Inventory Optimization Evolving from Fad to Necessity

There is broad agreement that inventory should be optimized to properly match demand, yet achieving this continues to prove difficult for many companies

How you think about inventory says a lot about where you sit in your organization. Sales views inventory as an opportunity because you can sell what you have. Finance views inventory as a liability, or a depreciating asset; the arrival of these units could have been delayed without harm.

Supply chain views it as a buffer reconciling the variability of demand and supply. The perception from the executive team lies on a spectrum ranging from unnecessary waste to necessary evil.

Regardless of how an individual views inventory, everyone can agree that inventory should be optimized to properly match supply and demand.

The concept of inventory optimization is not new. The six-volume Library of Factory Management, originally published by A. W. Shaw in 1915, has a chapter on economic order quantity.

And for more than a decade, enterprise-class software solutions have helped companies cut billions of dollars in inventory levels.

Yet even with nearly 100 years of history, inventory optimization is still perceived by some as more “nice to have” than “need to have.” Further, it is still discussed primarily within the supply chain organization vs. the senior executive ranks.

This article articulates how to move inventory optimization beyond a fad to an integral facet of supply chain planning.

To facilitate this transition and make the discussion relevant to senior executives, successful inventory optimization requires the following three active ingredients:

1. Change how inventory is measured and discussed.

2. Recognize the role of inventory optimization at every level of supply chain planning.

3. Choose the right inventory improvement initiatives for your company.

Talk about Inventory the Right Way

While everyone in the broader organization talks about inventory, they don’t talk about it the right way. Like every important metric, inventory is a target value we try to achieve and it is a result after demand and supply are balanced.

When it comes to inventory, too much time is spent talking (or complaining) about the inventory on hand (which is the output of supply chain decisions and the inventory target) and not enough time talking about the inputs to ensure that the inventory target is correct and achievable.

Companies exacerbate this problem by the way they report their inventory numbers. Most companies typically report an aggregate dollar value of inventory, or they might break the inventory into three buckets: raw materials, work in process, and finished goods inventories.

From a financial and accounting perspective, these definitions are sufficient. But from a supply chain improvement perspective, they are inadequate because the definitions are too high-level to be actionable.

We all know that “you get what you measure.” To define inventory at a level where we can improve it, we need to disaggregate the company’s overall inventory into classifications that reflect that particular inventory’s role in the supply chain.

There are many ways to define inventory. The list below presents a classification that has proven useful in practice. It reflects how total inventory at a company can be partitioned into classes based on the assignable reason the inventory exists.

Inventory Form and Function

• Anticipatory Stock

• Cycle Stock

• Early Arrival Stock

• Marketing Stock

• Obsolete Stock

• Pipeline Stock

• Prebuild Stock

• Promotion Stock

• Safety Stock

• Strategic Stock

Each of these classifications are discussed in turn on the following pages:

Anticipatory stock is inventory held to satisfy an exceptional demand that is itself a binary event. The demand either will materialize at a known time or it will vanish.

The classic example of such an event is end-of-year budget clear-outs where a department has to procure and receive its order before the end of its fiscal year. These orders typically have very little advance notice and are highly uncertain.

There might be three competing initiatives for this money from very different kinds of vendors, and only one will win the deal.

If the deal is lost, it will not just push out to the following quarter; it is truly lost forever. In these kinds of highly uncertain demand situations, a business case has to be made for building inventory for this possible demand.

This inventory is not part of the company’s normal operation and as such should be designated for its true purpose: to meet one-time special-case demand for a large order that may or may not materialize.

Supply chains do not operate in continuous time. There are underlying frequencies that drive their rhythm. For example, a cargo ship might visit a port only in the first week of every month. A distribution center might wait until it can fill an entire cargo container before it supplies a store.

There are review periods and batch quantities throughout the supply chain. These review periods cause lumpiness in a location’s on-hand inventory levels. Right after an arrival, the inventory spikes up and then it is steadily worked down until the next arrival.

Cycle stock is the inventory that exists due to review frequencies, or batching policies, in the supply chain.

When a product is comprised of multiple parts, coordinating the timely arrival of those parts is a challenge.

Early arrival stock is the inventory that has arrived earlier than projected. It is inventory assigned to an open order, but it cannot be completed because it has arrived earlier than required and the other required components are not yet on hand.

Marketing stock is inventory placed on store shelves to make the shelves look full and inviting to consumers. In retail environments, a facing is a portion of the linear width of a shelf equal to the width of the SKU.

In most cases, when a SKU gets a facing, the supplier is also agreeing to stock the shelf to its full depth since the retailer will not use the depth for any other products.

If the facing for a low-volume cereal has an associated depth of six boxes, it is possible that this marketing stock could greatly exceed the inventory required on the shelf just to satisfy demand.

For example, demand in a day might never exceed two units, but the supplier will still maintain six units of inventory on the shelf for marketing-stock considerations.

Obsolete stock is the dirty little secret in most supply chains. Obsolete stock is stock that is still functionally capable. From an accounting standpoint, it conforms to all GAAP and FASB rules and still qualifies as saleable product. However, in reality there is no way it is going to get sold in this or any future lifetime.

This poses a problem for the supply chain manager. The reason: writing it off can make him or her look bad so they will often just keep in on the books as a “gift” to the next manager that inherits the problem.

Not all inventory sits at a location waiting for its next use. A significant amount of inventory is always moving through the supply chain because of the associated leadtimes.

Pipeline stock is all the inventory moving through the supply chain; it is the inventory in transit on ships and trucks, the inventory moving through the assembly process, plus inventory moving through any other process.

Pipeline stock is all the inventory that is flowing through the supply chain at any given point in time. If it is sitting somewhere, it is another kind of inventory. If it is moving, it is pipeline stock.

Prebuild stock is the inventory built up in advance of demand due to capacity constraints. Many industries have some amount of prebuild stock.

For example, all of the candy required for Halloween cannot possibly be made to order in the month of October. So the prebuild process for Halloween candy starts in the summer.

Promotion stock is specific stock keeping units (SKUs) that are produced for a short-duration sales campaign at a select set of retail locations. In their simplest form, they are cardboard display stands placed at the end of store aisles filled with standard SKUs.

In the industry, these are referred to as PDQs, for “pretty damn quick” displays. In certain segments of the retail space, PDQs now account for 40 percent of a company’s sales.

Safety stock is inventory held to buffer against every kind of variability experienced in the supply chain. Safety stock is most often thought of as buffering variability in demand, but it could be buffering other types of variability. Common examples include supply-time variability and process lead-time variability.

Strategic stock is inventory procured in advance of need due to some favorable economic condition. It could be a quantity discount offered by the supplier or the purchase of a raw material in advance of a projected price increase.

When a company assigns its inventory to different classifications, it is defining its inventory by cause. Inventory by cause is a simple but extremely powerful mechanism to promote supply chain improvements.

A fundamental tenet of process improvement is that you can only improve a process to the level that you can measure it. If a process can only be measured in weekly units, then making the process shorter than a week is not possible because the resulting duration can only be measured to one week.

Inventory behaves in a similar way. It sounds like a tautology, but all companies that care about inventory carry significant inventories in relation to their size. It is not uncommon for a company with annual sales revenue of $100 million to have $25 million in inventory.

Fortune 500 companies have billions of dollars in inventory and billion-dollar divisions have hundreds of millions of dollars in inventory.

When the dollar amounts of inventory are significant, treating all inventory in a monolithic fashion prevents real process improvement. For example, if a company with $1 billion in annual sales reports $100 million in inventory one quarter and $93 million in inventory the following quarter, is that good or bad?

If the inventory value in the subsequent quarter is $110 million, is that number good or bad, and does it affect how we think about the previous two quarters? Without a detailed inventory classification, it becomes difficult if not impossible to answer these questions.

There are several benefits to assigning inventory by cause. First, it is easier to understand how well inventory is currently being deployed in the company.

A large increase in inventory might be due to increasing anticipatory stock, which is a valid reason to increase inventory; or it might be a big increase in obsolete stock, which is a bad thing.

Second, assigning inventory by cause helps prioritize what is worth working on. In a typical company, only 30 percent of the inventory is safety stock, with another 30 percent pipeline stock, 10 percent obsolete stock, and the remainder spread across the other categories.

This is an important realization because safety stock often gets the most attention from supply chain management professionals.

The reason is that when management calls for a 10 percent across-the-board inventory reduction, all classes cannot be reduced equally. Prebuild cannot be reduced because it is being made in advance due to capacity constraints. Marketing and promotion stocks are untouchable because they are viewed as driving revenue.

Obsolete stock can’t be changed because there is no demand for it in the first place. And while, in theory, pipeline stock could be reduced, that would require reducing lead times, which may be impossible—and if possible it would take money and time to accomplish.

Safety stock is the largest category of inventory that can be changed by a policy decision. That policy decision is the level of service the company wishes to provide.

Identifying What’s Most Important

In practice, you should identify the most important inventory classifications in your company. Usually, four to six classifications will be sufficient.

Next, you should track these classes of inventory, observe exceptional changes, and either correct the problems or understand their root causes.

The argument has been made that formally assigning inventory to specific classes eliminates an opportunity to pool inventory.

For example, it might be tempting to say anticipatory stock is counted in safety stock or that safety stock could simply be inflated to accommodate a potential one-time order. However, if the order does not materialize, then we are left with a significant inventory excess beyond our normal safety stock level.

It quickly becomes apparent that if this anticipatory stock can be lumped into safety stock, then any level of inventory can be rationalized. Therefore, to the extent possible (and reasonable) we want to separate inventory into classes.

The Impacts on Supply Chain Planning

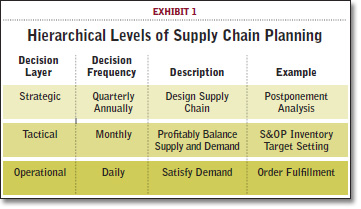

As a discipline, Supply Chain Planning occurs at operational, tactical, and strategic levels, as depicted in Exhibit 1. The operational level is the hour-to-hour and day-to-day execution of decisions on how to produce and move what, when, and where.

Tactical planning is the month-to-month sales and operations planning processes that determine the overall operating plan that will profitably balance supply and demand across the supply chain.

Strategic planning is the quarterly to annual process where macro-level decisions are made that dictate the capabilities of the supply chain. Inventory planning needs to be an integral part of every level of the supply chain planning hierarchy.

It is critical to realize that these decision levels are interdependent and reinforce one another. That is, one level lays the foundation for the right decisions made in another layer.

To reap the benefits of inventory optimization, you need to operate at every one of these levels. If you only focus on the operational level, the project will not achieve its full potential. If you only focus on the high-level strategy, the results are unlikely to be implemented and you will lose accountability across departments.

Operational Inventory Planning

At the operational level, optimizing inventory is the daily problem of replenishing orders. While supply chain experts may be dismissive of this as an inventory problem, it must be done properly to ensure that demand is fulfilled.

Importantly, there needs to be a process by which time-phased inventory targets are deployed at the SKU-location level to be available as part of the order fulfillment process.

Tactical Inventory Planning

At the tactical level, deviations from the sales and operations plan must be solved in an exception-based manner. The problems will reveal themselves as they occur, and corrective actions must be suggested.

While supply chain experts understand that an optimization model can solve this challenge, the important point for the organization is that inventory targets are updated and feeding the sales and operations planning process.

By updating inventory targets as part of the monthly planning process, the targets stay fresh and current to changing demand and supply conditions.

Furthermore, this establishes a cycle of continuous improvement whereby inventory targets get improved each planning cycle. These improvements, in turn, become the baseline improvement for future periods.

Tactical inventory optimization frees time for the planning organization. It avoids fire fighting and managing a “hot list” at the operational level. As part of sales and operations planning, it allows the planner to detect significant changes in inventory between runs (either in reaction to a significant shift in demand, or change in material lead-time, or adjustment in service).

Using the inventory optimization capabilities, the planner can do more by replacing reactive decision making with proactive analysis.

Strategic Inventory

At the strategic level, system-level inventory decisions can be made including where best to hold inventory in the network and how to change the network to more profitably satisfy demand or support postponement initiatives.

Without the foundation of operational and tactical inventory planning, these models could at best be done on an ad hoc, one-off basis for a subset of items. Yet the results would not directly reflect business conditions since even gathering the data would be an arduous process requiring significant simplification.

By contrast, whenever strategic models are built on the foundation of the tactical models, the data is readily available and the results are actionable because they can be tied directly back to the tactical system.

Choosing the Right Inventory Initiative

A company’s most finite—and hence its most valuable—resource is time. Time has to be allocated carefully in the inventory optimization effort. The following best practices will help you focus on the right inventory initiatives.

1. Pick the Right Product Supply Chain to Optimize

The biggest mistake teams make when beginning an inventory optimization initiative is selecting the wrong products to analyze. The team needs to pick a product family (or families) that “moves the needle” of corporate performance.

Picking a product that is a significant driver of business ensures that senior management will engage and care about the result. The product has to have sufficient complexity so there is an opportunity to optimize something.

Finally (and this can be hard for an outsider to judge so it requires insider knowledge), the supply chain has to be in control from a process-control perspective.

If the above criteria are met, you can avoid the problem of a knee-jerk reaction to pick the most recent product with a supply chain problem. In the heat of the moment, senior leadership will sometimes advocate picking such a product.

When the project has concluded, however, it quickly becomes apparent that it was the wrong product to pick.

Two attributes can help you choose between supply chains that satisfy the major criteria just mentioned. First, pick a product supply chain that is representative of the larger company.

If this is the case, then a successful initiative immediately provides a blueprint for other divisions to follow. If the supply chain is not representative, then a second initiative will be required before large-scale adoption can occur.

Second, pick a supply chain that has an easy-to-describe existing inventory policy. Some supply chains are employing rules of thumb or weeks of supply targets that can be easily summarized.

If this is the case, then creating a before-and-after business case becomes straightforward and the amount of time the model has to run before results are accepted is shortened.

2. Confine your Project to a Manageable Part of the Supply Chain

For most companies, the end-to-end supply chain stretches from raw materials through a far-flung distribution network. Consider a strategic commodity purchased for outsourced manufacturing and including smaller satellite distribution centers set up in emerging markets.

The supporting supply chain will often consist of five or more distinct echelons directly under the company’s control and easily 15 or more echelons when other parties in the supply chain are included (such as parts providers and retail partners).

In such environments, the objective is to focus your attention on the right portion of the supply chain to optimize.

The challenge is to scope a project large enough to create significant opportunity but small enough to be implementable. In practice, a natural demarcation point in the supply chain is the central distribution center.

Upstream supply chain activities that result in product being put into the distribution center (like procurement and manufacturing) often fall under the purview of the vice president of operations.

Once the product enters the central distribution center and for all subsequent activities, a general manager with profit- and-loss responsibility is often responsible for these downstream activities.

At a minimum, a first project should restrict its scope to one side of this boundary: either upstream or downstream. A main reason is that when conflicts inevitably arise as to how to rebalance inventory, there is a single person that can adjudicate the dispute.

But after deciding on one side of the supply chain, you need to narrow the focus even further. As a general statement, it is often best to begin with the distribution portion of the supply chain (distribution center out) because the product has more value in this portion and any processing steps are largely complete, therefore the same item is being evaluated at different stages in the supply chain.

It then makes sense to concentrate on one geography, and even one set of products within the geography.

3. Inventory Optimization Should Progress from Operational to Tactical to Strategic Supply Chain Planning

When it comes to optimizing inventory levels, an analogy to house building is appropriate. You have to start with a basic foundation. This is inventory planning at the operational level.

If the product can’t efficiently and effectively move between locations in response to orders, this underlying process has to be fixed before any advanced decision making can occur.

The more subtle distinction is to prioritize solving the tactical inventory planning problem over the strategic problem. The strategic problem designs the right supply chain (for example, by allocating consignment inventories across customers or delaying product differentiation through postponement).

These kinds of structural changes can reduce both inventory cost and cost of goods sold; in short, the opportunity is significant.

However, because these changes are significant they are going to face extreme scrutiny from multiple constituents in the enterprise, many of whom will not be familiar with inventory optimization and may have entrenched interests that run counter to any change.

These individuals will require some powerful persuasion to make the big changes and they will likely not embrace inventory modeling as a means to justify the changes.

If the tactical inventory models are already in place, then this debate over results at the strategic level vanishes. The justification for the results at the strategic level is the reality that these models are already running the business at a monthly tactical planning level.

So there is no need to “debate the math” because the math is already implemented and working. This shifts all strategic debates from arguing about the numbers to identifying alternatives and picking the best one (when all of these alternatives were built off the tactical inventory model).

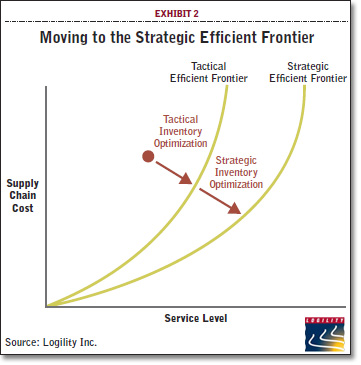

Exhibit 2 graphically depicts a company’s movement to the strategic efficient frontier. Tactical inventory optimization enables this by determining inventory targets, assuming all existing processes and parameters are unchanged.

Once the tactical targets are implemented, it is possible to push out to a new efficient frontier with strategic supply chain analysis.

A Philosophy and a Tool

We have to recognize that inventory optimization operates both at a tool level and at a philosophy level, just like total quality management or lean or any other improvement methodology.

For total quality management, the philosophy level is variance reduction and the tools include statistical process control, run charts, and fishbone diagrams.

For lean, the philosophy is waste elimination and the tools include process analysis, mixed model assembly, and poke-a-yoke practices.

Inventory optimization is no exception—it has its philosophy and tools as well.

The philosophy is right-sizing inventory to profitably balance demand and supply. The tools include multi-echelon inventory optimization, SKU stratification, and postponement.

Inventory optimization has matured to the point that it belongs in every facet of your supply chain planning. This article documents the steps you can follow to implement inventory optimization, points out the right way to begin, and helps you elevate the discussion to make it relevant to senior executives.

Article Topics

Logility News & Resources

Logility makes entrance into supply chain-focused AI, with acquisition of Garvis Logility Acquires Generative AI Supply Chain Planning Firm Garvis Supply chain software platforms help to level the playing field Logility to acquire supply chain network optimization vendor Starboard Solutions Logility partners with Körber to expand capabilities How Does IKEA’s Inventory Management Supply Chain Strategy Really Work? This is Not Your Father’s Inventory Optimization More LogilityLatest in Supply Chain

Happy Returns Partners With Shein and Forever 21 to Simplify Returns Baltimore Opens 45-Foot Deep Channel Following Bridge Collapse El Paso Border Delays Cost Juarez $32 Million Per Day in Economic Losses Ranking the World’s 10 Biggest Supply Chains The Top 10 Risks Facing Supply Chain Professionals Walmart’s Latest Service: Ultra Late-Night Delivery Dollar Tree’s Oklahoma Distribution Center Decimated by Tornado More Supply Chain