The New Indicators of Financial Success

The demand for nonfinancial performance and sustainability information is a business imperative and an opportunity to forge a smarter, more competitive corporation.

For years now, companies have been under pressure—first from regulators and sustainability-minded nongovernmental organizations and more recently from investors, customers, and employees—to disclose ever-increasing amounts of information about their operations. What were once indices and rankings created by special-interest groups are now detailed operational reports that can serve as bellwethers of a company’s future financial performance.

The vast majority of the largest companies in the world publicly report business sustainability information today: from how much water their operations consume to supply chain stability, greenhouse gas emissions, and the personal- and process-safety performance and reliability of assets. All of these nonfinancial data can be used as leading indicators of mid- to long-term financial performance.

A long-term investor in an asset-intensive business (a business that requires a large amount of capital to operate) would be well advised to research a company’s asset reliability, environmental performance, and risk-management and safe-operations processes, not simply its price-to-earnings ratio and earnings per share. Downtime, accidents, and regulatory violations all threaten business productivity and impact revenue, earnings, and shareholder value.

A company’s heavy emissions of greenhouse gases (compared with its peers), for instance, could be the sign of an organization with potential for pollution reduction. It could also signal an organization that has significant cost-reduction potential via a more concerted management focus on projects to reduce energy consumption in the long term. Unplanned downtime, whether because of safety issues, mechanical failures, or poor supply chain planning, likely signals that a company will incur costly facility disruptions and expense. A concerted plan to reduce unplanned downtime holds the potential for lowering cost and boosting productivity.

Lack of such a plan can degrade enterprise value. Consider the impact on a company’s market value from industrial accidents. A 2009 research study titled “How Does the Stock Market Respond to Chemical Disasters?” by Gunther Capelle-Blancardy and Marie-Aude Lagunaz, examined 64 explosions in chemical plants and refineries worldwide between 1990 and 2005 and found that, on average, petrochemical firms experience a drop in market value of 1.3% over the two days immediately following a disaster. The study calculated that each casualty corresponded to a loss of $164 million. A toxic release corresponded to a loss of $1 billion.

For companies already struggling to meet the demands to provide sustainability and other operational data, the financial market’s increasing interest in operating information may seem onerous. In reality, it is an enormous opportunity. Financial numbers are strong short-term performance indicators, but they do not always tell the full story. Nonfinancial operational metrics fill out the narrative, especially when it comes to projecting mid- to long-term performance.

Toward operational excellence

As companies have realized the opportunities revealed by mining operational performance data, they have focused on developing leadership and integrated management systems as a disciplined way to optimize performance. These systems underpin an operational excellence strategy.

Operational excellence is a state of operational execution attained by aligning the principles, systems, and tools throughout an organization to deliver sustainable improvement of key business objectives. In addition to operational excellence, these programs may be called sustainability or corporate responsibility, but what they all have in common is the pursuit of continuous improvement. The goal is to create competitive advantage.

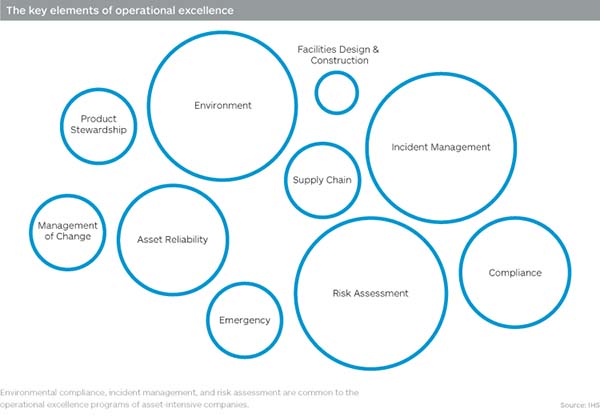

IHS has identified the 10 most common elements of operational excellence programs at top global oil, gas, energy, mining, chemical, and other asset-intensive companies (see figure below). Of these 10 elements, six typically characterize their operational excellence programs: asset reliability, compliance assurance, environmental performance, incident management, risk management, and supply chain management. These initiatives are nearly always discrete management systems, or frameworks of processes and procedures, that have evolved as the business has grown.

Many of today’s large asset-intensive companies have grown through mergers and acquisitions, and with each newly acquired asset came one more unique culture, set of processes, and information-technology platform. Like Russian matryoshka dolls, each facility or geography has multiple management systems with individual teams (environment, incident, etc.) applying policies and processes in their own way. For instance, a facility in Aberdeen, Scotland, might implement a process much differently than a subsidiary in Calgary, Alberta. So it is easy to see how complexity grows as a company expands and matures. Aggregating data on a global scale becomes complicated and decision making slows or becomes nearly impossible to manage with confidence.

Operational excellence programs cut through the complexity. Armed with an intimate knowledge of its operations at every level, a company can focus on addressing the most critical risks before they have a negative material impact on the business. They can cut waste, learn to solve problems, develop a culture that prizes continuous improvement, and create competitive advantage.

An enterprisewide operational excellence management system enables a company to do on an operational basis what well-known enterprise resource planning systems enable it to do on a financial basis. It affords a clear line of sight into corporate activities, from the individual operator level up to the enterprise level. Unlike financial information systems, which track what employees, facilities, and departments are earning or spending, the operational information system tracks what they are actually doing.

Operational excellence management systems are frameworks developed to support the policies and procedures outlined in the operational excellence strategy of the company. These systems underpin that strategy and provide a way to systematically maintain corporate policies and procedures.

So what can companies do with such a system? If a gas turbine at a plant in Chile breaks down, the lessons and solutions that emerge from that experience can be quickly deployed to every turbine the company operates, anywhere in the world. Any new learning, anywhere, can be quickly communicated across the entire company. This type of learning prevents the same unexpected downtime experienced by one facility of the enterprise from recurring in another facility and drives up the certainty that assets will perform as expected.

More than that, the operational excellence information management system provides a way to quantify leadership and shape the corporate culture. Managers can measure how, and how quickly, staff deals with a problem: how quickly a shift superintendent finds out about an incident or near miss with a potentially high impact; how long it takes to close out all the action items involved in addressing the root causes of the problem. With such information, companies can speed response rates as well as identify and reward employees who respond quickly to high-impact incidents.

A system that focuses on disciplined processes and supports corporate policies gives teeth to management objectives. Managers can set all the energy-saving goals they like, but it is the operator turning the knobs who determines whether those goals are met. The information-management system may be top-led, but the information input and adoption needs to be bottom-fed. Operations and maintenance personnel are in the best position to make decisions about what to do in an emergency or how to solve a problem or, better yet, prevent one.

The enterprise-wide information system makes the organization as a whole more agile. Employees at all levels are more conscious of risks they can control and more alert to opportunities to make improvements. Annual or bi-annual audits serve as measures of success, but bottom-up information management enables companies to become more proactive and make faster, more confident decisions that drive incremental improvements in operational efficiency.

In it for the long haul

Developing a global operational excellence information management system is a long-term commitment. Like the enterprise-wide financial information systems that most large companies have installed over the last few decades, it is the work of years, not months, and is dauntingly complex; there are no shortcuts.

In every case, it is a matter of building on what a company already has in place. Even if a company does not think in terms of business processes, it—like every company—has a way of dealing with and learning from the unexpected. Instituting an enterprise-wide information management system means expanding that effort to a global scale.

Where a company starts depends on the maturity of its existing system. Most asset-intensive companies have developed information systems as management system standards have emerged: environmental performance-management systems follow the ISO 14000 standard, quality follows ISO 9000, energy management follows ISO 50001, and risk management follows ISO 31000. Although the guidelines from the International Organization for Standardization and other standards bodies have allowed companies to standardize procedures, many information management systems have evolved from a collection of simple word-processing documents and spreadsheets that remain static and offer little insight for strategic decision making.

These tactical compliance solutions worked well when decision making was limited to one area of operations and one facility. But as sustainable operational performance improvements became more important to communicate business success to investors and customers, so did the need for a strategic enterprise-wide approach to global decision making.

As management systems evolved, companies started analyzing the aggregated data compiled across operations within each siloed operating unit—for environmental, equipment reliability, incident, supply-chain, and risk-assessment information—which provided management with more insight for decision making. Goal setting and investment decisions, however, were still made based on the strength of the leaders who managed the silos.

Today, companies are beginning to aggregate information and data from across multiple silos to create integrated management systems. Although corporate executives and their boards of directors are now able to compare operational performance across a variety of operational metrics, they are not yet able to prioritize the information. They may be seeing all the risks about the supply-chain or process-safety or environmental performance, but they do not yet have the insight to determine if the supply-chain, process-safety or environmental performance is being managed within established tolerances across the entire enterprise. That insight requires standardization, information convergence, and data analytics to create knowledge-based systems so that management can prioritize risks and make the right investment decisions that maximize the benefit for the corporation.

A case in point is Brazil’s Vale S.A., one of the world’s largest metals and mining companies. Vale developed a comprehensive knowledge-based system for enterprise risk management that gave it a broader view of its risk profile. Its operational risk framework was designed to provide standardized policies, procedures, and guidelines for operational risk governance. Vale developed tools and techniques to translate rules into action by measuring risks, making decisions, and assigning and tracking tasks.

Today, Vale’s senior executives use the risk framework to integrate and prioritize risks from across the company’s global operations. Environmental, health and safety, regulatory, social, legal, and financial risk information all converge so that Vale decision makers can focus on what is most important.

Implementing and sustaining a knowledge-based management system is the job of everyone in the corporation, from the CEO to the operator on the facility floor. Everyone must follow the same standards and use the same metrics. And everyone must share responsibility for making the system work.

The demand for nonfinancial performance information is not going to slow down. Integrated management systems are here to stay. And the companies that take advantage of such systems with the greatest discipline stand to capitalize on strategic opportunities, increased share price, customer and employee satisfaction, and accelerated growth. Getting there may be a challenge, but the payoff can be significant.

Let us know (Fill in the form on the right hand side) how operational excellence is measured in your organization.