State of Logistics 2022: Rail/Intermodal

Railroad and intermodal aim to get back on track.

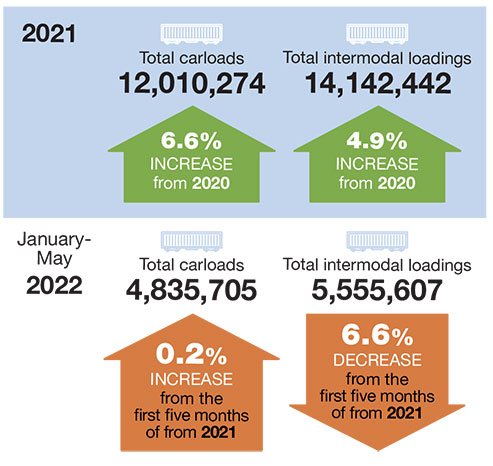

Going back to the onset of the COVID-19 pandemic, U.S. rail carload and intermodal volumes have seen their fair share of ebbs and flows. In 2020, the pandemic knocked a serious dent into volumes, whereas a year ago at this time, U.S. rail carload volumes showed an emergence from the pandemic-driven doldrums with a 7.3% annual gain through the first five months of 2021 as more people got vaccinated and the economy started moving again. But, through the first five months of 2022, there has been a retreat of sorts for volumes, according to data from the Association of American Railroads (AAR).

For this period, U.S. rail carloads are up 0.2% annually, and the weekly average carload for May—at 232,186—was off 3.7% compared to May 2021, down from a 7.3% annual gain for the same period a year ago. This far outpaced the May 2020 weekly carload average, the lowest ever recorded since AAR first began tracking this data. Putting that into additional perspective, to highlight the impact the pandemic had on rail carloads, May 2021 posted a 30.4% annual gain.

On the intermodal side, May U.S. container and trailer volume was off 4.3% annually, following a 26.2% improvement from May 2020 to May 2021. And, for the first five months of the year, U.S. container and trailer volumes are off 6.6%. But that tally may not be a major concern, considering that U.S. intermodal weekly average—at 275,640—while down 4.3% annually, marked its highest output since June 2021, as well as the third-highest May weekly intermodal average on record.

“Rail traffic volumes in May reflected an economy that is a mixture of good and not-so-good,” says AAR senior vice president John Gray. “Auto production and auto carloads seem to be slowly recovering; crushed stone and sand and food-related volumes are showing strength, while intermodal had its best month since June 2021. On the other hand, carloads of chemicals fell for the first time in more than a year in May, while grain volumes continued to be disappointing when compared to those of 2021 and the latter half of 2020.”

Anthony Hatch, principal of New York-based ABH Consulting, explains that while railroad and intermodal volumes could be viewed as sluggish, there is an expectation that they have bottomed out, noting that there are some “green shoots” in certain segments.

U.S. Rail Cargo Volumes

“Domestic intermodal is looking a little better, as are industrial volumes for a few of the American carriers,” Hatch says. “What we hope to see is incremental but steady and consistent progress over the next several months through the end of the year. And we should see that in rail results in service, and that will lead to volume [gains], like the KCS saying ‘service begets growth,’ one of the best phrases to come out of Precision Scheduled Railroading. There is more demand than can be served.”

However, Hatch cautions that the railroad and intermodal pieces of the supply chain are always subjected to continued shocks, such as the recent port closures in China and the setback it incurred when the Omicron variant was raging. What’s more, he observes that railroads have dealt with staffing issues, which they are taking steps to address by upping the number of people entering their training programs with vastly improved pipelines that align them well toward the very real possibility of having a strong second half of the year.

“There will be impacts from the pandemic that last into 2023, 2024, and 2025, and we will see the supply chain impacts go on,” says Hatch. “But we really hope we can say that by the second half of this year, things will be clearly looking up. Rail traffic is looking up, led by carload, with intermodal still dealing with port congestion and drayage shortages. But it appears that we’re trending in the right direction. However, this is a fragile recovery, so further shocks—or new variants—can wreak further havoc.”

Hatch also highlights how the Washington, D.C.-based Surface Transportation Board (STB) has been keeping a watchful eye on freight railroads, voicing concerns on service-related issues and the ongoing push for reciprocal switching.

“It’s a tough time to be a railroad if you want to defend your position and don’t want government involvement,” adds Hatch. “Because of the supply chain crisis, most of which is global and labor-related, and things like railroads’ increased dwell times, it is a tough time [for railroads] to defend their position. Reciprocal switching would potentially add more railroad competition and the problem I have with the STB is that it takes a look at rail competition, as if there were no other modes available. It’s clear that the STB is an interventionist board and wants to do something, and it believes that the government can help solve supply chain issues.”