Top 10 Equipment Acquisition Trends for 2015

Favorable Economic and Financing Conditions Will Drive Replacement and Expansion Spending.

The Equipment Leasing and Finance Association (ELFA) which represents the $903 billion equipment finance sector, has revealed its Top 10 Equipment Acquisition Trends for 2015.

Given U.S. businesses, nonprofits and government agencies will spend nearly $1.5 trillion in capital goods or fixed business investment (including software) this year, financing a majority of those assets, these trends impact a significant portion of the U.S. economy.

Businesses will find opportunities presented by a steadily improving economy and favorable credit conditions as they make their decisions for equipment replacement and expansion.

ELFA President and CEO William G. Sutton, CAE, said, “Equipment financing is a critical source of funding for a majority of U.S. businesses, allowing them to acquire the equipment they need to operate and grow. It enables equipment acquisition, which plays a critical role in driving the supply chains across all U.S. manufacturing and service sectors. To assist businesses in planning their acquisition strategies, we have distilled recent research data, including the Equipment Leasing & Finance Foundation’s 2015 Equipment Leasing & Finance U.S. Economic Outlook Report, industry participants’ expertise and member input from ELFA meetings and conferences to provide our best insight for the Top 10 Equipment Acquisition Trends for 2015.”

ELFA forecasts the following Top 10 Equipment Acquisition Trends for 2015:

- Investment in equipment and software will reach an all-time high in 2015

As the U.S. economy continues to improve, business investment is forecast to reach a record $1.484 trillion in 2015. As business investment grows, demand for equipment financing will increase. - Businesses will invest in equipment not just to replace aging assets, but also to aid in expansion

The pent-up replacement demand that has driven equipment investment in previous years may be supplemented by long-awaited expansion investment as capacity utilization rates in some industries reach or surpass levels historically known to spur business investment. Industries poised for investment growth include oil and gas extraction and transportation equipment manufacturing. - While some equipment types will see strong growth, others will moderate

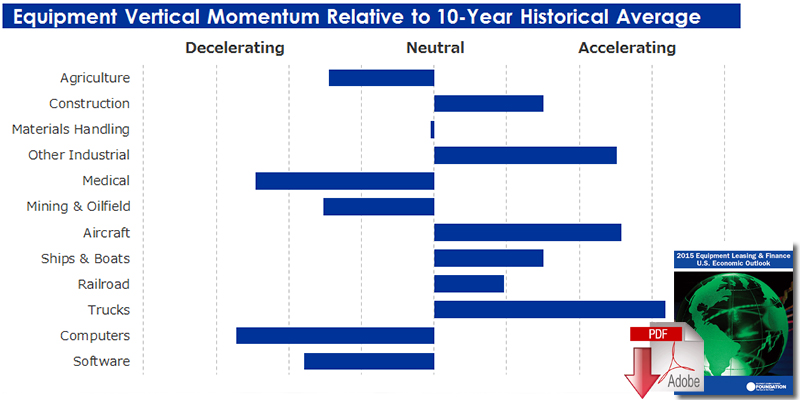

In 2014, equipment and software investment increased 9.6% in Q2 and 9.3% in Q3. Looking ahead, growth in equipment and software investment is expected to moderate somewhat, as it is unlikely to keep up the strong pace seen in Q2 and Q3. A still healthy growth rate of 6% is forecast for 2015. Aircraft, trucks and other industrial equipment are projected to be among the higher growth types, while agriculture, computers and software are expected to see slower growth. - Improving market conditions will continue to increase credit supply and demand for equipment acquisitions

As the economy steadily improves and business confidence continues to increase, credit standards should modestly loosen. The propensity to finance decreased in the wake of the financial crisis as businesses deleveraged and refrained from new business investment. Since bottoming out in 2010, the rate at which businesses finance their capital spending has grown consistently and will continue to increase in 2015 with steady economic recovery and shifts in Federal Reserve policy. - Eyes will be on short-term interest rate increases

Expectations for the Federal Reserve to raise short-term interest rates in 2015 should spur equipment investment as businesses seek to lock in equipment financing at lower rates. Despite rate increases, businesses will find that a highly competitive “buyer’s market” will continue to make financing an attractive option for acquiring equipment. - Businesses will use financing for a majority of their plant, equipment and software expenditures

In 2015, 62 percent or $922 billion of investment in plant, equipment and software in the United States is expected to be financed through loans, leases and lines of credit. A majority of businesses - seven out of 10 - will use at least one form of financing to acquire equipment. - Advances in the use of technology will drive innovative financing options

Equipment finance providers are streamlining their business processes and improving customer self-service capabilities using digital technologies. At the same time, some end-users are moving away from traditional equipment consumption models and toward hosted or managed services based on usage rather than total ownership. To meet customer demand and address evolving technology equipment requirements, equipment finance companies will tailor innovative financial offerings. - Several “wild cards” could impact equipment acquisition decisions

In what could be a breakout year for the U.S. economy, positive and negative external risks could affect equipment investment. Potential political gridlock, global economic weakness and geopolitical risks could be a drag on investment decisions, but GDP growth from low oil prices, a potential surge in the housing sector and sufficient capacity utilization could have firms ramping up capital expenditures. - Nontraditional financing will continue to grow and play a larger role in the equipment finance industry

As regulatory scrutiny increases and some banks’ lending standards tighten for certain credits, nontraditional financing sources, such as investment bankers, venture capitalists, insurance companies, crowd funders and others, are exploring opportunities in the equipment finance sector. - A final lease accounting standard will be released

The Financial Accounting Standards Board and the International Accounting Standards Board continue to work on the lease accounting project, which will change how leases are accounted for on corporate balance sheets. A final standard is anticipated in 2015, with a possible effective date of 2018 or later. The good news is that the benefits of leasing equipment will remain intact despite the lease accounting proposal.

Article Topics

Equipment Leasing and Finance Association News & Resources

8 Steps to Help Transition to the FASB Approved New Lease Accounting Rules 2015 Equipment Leasing & Finance U.S. Economic Outlook Top 10 Equipment Acquisition Trends for 2015Latest in Business

A Look at Baltimore’s Key Bridge Collapse—One Month Later European Parliament Passes New Law Requiring Supply Chain Accountability Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season Apple Accused of Multiple Human Rights Violations South Korea Finally Overtakes China in Goods Exported to U.S. UPS Struggles in First Quarter With Steep Earnings Decline More Business