Economic Report : Manufacturers Bullish, But Frustrated with Washington

National Association of Manufacturers/IndustryWeek Survey of Manufacturers Second Quarter, 2014 results.

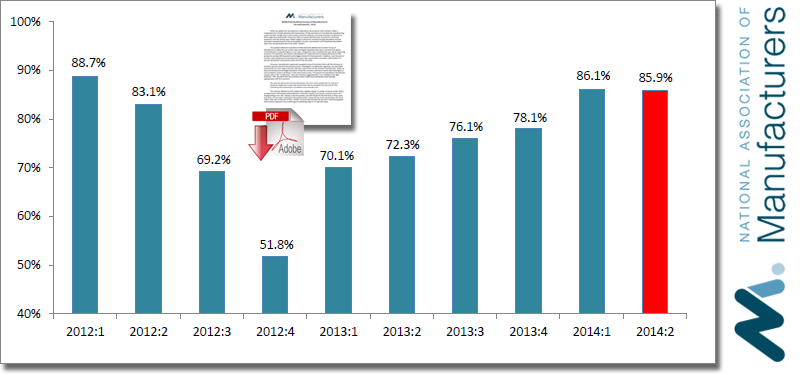

The latest NAM/IndustryWeek Survey of Manufacturers - released today - found that roughly 86 percent of manufacturers were either somewhat or very positive about their own company’s outlook, essentially unchanged from three months ago.

Yet, the underlying data show higher levels of anticipated activity across the board over the next 12 months. For instance, sales are expected to grow 4.1 percent on average over the next year, up from an average of 3.6 percent in the last survey and the fastest pace in two years. Capital spending and hiring plans were also anticipated to increase, with almost half of respondents planning to add workers in the coming months.

Nonetheless, the survey also found that manufacturers remain frustrated with the slower-than-expected pace of economic growth this year and with the political process. The top challenges continue to be health care costs, the tax and regulatory environment and the skills gap. Along those lines, the Federal Reserve’s Beige Book reported that manufacturing activity expanded across the country in its analysis, with rebounds noted in many of its districts. In addition, several businesses are having difficulty finding skilled workers, a challenge that has concerned manufacturers for some time. For instance, a recent study from Accenture and the Manufacturing Institute found that more than 75 percent of manufacturers have a moderate to severe shortage of skilled resources.

Download: Accenture 2014 Manufacturing Skills and Training Study

Several data releases last week support the view that the economy is rebounding. For instance, the number of nonfarm payroll workers rose by 217,000 in May, with an average of 231,000 over the past four months. This helped push nonfarm payrolls over its pre-recessionary levels for the first time—a feat that took roughly five years. The news for manufacturers was more mixed. While manufacturing has averaged just shy of 12,000 additional workers per month since August, the pace has slowed this year, and May’s 10,000-worker gain stemmed mainly from durable goods firms. We would like to see broader-based job increases in the sector moving forward, with monthly hiring growth between 15,000 and 20,000 on average.

Washington Frustration

IndustyWeek

Manufacturers expressed a palpable sense of frustration both with the slowness of economic growth and with the political process. Washington’s burdensome regulatory, tax and health care policies still loom large in business decisions, particularly for the smallest manufacturers. While we have moved beyond the budget showdown of last fall, concerns continue to mount that Washington is not solving the country’s problems.

In the most recent survey, 79.3% of respondents said that the country was on the “wrong track,” with just 5% suggesting that it was “headed in the right direction.” One individual from the machinery sector might have summarized these feelings appropriately with this comment:

We need less Democrats and less Republicans and more smart people that are willing to tackle the longer-term issues with compromise. Not as a bulldozer and not with BS, but something that all Americans can believe in and actually trust.

Figure 1: Manufacturing Business Outlook, by Quarter, 2012–2014

Note: Percentage of respondents who characterized the current business outlook as somewhat or very positive.

This year has started out a bit weaker than originally hoped. A number of severe winter storms wreaked havoc with demand and production in the early months, and exports continue to grow at a disappointingly slow rate. Indeed, in the first quarter, real GDP shrank for the first time in three years, and while we have seen a rebound in the spring months, overall activity levels remain below the more robust rates seen at the end of 2013. Already, we have seen forecasts for growth in 2014 downgraded from around 3% a few months ago to something closer to 2.5% today.

Meanwhile, the Institute for Supply Management’s Purchasing Managers’ Index (PMI) has risen each month since January, up from 54.9 in April to 55.5 in May. The data were mostly positive, with higher levels for both new orders (up from 55.1 to 56.9) and production (up from 55.7 to 61.0). The output index exceeded 60—signifying strong monthly gains—for the first time since December. At the same time, new factory orders increased for the third straight month, up 0.7 percent in April and building on healthy figures for both February and March. This release was another sign of recovery in manufacturing sales after weather-related softness in December and January. Yet, the underlying data also indicated some weaknesses beyond defense capital goods spending. Excluding defense, new durable goods orders would have shrank by 0.1 percent for the month. As such, there is room for improvement even with the recent rebound in activity.

While total construction spending increased for the third straight month, manufacturing construction declined 1.1 percent in April, and it has been down slightly since December. Still, the longer-term trend remains more encouraging, up 7.3 percent year-over-year. On the trade front, manufactured goods exports have seen marginal gains so far in the early months of 2014 relative to 2013, but we have seen increased exports in each of the top-five export markets so far this year. Still, export growth has been disappointing of late, and due to a significant increase in goods imports in April, the trade deficit rose to its highest level in 12 months. One positive continues to be energy, with the petroleum trade deficit narrowing on increased exports and fewer imports.

This week, we will get new data releases for consumer confidence, job openings, producer prices, retail trade and small business sentiment. In particular, we will see if Americans are becoming more confident and if the rebound will translate into increased purchasing. The expectation is that May retail sales will bounce back from slower April numbers. Regarding inflation, producer prices in April were higher mainly due to increased costs for food—namely, meat, eggs and dairy products. Energy costs were also up a bit. Analysts will be looking to see if core inflation creeps ever closer to the Federal Reserve’s 2 percent goal, which is anticipated.

Article Topics

Accenture News & Resources

What generative AI means for supply chain work Supply Chain Currents Part I: Is there a different way to move freight more effectively? Companies Shifting Away from China a Boon to U.S., Mexico Accenture survey highlights factors that can influence nearshoring decisions AI Simulation Helps Supply Chains Predict the Future Navigating Cultural, Country Differences When Nearshoring Operations Global companies are planning more regional approaches to manufacturing, selling More AccentureLatest in Business

Happy Returns Partners With Shein and Forever 21 to Simplify Returns Baltimore Opens 45-Foot Deep Channel Following Bridge Collapse Ranking the World’s 10 Biggest Supply Chains The Top 10 Risks Facing Supply Chain Professionals Walmart’s Latest Service: Ultra Late-Night Delivery Dollar Tree’s Oklahoma Distribution Center Decimated by Tornado City of Baltimore Files Lawsuit to Recoup Money for Collapsed Bridge More Business