Tokyo is World’s “Hottest” Retail Market, According to CBRE Report

Toronto stands out as hottest market in the Americas U.S. retailers dominate cross-border expansion, with Asia and Europe being prime targets.

Tokyo is the world’s hottest market for retail expansion, attracting 63 new brands last year as leasing momentum in core areas remained strong, despite mixed signals in the economy and an increase in the sales tax to eight percent in April 2014, according to the latest report from CBRE Group, Inc., “How Global is the Business of Retail?”

Toronto stood out as the hottest market in the Americas, attracting 25 new international brands in 2014.

According to the report - which tracks the target markets of new brands in 164 cities in 50 countries - U.S. retailers are the most active when it comes to expanding into new global markets.

In 2014, U.S. retailers accounted for 26 percent of cross-border expansion. Primary expansion targets for Americas retailers are Asia (41 percent) Europe (33 percent), and the Middle East and Africa (12 percent).

Italian retailers were the second most active, accounting for 14 percent of cross-border expansion, followed by U.K.-based retailers (11 percent) and French retailers (10 percent). Globally, Europe accounted for 42 percent of retailer expansion, followed by Asia with 39 percent and the Middle East and Africa with 10 percent. North America was only a target for three percent of retailers.

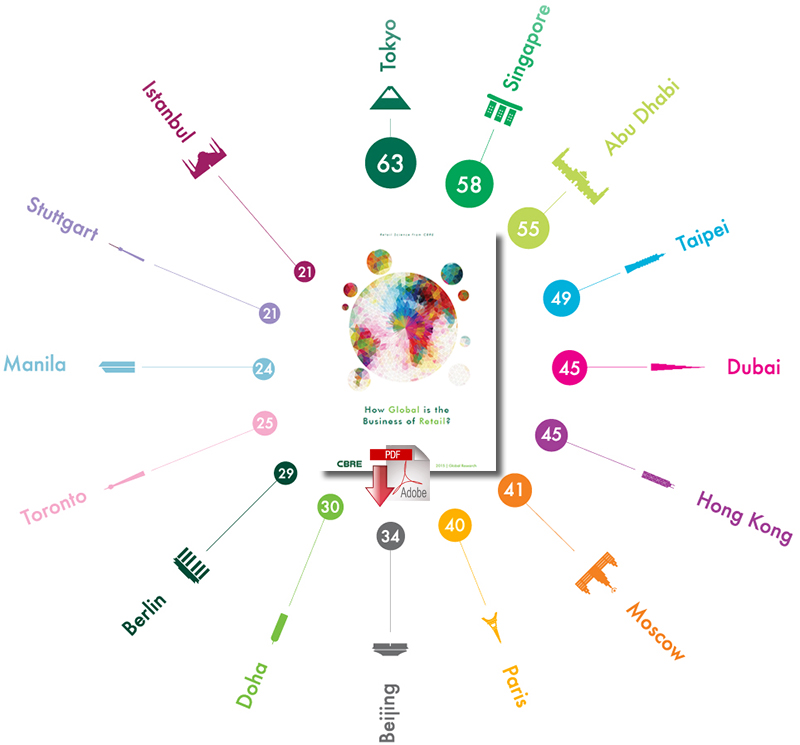

Top Target Markets By New Entrants

Source: How Global is the Business of Retail?

“The core elements of globalization, technology and demographic change, continue to have a dramatic impact on the business of retail. Demographic shifts in many countries have resulted in changes in both spending power and shopping habits. Technology enables retailers to enter markets and evaluate performance more swiftly,” said Brandon Famous, Senior Managing Director, Retail Occupier Advisory & Transaction Services, CBRE.

“Consumer traveling patterns mean that many brands are well known before they even enter a market and the pent-up demand for the chance to purchase locally creates a ready-made market before entry.”

Among the most active retail sectors globally, Mid-Range Fashion retailers led the field, accounting for 21 percent of global expansion, followed Luxury & Business retailers, with 20 percent, and Coffee & Restaurant and Specialist Clothing, each with 16 percent.

When it comes to expansion into the Americas, Luxury & Business retailers were the most active at 26 percent, followed by Mid-Range Fashion representing 20 percent of total activity, and Specialist Clothing representing 14 percent.

“Consumers continue to view the physical store as their preferred mode of purchase and perhaps more importantly, as a point of social interaction,” Mr. Famous added. “Consumers view shopping as a leisure activity and the continued expansion of brands and the development/improvement of shopping locations gives them the opportunity to embrace this.”

Related: Global Powers of Retailing: Embracing Innovation

Article Topics

CBRE News & Resources

CBRE report points to a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights the ever-growing role of holiday season reverse logistics operations Top 20 Warehouses 2023: Demand soars and mergers slow Top 20 Warehouses 2023: Demand soars, mergers slow CBRE report highlights mixed Q3 industrial real estate directions Q3 Commercial Construction Starts Fall 37% vs. Q2 More CBRELatest in Supply Chain

Ask an Expert: How Shippers Can Prep for Hurricane Season Apple Accused of Multiple Human Rights Violations South Korea Finally Overtakes China in Goods Exported to U.S. UPS Struggles in First Quarter With Steep Earnings Decline How Supply Chains Are Solving Severe Workplace Shortages SAP Unveils New AI-Driven Supply Chain Innovations How Much Extra Will Consumers Pay for Sustainable Packaging? More Supply Chain