Are You Buying or Selling Customers?

When it comes to true customer profitability, most companies don’t know whether they are making or losing money on a customer.

Are you losing money on some of your customers; possibly buying business by offering services such as complimentary co-managed inventory and Just-in-Time (JIT) replenishment programs, as well as free emergency shipments? I doubt most companies know the answer.

Experience with Customer Profitability

During my tenure in the field service division of a mini-computer company, our finance organization planned to conduct an analysis into the profitability of our service customers.

However, prior to the advent of today’s sophisticated Enterprise Resource Planning (ERP) systems, these analyses were difficult to do and had serious shortcomings when it came to estimating customer and product level costs. Finance knew that it would be a long and arduous process, so it decided to pilot the concept with our largest customer.

This customer provided “first call and remote support” for its computer users, and then relied upon our division to follow-up by dispatching field service technicians to conduct remedial and preventive maintenance services. This made estimating costs a hard part of the profitability analysis, yet necessary because the customer’s billings were heavily discounted to compensate it for its “first call and remote support.”

After many months, the finance department estimated that we were losing money on the customer. Rather than trying to address whether or not there was any merit to the pilot analysis, our executives merrily dismissed it as a worthless exercise and finance stopped work on the analysis.

I believed the analysis was reasonable and could have been revised to make it credible. However, no one wanted to face up to the fact that our aggressive selling and marketing efforts could lead to losing money on any customers. My beliefs were predicated on knowing that rarely did anyone have to really cost-justify negotiated discounts. For the most part, discounts were justified essentially on maintaining and enhancing revenues.

Maximizing revenue was the primary goal of the marketing and sales departments of the division, while supply-side service operations were goaled on minimizing costs and inventories, while maximizing customer satisfaction. As in most companies back then, marketing and sales’ demand creation and demand shaping decisions were made in isolation, without regard to supply chain operations. Sales and Operations Planning (S&OP) processes were not prevalent so demand-side activities often disrupted supply operations, making them less efficient.

“True” Customer Profitability Required

I suspect companies today are still trying to gauge “true” customer profitability. (Indeed, there might be quite a few suppliers losing money on their Wal-Mart business, but would never want to have to come to grips with doing anything about it.) Yet having an analysis of “true” customer profitability would go a long way toward helping their sales and marketing managers make more profitable demand shaping decisions during customer negotiations, as well as during S&OP meetings.

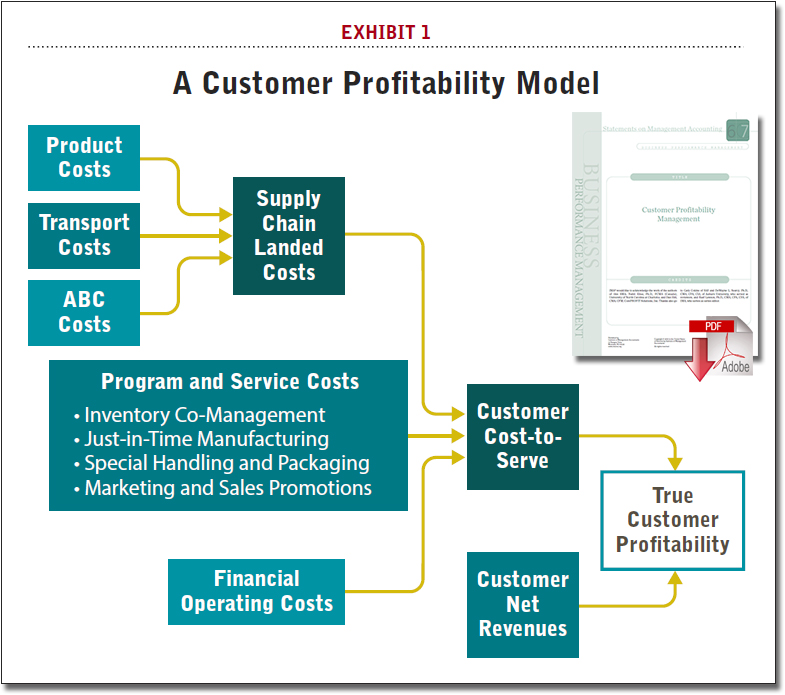

Exhibit 1 depicts a Customer Profitability Model that I will describe going from left to right, following the flow of information needed to estimate true profitability. Customer Cost-to-Serve is the most important, yet hardest to estimate, because accountants don’t track costs at the detail level required.

Many costs are tracked as aggregates, and breaking them down by customer is not an easy task, so estimation techniques must be developed that utilize the data available from standard accounting systems. On the other hand, Net Revenues are easier because customer level data are readily available from Account Receivable records.

Supply Chain Landed Costs is the first of the three components of Customer Cost-to-Serve. Landed costs are detailed because they involve calculating the costs to get products delivered to customer locations. They include the costs to source, make, transport, handle, store, and deliver products to a customer’s door. Product Costs are the costs to source and make products, and these are usually tracked in standard-cost accounting systems that are part of ERP systems.

Transport Costs includes inbound, inter-facility, and customer delivery costs and can be easily gotten from these systems, supplemented by data from specialized Transportation Management Systems. However, these costs are not typically tracked by customer so Activity-Based Costing (ABC) methods have been developed. ABC methods are especially needed to breakdown various logistics costs, such as warehouse receiving, storing, maintaining, picking, packing, and shipping goods to fill external customer orders as well as internal orders.

Cost-to-Serve also involves estimating a second component, Program & Service Costs. It also needs to be estimated at the customer level, yet not routinely tracked at that level. Customer programs might include supply chain programs such Inventory Co-Management programs (e.g., Vendor Managed Inventory [VMI] and Collaborative Planning, Forecasting, and Replenishment [CPFR]), and Just-in-Time Manufacturing programs. Customer Program & Service Costs also include the costs incurred to do any special handling and packaging demanded by customers.

Marketing & Sales Promotion Costs include the costs of promotions, new product launches, and trade marketing and co-marketing programs. For example, the “true” cost of running a promotional campaign or a new product launch needs to incorporate any manufacturing costs incrementally incurred by any extraneous plant setups and changeovers needed to support these programs, as well as labor overtime costs needed to produce the large amounts of product distributed, in advance.

The third component of Customer Cost-to-Serve is Financial Operating Costs. These include any financial capital costs incurred to carry inventories from before a customer shipment and until a customer payment is received. Other operating costs include those incurred by an Accounts Receivable department to invoice and collect payments as well.

Customer Net Revenues are also needed for estimating True Customer Profitability. These are based on customer invoices that reflect the various discounts given to a customer during sales negotiations. In addition, however, some customers take advantage of discounts for early payment, and these too should be applied in deriving Net Revenues.

The Customer Profitability Model described above (while complicated to implement) provides a truer view of customer profitability than that which might be gleaned from standard accounting systems alone. While it may take a significant amount of time and resources to implement, the model can be the underlying basis for a decision support system needed by demand-side managers to make more profitable demand-shaping decisions.

Supply chain managers should help implement these types of systems at their companies to help maximize profits rather than just maximizing revenues—which marketing and sales managers will naturally do if they don’t have a clue about customers’ true profitability.