State of Logistics 2022: Ocean

Ocean shipping continues its rough passage

Stormy conditions will prevail for the global ocean freight market given the continued shortage of shipping services and containers combined with unreliable services and congested ports.

A major catalyst is the Shanghai lockdown that started in mid-March, which resulted in cancelled sailings by all alliances. Now with Shanghai opening again, West Coast seaports are bracing for a massive cargo surge. In fact, London-based Transport Intelligence (Ti) analysts warn that these factors will continue to affect rates, producing potentially violent swings.

“Rising inflation and the ratcheting up of interest rates, particularly in North America, have already begun to suppress demand on head-haul routes into Europe and North America,” Ti states. “With both biting hard at consumer confidence and spending power, it could be expected that at least some upward pressure on rates will dissipate as consumer demand drops.”

In the meantime, port congestion is reducing available capacity in the market. The big issue at the Port of Shanghai is landside supply chain operations. Trucking is restricted and drivers are barred from accessing certain lockdown zones.

“The impact is complex, with signs that both production capacity and shipping capacity will reduce,” Ti reports. “For example, Toyota and Tesla were added to a list of manufacturers that cut output volumes from the city and beyond.”

While ports on both the U.S. East and West Coasts are reporting record volumes, some, such as the Port of Oakland, note that cargo volumes are down in 2022. Oakland cited China’s COVID crackdown and its ripple effect on ocean carrier scheduling as the reason.

“Chinese lockdowns are hitting a global container distribution system that is already severely stressed and facing reduced capacity due to pervasive congestion,” says Philip Damas, head of Drewry Supply Chain Advisors.

Drewry analysts state that a positive reading of this situation could be that the reduction in volumes will speed up the normalization of liner network performance and port productivity. However, they estimate that with 260,000 TEU of export cargo not shipped from Shanghai in April alone, further capacity challenges will be coming that will coincide with the peak summer season.

“We’re preparing for a likely summertime surge as China recovers from an extended shutdown due to COVID-19,” says Port of Long Beach executive director Mario Cordero.

On the capacity side, shipping lines appear to be managing capacity. Project44 indicates that the major alliances will increase blank sailings, at least over the remainder of the second quarter. Between mid-May and mid-June, data shows THE Alliance is expected to blank 33% of its Asia export sailings, with the Ocean Alliance (37%) and the 2M Alliance (39%) blanking at a higher rate.

Project44 surmises that this management of capacity will contribute to keeping rates at more elevated levels, particularly on the Asia-to-Europe-lane which is most affected. “The mix of factors driving global ocean freight rates in in the second quarter of 2022 looks likely to keep rates close to the highs seen over the last several quarters, especially with higher oil prices contributing to increased costs for the carriers,” the company reported.

Looking ahead, however, gathering headwinds and a dampening of growth prospects in major western economies suggest a period of lower demand into the second half of 2022. “There are hints that the conditions for rates to finally begin their descent are being set,” adds John Manners-Bell, chief executive of Ti.

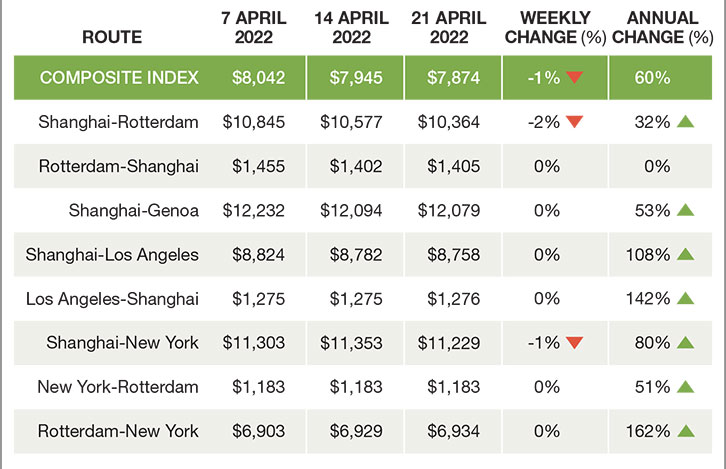

World container index for week April 21, 2022