UPS Discuss New Trends in Emerging Markets

Scott Williams, Manager, Global Forwarding Marketing, UPS talks about the shift in manufacturing from coastal China to inland China and on to Southeast Asian countries like Vietnam and why they are likely to be one of the more impactful trends.

As near shoring becomes more of an option for many shippers, will we see a decline in reliance on emerging nations?

Scott Williams: The global economy will continue to evolve but we expect emerging nations to continue to play a key role as a source of manufacturing as they leverage comparative advantages in labor cost.

However, near shoring offers greater supply chain flexibility with many benefits like reduced transit times/cost, greater quality and inventory control, and less communication issues due to time zone differences. So we expect this trend to continue.

What about Mexico?

Williams: We are seeing an increase in near shoring with Mexico across several industries including high tech, automotive, and aerospace. At the same time, we continue to see an increase in cross-border e-commerce transactions.

Consumers are purchasing unique or hard-to-find items from businesses throughout the world. E-commerce is empowering consumers to purchase goods from different countries more easily, and we believe this will continue to increase.

Have you seen a sudden shift in manufacturing overseas from one emerging market to another?

Williams: There clearly have been shifts in manufacturing, but I would describe it more as gradual rather than sudden shifts.

Can you provide any examples?

Williams: The shift in manufacturing from coastal China to inland China and on to Southeast Asian countries like Vietnam has likely been one of the more impactful trends.

With regard to a shift in manufacturing that has a more local impact on U.S. trade, the movement of manufacturing from Asia to Mexico in the high tech, automotive, and aerospace industry has created new opportunities for UPS to enhance our portfolio with unique cross-border supply chain services to best serve our customers’ needs.

Which emerging markets provide the best opportunities for U.S. exporters?

Williams: With the rise of the middle class and access to technology, empowered consumers in developing markets around the world are demanding American brands and American made products.

This trend is evident with the rise in foreign direct investment in the U.S. from countries like China as well as policies like reductions in Chinese import duties for goods made in Europe or North America.

Any final insights you would care to share?

Williams: Yes, glad you asked. China, India, Brazil and Russia have been consistently identified as key countries from a global growth perspective, while other countries have come into the discussion in recent years – like Mexico, Indonesia, Nigeria, and Turkey (known as the MINT group).

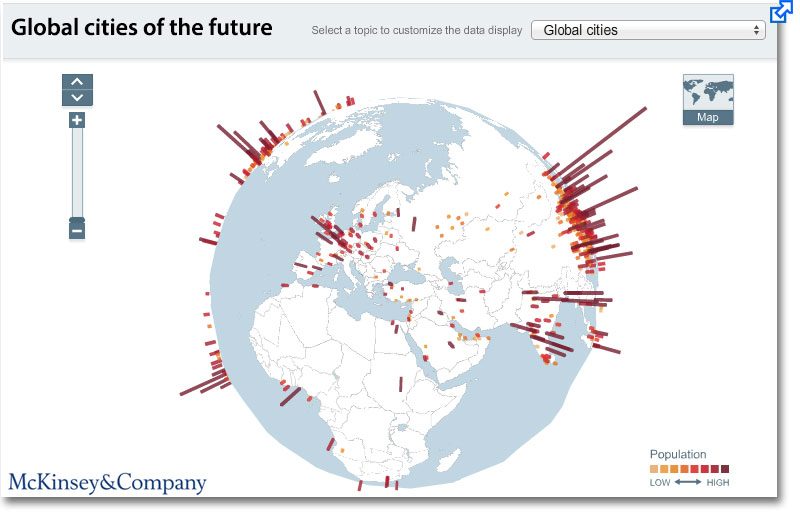

According to McKinsey, in the next 10 years, 136 new cities will replace older ones in the world’s top 600 cities – all of them in the developing world, and 100 of them in China.

So rather than targeting specific countries, it could be prudent for businesses to focus on specific cities for growth or expansion.

Explore the globe and view data on the dramatic urban growth expected by 2025

The City 600 Will Drive Global Growth to 2025

The City 600 metropolises are home to just over 20 percent of the global population today and account for $30 trillion, or more than half, of the world’s GDP. From 2007 to 2025, we expect their combined GDP to increase by $34 trillion to more than double today’s GDP, contributing more than 60 percent to world GDP growth. They will, in short, drive global growth.

Faster than average growth in both per capita GDP and population are propelling the rapid expansion of the City 600. These cities will be home to an estimated 480 million new inhabitants, many of them rural migrants in China and in other emerging markets that are experiencing a fast pace of urbanization. We project that average per capita GDP in these cities will rise from $23,000 in 2007 to a projected $38,000 in 2025 (in PPP terms), nearly a twofold increase.

* The City 600 are the top 600 cities by contribution to global GDP growth from 2007 to 2025.

Article Topics

McKinsey News & Resources

2024 Global Logistics Outlook: Crisis mode lingers An Increasingly Digital Procurement Function Lacks Talent Required for Future Needs New McKinsey survey highlights steps companies are taking to stay on top on global trade processes 2023 State of Logistics: Third Party Logistics (3PL) Ocean Cargo: Carriers, shippers continue to navigate choppy waters Could Climate Become The Weak Link In Your Supply Chain? 7 Actions to Drive Demand Planning During the COVID-19 Pandemic and Prepare for the “Next Normal” More McKinseyLatest in Supply Chain

Is the Trailers as a Service (TaaS) Model Right For Your Business? Why Grocery Shoppers are Leaving Stores and Buying Their Food Online Is There a Next Generation of Truckers? Data Reveals Grim Outlook A Look at Baltimore’s Key Bridge Collapse—One Month Later European Parliament Passes Law on Supply Chain Accountability Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season More Supply ChainAbout the Author