2013 Materials Handling Technology Software Survey

Readers evaluate their usage of materials handling software technology, its value to their organizations, and spending plans for expanding and updating existing applications.

It’s a Big Data world as information about material movement becomes more essential to the art of materials handling.

And, software applications designed to grant visibility into products, processes and pieces of equipment have grown accordingly.

Based on the results of Modern’s 2013 Software Usage Survey, many readers have big plans for improving information systems or rolling out their first attempts at detailed data collection.

Peerless Research Group (PRG) recently surveyed subscribers of Modern as well as a sample of recipients of our e-newsletters, and with 405 qualified respondents, this year’s survey represents the perspectives of more than twice as many materials handling professionals as in recent years.

“Those who have succeeded have benefited from the convergence of information systems, as businesses recognize the value of a holistic view of supply chain management”John Hill, director at St. Onge

According to John Hill, director at St. Onge, the broader respondent base has impacted the results and in many cases brings the survey’s data more in line with overall industry trends.

Hill notes some important themes highlighted in the data. “It seems many who have not seen a return on investment from their software implementations might not have done due diligence in creating upfront justifications and objectives,” says Hill. “Those who have succeeded have benefited from the convergence of information systems, as businesses recognize the value of a holistic view of supply chain management.”

Software, innovation and spending

The results of this year’s survey clearly reflect the importance of materials handling software to our readers. Nearly 43% of them report their use of such systems has increased in the last two years, while 52% said their use of materials handling software has stayed the same. Fewer than 5% said it has decreased.

The survey first asked readers to characterize their companies’ adoption of materials handling technology. Last year, 16% of respondents admitted they were among the last to adopt technology, while only 9% considered themselves innovators.

This year, just 11% are slow to adopt, while 12% feel they are leading the way. In the middle of the curve, readers who reported their companies “cautiously embrace change” fell from 46% last year to 44% in 2013. Those who pledged to take a wait-and-see approach grew from 15% to 19%.

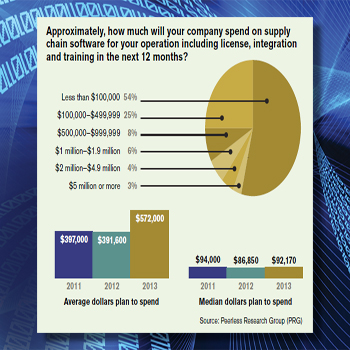

Despite any hesitancy suggested elsewhere in the survey, when asked about spending predictions, readers expressed plenty of intent to buy. Of those who plan to spend on supply chain software in the next 12 months, the average anticipated spending increased from about $400,000 in 2012 to $572,000 in 2013. In 2013, 13% plan to spend $1 million or more, including 3% who plan to spend more than $5 million. About 46% of respondents plan to spend less than $100,000.

In this economy

When asked how the economy is impacting the adoption of materials handling technology, 18% of readers said they plan to move forward with new software investments this year. That’s down significantly from last year’s 27%.

It seems many have decided to hold off on software investments this year. For the last two years, just 20% of readers said they would hold off, but this year the number spiked to nearly 27%. Of course, it is possible that some of these respondents pulled the trigger on software plans last year and are now waiting for those initiatives to bear fruit.

At 17%, a full 5% more than last year, many readers have decided to upgrade existing software rather than buy new software packages. A growing number (8%) also plan to outsource software implementations, up from 5% in 2012. For those readers who license software, there are four different approaches to implementation.

As with last year, in-house staff is most often tasked with some part of this responsibility (69%), while 36% work with the software supplier. Systems integrators are brought in for 26% of installations, while 18% go with a business management consulting firm.

Challenges decline

This year’s survey asked readers about the challenges they anticipate or have experienced when implementing materials handling software applications. Of 11 top concerns, 10 saw fewer respondents indicate them as problems. The only one to increase two years in a row was the likelihood of corporate or management approval.

Last year, many readers were uncertain whether new systems would yield results, doubting whether process efficiencies would improve (2012: 39%; 2013: 29%), or whether they had the resources to implement, manage or maintain the systems (2012: 38%; 2013: 29%).

At the top of this year’s list of concerns is “integration with existing software applications.” In 2012, 50% of readers said this had been or was likely to be a sticking point. This year, just 43% are worried. Concerns over the total cost of ownership dropped by a similar margin, from 42% last year to 33% in 2013.

Usage of software applications

This year’s larger respondent base seems to have influenced the percentage of readers who claim to have certain software applications in use. In terms of warehouse management systems (WMS) alone, last year, 67% of readers said they had a WMS in use, but this year that figure was just 57%.

As an indicator of the overall potential market for WMS, Hill says the smaller number is likely much more accurate. As with last year, the same 36% plan to evaluate WMS in the next 24 months.

Adoption and interest in warehouse control systems (WCS) stayed largely the same since last year, with slightly more claiming to have one in place (31%) and slightly fewer expressing interest (21%). Supply chain management and planning software jumped two full ranks from the fourth most adopted software application to second, with 37% of readers having deployed it.

Asset tracking software also enjoyed a bump from 20% utilization last year to 25%. Slotting software, which last year drew 11% interest and 14% adoption, is this year 7% for both. Presented with eight different software applications in the survey, 11% of readers said they had installed none of them, and 28% said they had no interest in any.

These readers might have concluded they will not benefit from these systems, or might have already installed them.

Adoption and return on investment

Of the eight software applications covered in the survey, WMS has enjoyed the longest average duration of use, at about seven years. Nearly 10% of those with a WMS have had it for 15 years or more, and 42% have had it for less than five.

When asked why they might evaluate or buy a WMS in the next two years, 46% of respondents said the purchase would consist of an upgrade to an existing package.

Second most appealing was the concept of real-time control, in which 37% expressed interest, followed by inventory deployment (32%); labor management (25%); yard management (8%); and slotting (8%).

A quarter of WMS users have upgraded the software within the past year, and roughly the same number last upgraded 10 or 15 years ago.

For many companies, says Hill, a reasonably robust WMS provides a good deal of labor management and slotting functionality, which is a valid reason to go forward first with a new or upgraded WMS before assessing the need for a standalone labor management system (LMS) or slotting modules.

Even those operations without the need for a WMS might benefit from some basic slotting software, says Hill, who adds that the benefits of intelligently deploying inventory can be huge. Of those who already use slotting software: 35% re-slot quarterly, 19% every six months, 27% annually, and 19% less often.

Supply chain management and planning (SCMP) software is being used for the following primary goals: demand planning (61%), inventory visibility (58%), procurement (54%), order management (53%), manufacturing (46%), and collaboration with vendors and suppliers (37%).

In tracking recent growth among each application type, the number of readers who have had their software for less than a year rank as follows: WCS (8.7%), WMS (8%), LMS (7%), asset tracking (6%), SCMP (6%), TMS (4.4%), YMS (0%).

When it comes to investing in software, setting goals and benchmarks at the outset is critical, says Hill. Yet between 30% and 40% or respondents report that they have either not yet achieved a return on investment (ROI) or don’t know. For those who have tracked their results, each application takes an average of about 13 months to produce an ROI. WCS, for example, produced an ROI within a year for nearly 30% of respondents while asset tracking solutions produced a one-year ROI for just 23% of respondents.

Labor management

There was a definite uptick in the number of LMS installations this year, which correlates to the stated intentions of last year’s respondents to pursue labor management.

LMS implementations were second only to WCS for rapid payback, with a little more than 29% paying themselves off in the first year. Not quite 42% of these systems have been in place for less than five years, and 42% have been upgraded in that time. Approximately 20% of respondents said that they did not have an LMS, but planned to evaluate or implement one in the next two years.

Engineered labor standards (ELS) drew mixed results, with 44% saying they have no plans to evaluate or implement. Thirty percent are now using ELS, and 26% have plans to evaluate standards.

The field was split down the middle is response to a question about incentivizing employee compensation, with 52% of readers reporting they have adopted or plan to adopt an employee payment program tied to productivity improvements.

Respondent demographics

Modern’s 2013 Software Usage Survey collected responses from 405 qualified individuals. To qualify, respondents must be personally involved in using, evaluating or purchasing software for their company’s materials handling operations.

This year’s respondents reflect management at all levels. Upper level management, meaning vice presidents, general managers and division managers, account for 35%, while 44% are responsible for managing their company’s logistics distribution, warehouse, supply chain, traffic, operations or purchasing functions across both manufacturing and non-manufacturing vertical industries.

In terms of vertical markets served, respondents indicated their businesses were food and beverage (8.3%), industrial machinery (7.3%), computers and electronics (7%), automotive and transportation (6.7%), chemicals and pharmaceuticals (6.4%), electrical equipment (3.8%) and aerospace (2.9%). On the non-manufacturing side, wholesale trade (8.6%), retail trade (7.3%), transportation/warehousing services (4.4%), and third-party logistics providers (4.1%) were among the respondents.

While 5% of the companies report annual revenue of more than $1 billion, 29% are small businesses that report less than $10 million annually. The median revenue for 2013 is $70 million, up from $42.8 million in 2012, which tells us that this year’s group represents more large companies.

Article Topics

Peerless Research Group News & Resources

2024 Intralogistics Robotics Survey: Robot demand surges 2024 Salary Survey: How Does Your Yearly Income Stack Up? 40th Annual Salary Survey: Salary and satisfaction up 2024 Warehouse/DC Outlook Survey: Cautious, but seeking efficiencies We love research The employee satisfaction survey: Don’t worry, be happy MRO Survey: Finding and keeping the best technicians More Peerless Research GroupLatest in Technology

Robots are Enhancing Human Workers, Not Replacing Them Why Companies are Pushing for a Quieter Warehouse Meet Bluicity: The Startup That’s Predicting and Perfecting the Supply Chain Reveel Expands Shipping Intelligence Platform with New Parcel Carriers Integration Happy Returns Partners With Shein and Forever 21 to Simplify Returns Frictionless Videocast: AI and Digital Supply Chains with SAP’s Darcy MacClaren The Top 10 Risks Facing Supply Chain Professionals More TechnologyAbout the Author