State of Logistics 2021: Less than Truckload (LTL)

Retail, e-commerce, carrier discipline driving revival

Back in the early part of this century, e-commerce rarely excited less-than-truckload (LTL) executives because of the way those deliveries used to be made—mostly to shopping centers and malls.

It wasn’t terribly efficient. It was costly. It was time-consuming. And deliveries to private homes were even worse.

“Amazon and Wayfair changed all that,” says Satish Jindel, principal of SJ Consulting, a firm that closely tracks the LTL industry. “E-commerce has been transformed, and the LTL industry is hitting on all 24 cylinders.”

LTL carriers are now doing lots of “middle-mile” deliveries to warehouses for those online giants. And, as a result, they have become big, reliable customers to shrewd LTL carriers. “That business was always there, but LTL carriers are now managing it differently and pricing it smarter.”

Amazon and other e-commerce behemoths have become huge consumers of LTL capacity, and that has taken capacity away from LTL’s “other half”—the industrial economy. This fact has led to an economic revival of the LTL sector, where the top 25 carriers control 90% of the market.

So, when that industrial economy hit the COVID doldrums last year, LTL carriers astutely changed gears and used that additional capacity to handle surging e-commerce, middle-mile deliveries.

This was a significant shift in priorities. A decade ago, LTL carriers thought building expensive last-mile delivery networks for home deliveries would be their panacea. “That was missing the point,” says Jindel. “The fact is there are lots of middle-miles when Amazon is going to have deliveries to 400 of their warehouses.”

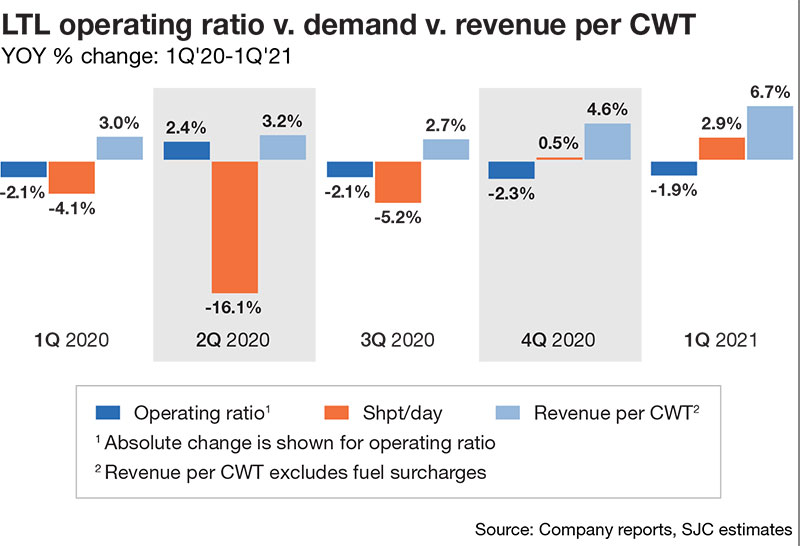

As the chart shows, carriers in both LTL and TL segments have seen volume declines due to the pandemic in the first half of 2020—more significantly within the LTL industry. However, TL and LTL carriers have done a better job of maintaining profitability, with their collective operating ratio improving in the last three quarters, including the first quarter this year.

One can see the results in the headlines. Old Dominion Freight Line earned $199.4 million in net income in the first quarter, nearly 50% ahead of that period a year ago. XPO Logistics, parent of the 3rd-largest LTL concern, reported record first quarter net income of $115 million while revenue surged 21% to $4.77 billion from the 2020 first quarter.

Similarly, ArcBest, parent of ABF Freight System, the nation’s 7th-largest LTL carrier, saw net income improve to $23.4 million from year-ago earnings of $1.9 million on an 18% rise in revenue of $829 million.

Industry officials and analysts say it’s not just surging e-commerce and tight capacity that are driving this profitability. Carriers are now correcting erroneous weights in shipments that Jindel estimates have added an additional 4% to 6% of yield improvement—which goes directly to the bottom line.

LTL carriers have UPS and FedEx to thank for those yield improvements. Those package delivery giants weigh their packages down to the final ounce. It took a while, but the LTL industry has followed suit, along with dimensional pricing to help charge additional fees for larger, lighter packages.

So, when will this LTL revival end? No time soon, analysts predict.

“All the stars are aligned perfectly for the industry to have a good two to three years,” Jindel predicts. “And that’s a long time in today’s world.”

The only thing that could spoil this party would be the carriers themselves—not so much by pricing, but by adding capacity in the form of adding new trucks. “It’s the pricing that takes away discipline,” says Jindel.

In fact, LTL carriers are aggressively looking to add drivers, and that baffles Jindel. “Why would companies want to disrupt the balance between supply and demand when it’s in your favor?” he asks. “Why are you wanting to change that?”

And for shippers trying to cope with ever-rising LTL freight costs, Jindel has a simple solution. “Transportation for every customer vertical is not more than 7% of cost of what they are selling,” he adds. “If transportation goes up 10%, that’s less than 1% of the cost of the product. Pass it on to the consumer.”