The EPA Thinks Truckers Aren’t Doing Enough To Save Fuel - How Is That Possible?

Why do we need EPA regulations to persuade truckers to save money? Shipping companies were presumably aware that fuel is costly and that they can reap savings by paying more upfront for more efficient trucks.

Today (6/19/2015), the Environmental Protection Agency proposed sweeping new regulations to cut greenhouse-gas emissions from all new heavy trucks, buses, and vans.

It’s a huge piece of President Obama’s broader plan to tackle global warming.

The logic behind the truck rule sounds simple enough: Even though trucks make up just 4 percent of vehicles on the road, they account for 20 percent of greenhouse-gas emissions from transportation. So let’s clean ‘em up.

The EPA is proposing to raise fuel-economy standards for medium- and heavy-duty vehicles between 2021 and 2027 - saving an estimated 1.8 billion barrels of oil. Truck owners will have to pay a higher price upfront for more efficient engines (about $12,000 more, on average). But, the EPA says, they’ll actually save money over the long run through lower fuel costs. Everybody wins.

This raises a nagging question, though: Why do we need EPA regulations to persuade truckers to save money? Shipping companies were presumably aware that fuel is costly and that they can reap savings by paying more upfront for more efficient trucks. Weren’t they already doing all they could to save fuel? Why get the government involved? This question turns out to be central to these new rules.

Do trucking companies need more incentive to save fuel?

In its proposed rule, the EPA says there are all sorts of technologies available - engine-friction reduction, turbochargers, etc. - that would clearly help trucks use less fuel per mile. But these technologies don’t seem to be as widely adopted as one might expect, despite the potential cost savings.

There are a couple possible reasons why companies aren’t investing in these technologies. One is that these fuel-saving modifications actually have hidden drawbacks. Maybe they make truck engines less reliable and raise repair costs - so truck owners have rational reasons not to adopt them, even if they do save fuel.

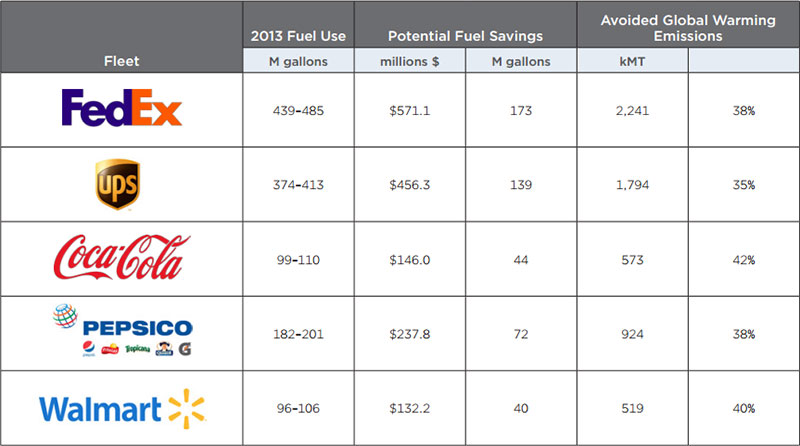

Estimated Savings for Five Major Fleets Under Strong Standards

FedEx, UPS, Coca-Cola, PepsiCo, and Walmart operate five of the largest fleets in the country, consuming more than a billion gallons of fuel annually. New fuel economy standards could help reduce the fuel usage of these fleets by over 500 million gallons, saving $1.7 billion in fuel and preventing 6.7 million metric tons of global warming emissions annually.

Notes: M gallons = millions of gallons; kMT= thousands of metric tons of CO2- equivalent.

Because diesel fuel is the overwhelming majority of fuel used by these truck fleets (95 percent on an energy-basis), fuel usage is given in millions of gallons of

diesel-equivalent. Financial savings assume fuel prices projected out to 2020 by the Energy Information Administration (EIA 2014b) discounted by 10% to reflect

private fuels contracts (e.g., $3.31 per gallon of diesel fuel).

Source: Engines for Change

But a second, alternative explanation is that there are undesirable market barriers that prevent truck owners from investing in these fuel-saving technologies. If so, regulation might help overcome them. The EPA’s argument is that these market failures do indeed exist - and that’s why regulations are needed. (See page 652 of the rule for an extended discussion.)

For example, the EPA notes, trucking companies might not always adopt the latest fuel-saving technology because of misaligned incentives. Say there’s a shipping company that owns and leases tractor trailers to operators. The company buys the trucks, but the operators pay the fuel costs - so there’s less incentive for the owner to invest in more efficient technology. One 2012 study found that 23 percent of tractor trailers in the United States have some version of this principal-agent problem.

In other cases, the EPA argues, trucking firms might not have good information about the value of new fuel-saving technology - they often need to test the technology in-house, which leads to slower-than-optimal adoption rates. On top of that, trucking companies are frequently reluctant to be the first to adopt a new technology, especially if there’s a risk it might make their operations less reliable. They’d prefer to wait and see what other companies do. That, in turn, slows the rate of adoption.

There’s a fair bit of empirical evidence that these market barriers exist, though there’s still some debate among economists over how important they are. But the EPA ultimately concluded that “some combination of uncertainty about future cost savings, transactions costs, and imperfectly functioning markets” was impeding the adoption of fuel-saving technology.

“I realize fuel is expensive, thanks.”

Market failures are key to the case for stricter regulation

This question about market barriers turns out to be crucial. If the EPA’s right, and there really are coordination problems that hinder the adoption of new fuel-saving technology, then government regulations can help overcome these barriers. The air gets cleaner, truck companies save money - everyone wins.

On the flip side, if truck owners actually had good reasons for not adopting these technologies in the first place - say, because they make engines less reliable or whatnot - then these new truck regulations might be more economically costly than the EPA thinks. (The EPA concedes as much on page 835 of the rule) The rules could still reduce greenhouse gas emissions and be good for the environment even so. But they’d be more expensive than expected.

For what it’s worth, some corners of the trucking industry do agree with the EPA that the market failures are real - and well-designed regulations can help companies save money. “In 2014, trucking spent nearly $150 billion on diesel fuel alone,” said Glen Kedzie, vice president of the American Trucking Association, in a statement. “So the potential for real cost savings and associated environmental benefits of this rule are there.”

Still, Kedzie did express concern that the EPA’s new truck rule, if badly implemented, could require trucking companies to adopt still-unproven technology. Meanwhile, the EPA’s proposed rule has opened a rift between companies that manufacture engines and companies that manufacture entire trucks (because the rule mainly aims at improving efficiency in engines and transmissions, rather than allowing truck manufacturers to comply by, say, improving aerodynamics.)

In any case, this rule is only a proposal for now - the EPA will now hold a 60-day comment period, allowing people around the country to suggest tweaks and changes.

Further Reading:

- This report from the Union of Concerned Scientists makes the most detailed case in favor of heavy-duty truck regulations. They argue that market barriers are real - and EPA regulations can overcome them.

- This paper by Winston Harrington and Alan Krupnick of Resources for the Future, by contrast, highlights some of the potential pitfalls with truck regulations. For instance, the EPA’s regulations only apply to new trucks. Because that means new trucks will be more expensive, truck operators could have incentive to keep their older, dirtier trucks around for longer.

- Meanwhile, we might one day see driverless trucks hit the road. That technology has huge potential for saving fuel and reducing pollution. On the flip side, it could put the nation’s 1.7 million truck drivers out of work.

Source: Vox

Related: How Trucking Companies Can, and Must, Improve Fuel Sustainability

Article Topics

C.H. Robinson News & Resources

Q&A: Mike Burkhart on the Recent Nearshoring Push Into Mexico Q&A: Mike Burkhart, VP of Mexico, C.H. Robinson C.H. Robinson introduces new touchless appointments technology offering C.H. Robinson President & CEO Bozeman provides overview of key logistics trends and themes at SMC3 JumpStart 2024 C.H. Robinson touts its progress on eBOL adoption by LTL carriers and shippers Retailers Pivot Supply Chain Strategy, Seek Red Sea Alternatives C.H. Robinson announces executive hire to run new Program Management Office More C.H. RobinsonLatest in Transportation

April Employment Update: Trucking Sector Faces 300 Job Losses Porsche Gets Greener, Shifts to Sustainable Transport Logistics How Much Will it Cost to Repair Baltimore’s Francis Scott Key Bridge? Trucking Industry Pushes Back on Government’s Electric Mandates Maersk Sees Silver Lining in Red Sea Shipping Challenges Baltimore Opens 45-Foot Deep Channel Following Bridge Collapse El Paso Border Delays Cost Juarez $32 Million Per Day in Economic Losses More Transportation