Top 30 Ocean Carriers 2023: Volatile conditions persist

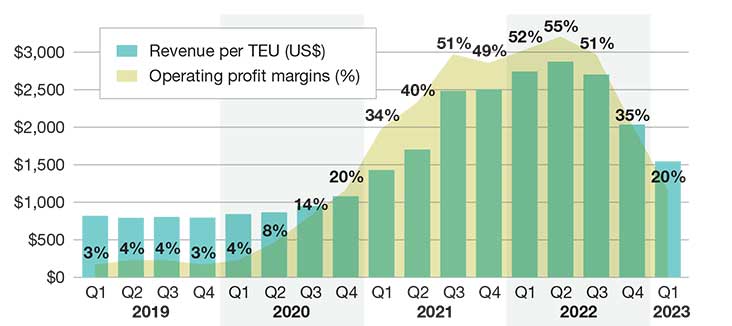

With too many vessels chasing too few cargoes, volumes—and rates—have spiraled downward. Consequently, the ocean lines are scrambling to find ways to prop up profits and remain competitive.

The container shipping industry is sailing into a

severe overcapacity situation, compounded by record orders for new ships placed by ocean carriers and charter owners.

With too many vessels chasing too few cargoes, cargo volumes—and rates—have spiraled downward. Consequently, the ocean lines are scrambling to find ways to prop up profits and remain competitive.

The economic downturn and sharp decrease in consumer spending for goods has exacerbated the situation. From June 2022 to June 2023, demand fell by 13%, but ocean carriers cut capacity by only 3%, reports Drewry Supply Chain Advisors.

“Unsurprisingly, spot freight rates have fallen,” says Philip Damas, Drewry managing director.

Alphaliner’s Top 30 reflects further consolidation | ||

| Rank | Operator | TEU |

| 1 | Mediterranean Shg Co | 5,302,014 |

| 2 | Maersk | 4,147,891 |

| 3 | CMA CGM Group | 3,507,102 |

| 4 | COSCO Group | 2,970,081 |

| 5 | Hapag-Lloyd | 1,875,780 |

| 6 | Evergreen Line | 1,690,196 |

| 7 | ONE (Ocean Network Express) | 1,685,069 |

| 8 | HMM Co Ltd | 790,342 |

| 9 | Yang Ming Marine Transport Corp. | 705,614 |

| 10 | Zim | 584,817 |

| 11 | Wan Hai Lines | 447,852 |

| 12 | PIL (Pacific Int. Line) | 295,331 |

| 13 | SITC | 156,222 |

| 14 | KMTC | 153,261 |

| 15 | X-Press Feeders Group | 145,616 |

| 16 | IRISL Group | 137,720 |

| 17 | Sea Lead Shipping | 121,107 |

| 18 | UniFeeder | 118,453 |

| 19 | Sinokor Merchant Marine | 117,501 |

| 20 | Zhonggu Logistics Corp. | 115,676 |

| 21 | Antong Holdings (QASC) | 84,540 |

| 22 | TS Lines | 79,333 |

| 23 | Global Feeder Shipping LLC | 74,159 |

| 24 | Swire Shipping | 70,838 |

| 25 | RCL (Regional Container L.) | 69,248 |

| 26 | SM Line Corp. | 68,489 |

| 27 | Emirates Shipping Line | 67,730 |

| 28 | Matson | 63,776 |

| 29 | Ningbo Ocean Shg Co | 62,251 |

| 30 | Arkas Line / EMES | 54,357 |

SOURCE: ALPHALINER All information above is given as guidance only and in good faith without guarantee. | ||

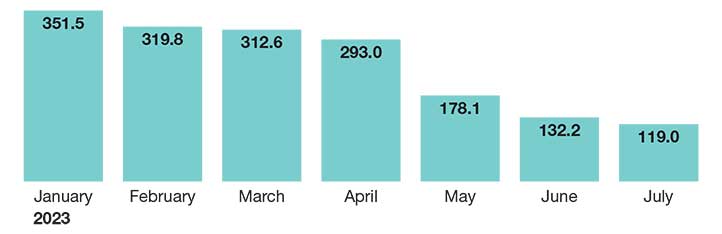

Contract rates continued to fall and normalize, however. In July, Drewry reported that East-West contract freight rates declined by 10% month-on-month, with a total fall in the 12 months to July of 69%.

In response, carriers withdrew some capacity and raised spot rates on the major East-West routes as well as vital transpacific routes. Consequently, in July and early August, rates begun to rise, particularly on transpacific and Asia-Europe routes.

“The highest rate increases were from Shanghai to Los Angeles (up 44%), followed by Shanghai to New York (up 24%) and Shanghai-to-Rotterdam (up 24%),” Damas says. Transatlantic westbound spot rates (Rotterdam to New York), which fell by 20% in July/early August, stabilized in mid-August.

The massive build-up of ship orders is the biggest factor impacting the industry today. Between 2021 and 2022, carriers splurged on approximately 7.2 million TEU-worth of containerships. “That’s more than they had in the previous six years combined,” say Damas.

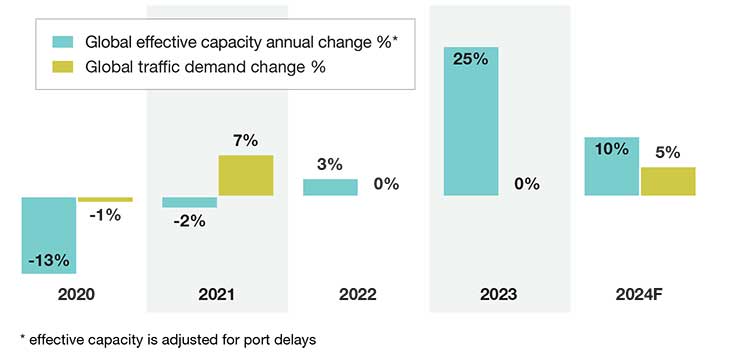

In the first half of 2023, 123 new container ships with a combined capacity of 0.9 million TEUs were delivered, increasing the global fleet to 27 million TEU. By the end 2023, Drewry expects the global fleet to have expanded 5%, with forecast demand at -7% in North America and 2% in Asia.

Mediterranean Shipping Co. (MSC) has the largest vessel orderbook. MSC had 125 ships on order as of May 31, 2023, according to Statista. CMA CGM Group ranked second with 103 ships on order, followed by Evergreen Line with 49 ships. Hapag Lloyd has ordered 22 new ships that will “be delivered within the next few years,” according to the carrier.

Many ships on order are in the 5,000 TEU to 6,000 TEU neopanamax range. “This gives the lines more flexibility, and they will not have to go all China-Europe,” says Stefan Verberckmoes, an analyst at Alphaliner. Meanwhile, inadequate scrapping is taking place.

Global effective capacity vs global traffic development

However, Drewry estimates that about 1 million TEUs of capacity must be scrapped in 2023 to keep a supply-demand balance. Damas attributes the low scrapping rate to the fact that some ships were leased at high charter rates and a long duration to ocean carriers, which delayed decisions on scrapping.

“Carriers are reluctant to get rid of old assets,” says Damas. “This may be a consequence of market uncertainty.”

Cost containment

No one is certain if rates will continue to increase given continuing overcapacity.

“In recent earnings calls, carrier CEOs have expressed concerns about overcapacity impacting profits,” says Peter Tirschwell, vice president, S&P Global Market Intelligence. “Now they’re looking at the prospect of overcapacity for the next three years to four years.”

Consequently, carriers are trying to manage their assets and networks to mitigate over-capacity and minimize losses. “The larger carriers are better able to do this, whereas the small carriers are currently running losses,” Damas says.

Among their strategies are changes in fleet positioning and routings via blank sailings and the discontinuation of some weekly services. “None of these measures are enough to stop the increase in overcapacity, however,” Damas says.

Blank sailings are particularly occurring on a large scale. One example, says Verberckmoes, is what’s happening on routings from Shanghai and Ningbo, China, to Europe. “In June and July, around 11% of the voyages did not materialize,” he reports. “And, many carriers also aren’t communicating about blank sailings. They’ve become a common business procedure.”

Some carriers have shifted some routings to China to Africa and China to India, where volumes are still good. “India has a lot of potential,” says Hapag Lloyd’s Jansen. He points to Saudi Arabia and South America as other markets with growing opportunities.

According to Jansen, Hapag Lloyd is looking at combining services if demand is not strong rather than blank sailings. “We learned throughout the pandemic that some service was too irregular.”

Global effective capacity vs global traffic development

Drewry East-West contract rate index (December 2019 = 100)

Meanwhile, several upstart carriers that entered the market during the pandemic and took advantage of record high freight rates have withdrawn. “This has left the industry to be controlled by the traditional major players,” says Tirschwell.

One example is China United Lines. “The only deep-sea trade route they had left was from the Far East to Turkey utilizing small vessels,” says Verberckmoes. “They appeared to have a smart future, but are back to the status of an intra-Asia carrier after having quit all big East-West routes.”

Going green

Meanwhile, there are some silver linings. Half of the new vessels coming on line, Drewry reports, are environmentally clean. “If there was ever a time to

step forward and be green, it’s now,” says Verberckmoes.

All ocean carriers to one degree or another are investing in ships that use alternative fuels such as LNG, methanol, and ammonia to reduce their carbon footprint—and, in some cases, are dual-fuel capable.

MSC is making a mammoth commitment of LNG-fueled container vessels, with recent reports stating that the line has 10 on order, each with a 10,300-TEU capacity and estimated delivery of end of 2026 or early 2027.

“Given that the supply of alternative fuels is tight, and costs are high relative to traditional CO2-emitting bunkers, questions exist as to how these costs will get passed along,” says Tirschwell. “Many are looking to the International Maritime Organization (IMO) to enact a carbon tax or other market-based measure to neutralize the price differential.”

International Maritime Organization (IMO) rules require ships to be environmentally compliant. Beginning January 2023, the IMO mandated that all ships calculate their attained Energy Efficiency Existing Ship Index (EEXI) to measure energy efficiency and initiate the collection of data to report their annual operational carbon intensity indicator (CII) and CII rating.

“These requirements become tougher every year,” adds Jansen. “To meet those requirements, ships need to be more than fuel efficient.”

Takeaways

While many retailers are still working off excess inventory taken on during the pandemic, the general view is that new stocks of merchandise will soon be flowing.

“This will drive a mild recovery in container volumes during the remainder of 2023,” predicts Tirschwell.

Hapag Lloyd’s Jansen is confident that there will be a small recovery. “Our volumes [this summer] are up compared to last year,” he says.

As market conditions continue to grow, Jan Tiedemann, vice president of Liner Strategy at AXSmarine, is also optimistic. “We’re leveling off into a ‘new normal’ for liner shipping,” he says. “It might look ice cold or lukewarm right now, but the long view is we see a more stable trend.”

Meanwhile, the dichotomy of larger carriers remaining profitable and smaller carriers struggling to break even is becoming evident. “This should accelerate the potential for future consolidation,” Damas concludes.

Opposing strategies

Today’s challenging operating environment is resulting in carriers implementing new strategies to stay on top.

“Lines still have a lot of cash, but their strategies are still to be proven,” says Stefan Verberckmoes, at Alphaliner.

“MSC, Maersk, and CMA CGM have maintained their position, but there are shifts in market share among them,” comments Peter Tirschwell, vice president at S&P Global Market Intelligence.

MSC and CMA CGM are aggressively increasing their fleets by ordering new builds and chartering second-hand ships.

“CMA CGM is on track to replace Maersk as number two in terms of fleet size,” says Philip Damas, managing director at Drewry Supply Chain Advisors. He sees their fleet expansion as a possible means to prepare “for the rate war intensifying between carriers in the coming years, and thus pressuring rivals.”

In early 2022, MSC overtook Maersk as the largest carrier. Then came the big surprise announcement of the breakup of their alliance 2M in 2025.

Maersk portrays the move as a logical consequence of their integrator strategy to retire Hamburg Sud, Sealand, and Twill to the Maersk brand, and offer a host of services, logistics solutions, and digital and data platforms that go beyond shipping.

“Maersk is building out an end-to-end logistics product offering including everything from origin consolidation to last-mile

delivery,” says Tirschwell. “The Maersk integrator model that offers logistics services along the full end-to-end supply chain has not been attempted before on this scale. It’s too soon to know if true synergies and customer acceptance will result.”

Hapag-Lloyd has changed from being solely focused on liner operations to building a terminal presence by acquiring ports in high throughput growth regions like India and Latin America, and building a transshipment hub in Egypt.

Evergreen is diversifying its business by buying a 100% stake in Colon Container Terminal S.A. in Panama. “Evergreen plans to expand and reorganize its Asia-America routes and will likely cascade its newbuild ships on these routes,” Damas says.

In August, Evergreen also took a 20% stake in the Port of Rotterdam’s Euromax Terminal. “This nearly $79 million investment is understandable because Evergreen has an enormous orderbook, especially for the larger ships that are destined for the China-Europe trade,” Verberckmoes says.

Carriers have also ventured into owning and expanding other activities. “CMA CGM has gone into newspapers,” Verberckmoes says. Meanwhile, MSC, Maersk, and CMA CGM have expanded into air cargo—another asset where true synergies are still unknown.

Tirschwell warns: “The transportation industry is littered with examples of failed synergies resulting in different freight transport modes.”