Institute for Supply Management: US Manufacturing Expands at Fastest Pace Since August 2014

Economic activity in the manufacturing sector expanded in February, and the overall economy grew for the 93rd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM Report on Business.

As reported by Bloomberg, the Institute for Supply Management’s index climbed to 57.7, the sixth straight advance, from 56 a month earlier, the Tempe, Arizona-based group’s report showed today.

Readings above 50 indicate growth.

The median forecast in a Bloomberg survey of economists was 56.2.

The ISM’s gauge of orders increased to the highest level in just over three years, while an index of production posted its best reading since March 2011.

The data were preceded by recent regional indicators showing similar strength that has prevailed since the presidential election as companies begin to step up investment and the global economy stabilizes.

“Things look good at this point,” Bradley Holcomb, chairman of the ISM survey committee, said on a conference call with reporters.

“I don’t see anything here, or in the winds, that would suggest we can’t continue with this kind of pace going forward in the next few months.”

Seventeen of 18 industries surveyed by the purchasing managers’ group, the most since August 2014, posted growth in February, including textiles, apparel, machinery and computers. Furniture was the only industry that shrank.

Even while manufacturing sentiment gauges have surged, actual measures of output have shown more moderate progress.

The Federal Reserve’s gauge of factory production increased 0.2 percent in both December and January.

Estimates for the ISM’s manufacturing index from economists in the Bloomberg survey ranged from 55 to 58.5.

The group’s gauge of new orders increased to 65.1 last month from 60.4 in January.

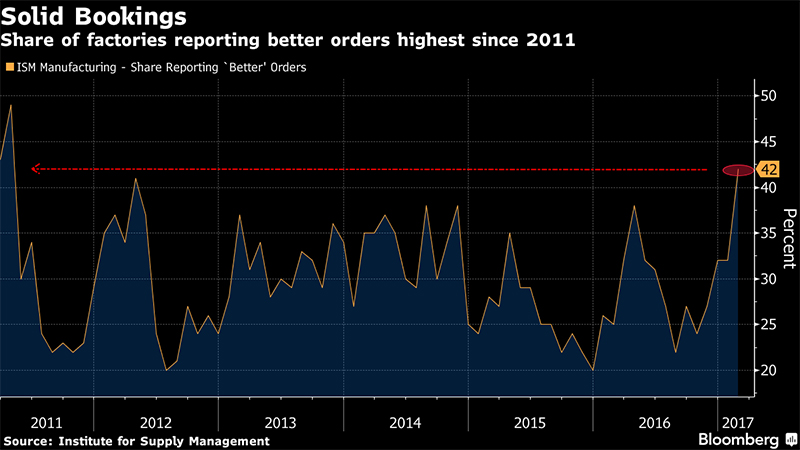

Forty-two percent of purchasing managers said orders were better in February, up from 32 percent in January and the largest share since April 2011.

Order backlogs jumped to 57 from 49.5, the biggest one-month advance in four years.

The pickup in unfilled orders indicates production will probably stay strong in coming months.

The ISM said 26 percent of purchasing managers reported backlogs were increasing, the biggest share since May 2015.

The measure of export demand improved to 55, close to a December reading that was the strongest since May 2014.

The index of production rose to 62.9 in February from 61.4.

The ISM’s factory employment index fell to 54.2 from 56.1 the prior month, Wednesday’s report showed.

The report also factory inventories expanded in February for the first time since June 2015. Customer stockpiles, however, became leaner. The group’s gauge fell to 47.5, the fastest rate of contraction since April 2016.

A measure of prices paid eased by 1 point to 68. That’s still the second-highest reading since 2011.

What Respondents Are Saying

- “Business [is] improving and lead times are extending by two or more weeks.” (Chemical Products)

- “Very positive outlook for this quarter. Production goals have been adjusted multiple times and increased each time due to demand.” (Computer & Electronic Products)

- “Product demand continues to be solid.” (Plastics & Rubber Products)

- “Bookings are heavy early in the season. Expect robust first half of the year.” (Primary Metals)

- “Demand still outstrips capacity. Competitors have announced heavy capital investments to increase capacity.” (Food, Beverage & Tobacco Products)

- “Sales and business continue to be strong and increasing.” (Machinery)

- “Business holding steady in Q1.” (Transportation Equipment)

- “Medical device manufacturing is still strong.” (Miscellaneous Manufacturing)

- “Even though oil and gas prices are on the upswing, we still face a tough 2017 and will continue to save on costs.” (Petroleum & Coal Products)

- “Major focus on commodities and potential [for] further inflation.” (Electrical Equipment, Appliances & Components)

Related Article: Digitization, Synchronization, Visibility, Amongst 2017 Top Trends in Demand-Driven Manufacturing

Article Topics

Institute for Supply Management News & Resources

April Services PMI contracts following 15 months of growth, reports ISM April Services PMI contracts after 15 months of growth, reports ISM April manufacturing output recedes after growing in March April manufacturing output takes a step back after growing in March U.S. Manufacturing Gains Momentum After Another Strong Month Services sector sees continued growth in March, notes ISM Manufacturing sees growth in March, snaps 16-month stretch of contraction More Institute for Supply ManagementLatest in Business

VIDEO: Baltimore’s Francis Scott Key Bridge Demolished in Controlled Explosion Nike Signs 20-Year Lease on New UK Supply Chain Hub USPS Sees Increase in Revenue but Overall Net Loss in Q2 Week in Review: Baltimore Bridge Price Tag, FTC Fines Williams-Sonoma, and More GXO and Conair Open Maryland’s Largest Distribution Center Shipping Dispute Heats Up: Peloton vs. Flexport Robots are Enhancing Human Workers, Not Replacing Them More Business