The Demise of Malls and Traditional Distribution

Since 2010, more than 24 enclosed shopping malls have closed, and 60 more are on the brink of closure, about 15% of U.S. malls will fail or be converted into non-retail space within the next 10 years.

E-commerce and omni-channel fulfillment are the main drivers of transformational change in retail supply chains.

However, there are two other trends also illustrate how retail supply chain networks are changing:

1. the declining role of shopping malls, and;

2. the type of distribution facilities retailers and third-party logistics providers are investing in today compared to just a few years ago.

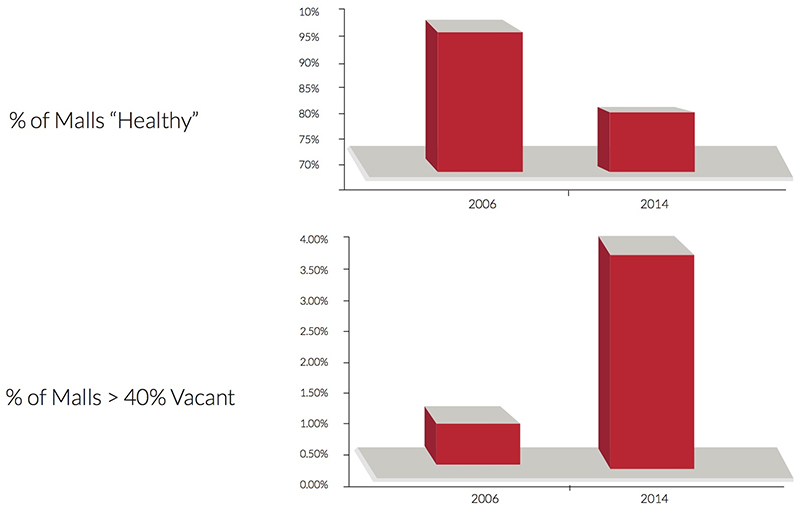

According to CoStar Group, a provider of commercial real estate information, the number of malls with vacancy rates greater than 40 percent - which generally means the mall is in “a death spiral” - has increased from less than 0.5 percent in 2006 to 3.4 percent in 2014.

And according to real estate research and consulting firm Green Street Advisors, “Since 2010, more than 24 enclosed shopping malls have closed, and 60 more are on the brink of closure.”

“About 15% of U.S. malls will fail or be converted into non-retail space within the next 10 years.”

Data Sources: “The Economics (and Nostalgia) of Dead Malls” (New York Times) and “America’s Shopping Malls Are Dying A Slow, Ugly Death (Business Insider)

The rise of e-commerce is just one of several factors contributing to the demise of many malls (those with high-end stores and clientele, however, continue to thrive). But it’s clear, nonetheless, that shopping malls will cater to a smaller niche of consumers moving forward, and thus play a diminished role in retail supply chains.

Traditional distribution networks and facilities were originally designed to flow truckloads of products from large distribution centers to stores. Today, retailers and third-party logistics providers are changing their network designs and facilities to enable omni-channel fulfillment and faster delivery times. As mentioned earlier, stores are now serving as fulfillment centers, and retailers are also setting up local depots in large urban areas to “either cross-dock items shipped from larger e-fulfillment centers or to ship certain ‘fast moving’ products direct to customers.”

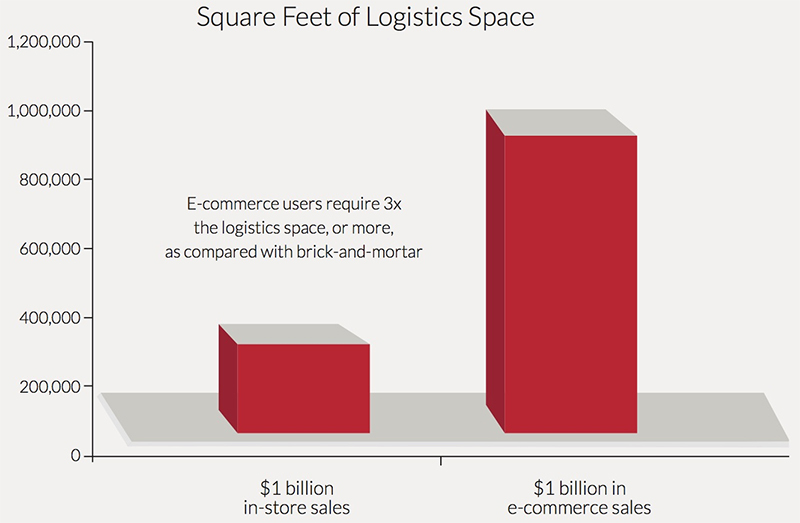

Further up the distribution chain, as e-commerce volumes grow, so will the need for more logistics space. According to the industrial real estate firm Prologis, “e-commerce users require 3x the logistics space, or more, as compared with brick-and- mortar” due to a variety of factors, including the need to carry a broader variety of SKUs, the need to carry greater levels of buffer stock, the allocation of space for returns processing, and the fact that individual order picking, packing and shipping direct to consumers requires more space than store distribution.

Data Source: “E-Commerce and Logistics Real Estate,” Prologis, July 2014

From Prologis’ perspective, “Retailers will continue to proceed along the arc of e-commerce fulfillment requirements, initially growing within existing distribution networks, then leveraging multi-tenant facilities and 3PLs to scale and ultimately requiring dedicated facilities. As online retailers reach sufficient size and scale, fulfillment models will emphasize proximity to major population centers, allowing for faster delivery times, higher service levels and greater flexibility in the supply chain.”

The bottom line: traditional distribution networks and processes were built around yesterday’s consumer - who shopped almost exclusively at stores and malls, and who didn’t mind waiting 3-5 days for delivery - but new distribution networks and processes are emerging for a new generation of consumers, who will shop more online (especially on mobile devices) and expect same-day shipping and delivery, or click-and-collect within an hour, as a standard offering.

Editors Note: The above is an excerpt from Keeping Up with the Retail Consumer: 6 Supply Chain Disciplines Retailers Must Master, an ebook published earlier this year by Adelante SCM and LEGACY Supply Chain Services (see previous post for additional details). Although the research focused on the retail industry, the six fundamental disciplines outlined in the book, and the recommendations we make, apply to companies across all industries that want to enhance and leverage their supply chain capabilities to drive profitable growth.

Supply Chain Leaders Make Smarter Decisions Faster

Supply Chain Leaders use their supply chain as a way to drive profitable growth, capture market share and enhance customer loyalty.

In part 1 of our series, we introduced the 6 Critical Disciplines to Becoming a Supply Chain Leader. Leading supply chain organizations are able convert data into information & and information into action – while staying ahead of the rapid pace of change in today’s complex business environment.

Don’t miss Part 2 of our 3-Part series, where you’ll learn more about:

- The disciplines Supply Chain Leaders use to create a smarter supply chain

- How to get started - evaluating competency within your supply chain

- Taking action - implementing best practices in your supply chain

Join Adrian Gonzalez, President of Adelante SCM and Mike Glodziak, President of LEGACY Supply Chain Services, as they lead you through a session designed to provide a framework for implementing continuous improvement initiatives within your organization.

Part 2 | December 10, 2015 | 2 PM ET

Register Now

Article Topics

LEGACY Supply Chain Services News & Resources

Outsourcing eCommerce Fulfillment to a 3PL Rapidly Improve the Performance of Your Warehouse Logistics 20 Warehouse & Distribution Center Best Practices for Your Supply Chain Warehouse Contingency Planning Template 7 Last Mile Logistics Delivery & Ecommerce Trends You Don’t Want to Overlook Increase Inventory Visibility across Your Supply Chain and Optimize Omni-Channel Fulfillment Omni-Channel Logistics Leaders: Top 5 Inventory Insights More LEGACY Supply Chain ServicesLatest in Supply Chain

Happy Returns Partners With Shein and Forever 21 to Simplify Returns Baltimore Opens 45-Foot Deep Channel Following Bridge Collapse El Paso Border Delays Cost Juarez $32 Million Per Day in Economic Losses Ranking the World’s 10 Biggest Supply Chains The Top 10 Risks Facing Supply Chain Professionals Walmart’s Latest Service: Ultra Late-Night Delivery Dollar Tree’s Oklahoma Distribution Center Decimated by Tornado More Supply Chain