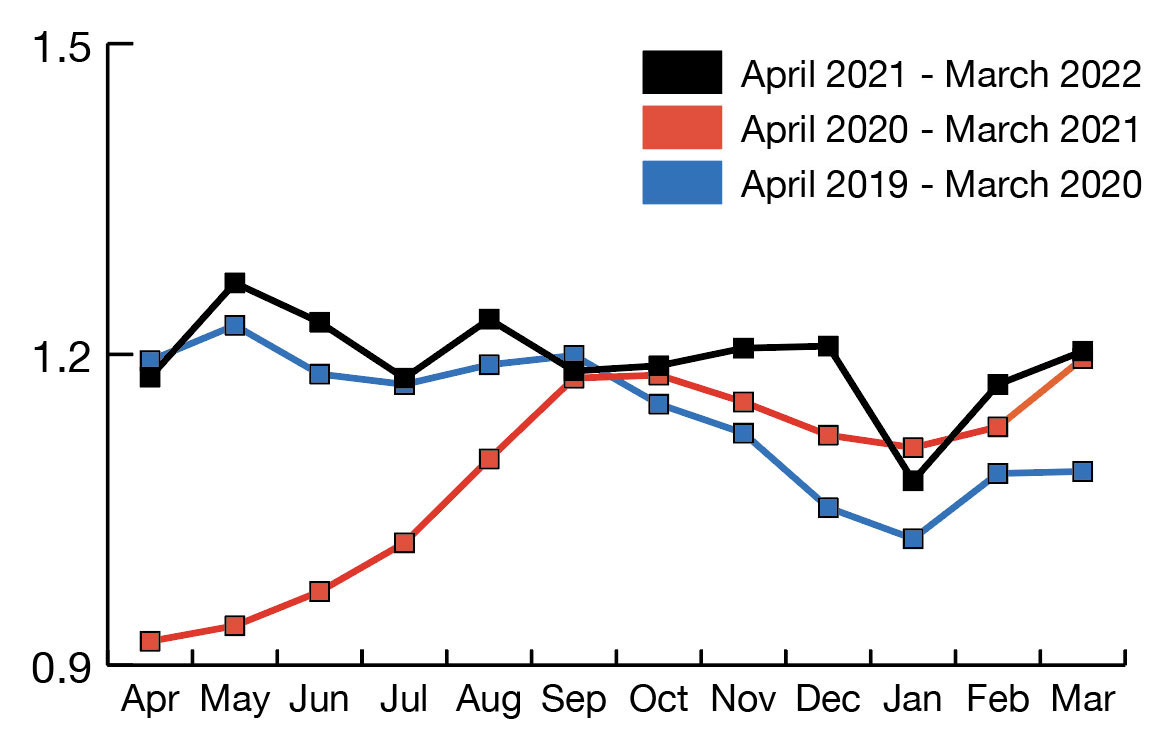

March’s shipment reading—at 1.203—eked out a 0.6% annual increase, down 3.0% from February’s 3.6% annual increase and ahead of January’s 2.9% annual decline. On a two-year stacked basis, it was up 10.7%. Shipments were up 2.7% and down 1.0% on a month-to-month and month-to-month seasonally-adjusted basis, respectively.

For the first quarter, shipments were up 0.4% annually, well below a 4.3% gain in the fourth quarter of 2021 and a 9.5% gain in the third quarter of 2021.

The report’s author Tim Denoyer, ACT Research vice president and senior analyst, observed that a few points of softness on first quarter shipments were attributed to Omicron-related absenteeism, and freight slowing in advance of the Russia-Ukraine conflict.

“The threat of freight recession has risen recently as services reopen, inflation presses up interest rates, and— though war-related effects are likely to be modest in the near-term—higher energy prices have an increasingly negative effect over time,” he wrote. “We’re certainly seeing a freight slowdown and spot market correction, but in our view, it is too early to call it a freight recession.

March expenditures—at 4.501—saw a 33.2% annual gain, in line with the Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) showing yet another new high, rising 8.5% annually in March, and marking its biggest percentage gain going back to 1981.

Expenditures were up 69.8% on a two-year stacked basis and were up 1.1% and down 0.2% on a month-to-month and month-to-month seasonally-adjusted basis, respectively.

Denoyer wrote that this index rose 38% in 2021, after a 7% decline in 2020 and no change in 2019.

“Tougher comparisons in the coming months will naturally slow these [annual] increases, but just using normal seasonality from here, the increase in 2022 will still be about 25%,” he wrote.