Nothing This Big Has Ever Been Seen In America

The CMA CGM Benjamin Franklin, which was launched on Dec. 10, 2015, is scheduled to make her maiden call at APM Terminals-Pier 400 at the Port of Los Angeles followed by a subsequent visit to the Port of Oakland.

The CMA CGM Benjamin Franklin, which was launched on Dec. 10 is scheduled to make her maiden call at APM Terminals-Pier 400 at the Port of Los Angeles. the Port of Oakland will host a subsequent visit.

As this year ends, the era of the mega vessel may be finally be ushered in as the largest container ship ever destined for North America calls West Coast ports.

The ship has a capacity of nearly 18,000 Twenty Foot Equivalent Units (TEUs), which is about a third larger than the biggest container ships that currently call at the San Pedro Bay port complex.

“We were just welcoming a generation of 13,000 TEU vessels earlier this year, and now we are seeing one 28 percent bigger,” said Philip Sanfield, a spokesman for the port.

It is anticipated that the CMA CGM Benjamin Franklin will return to San Pedro Bay in the first quarter of 2016 for a call at the Port of Long Beach.

“The arrival of the Benjamin Franklin signals a new chapter in Pacific Rim trade flow and supply chain optimization,” noted Port of Los Angeles Executive Director Gene Seroka.

As North America’s leading seaport by container volume and cargo value, the Port of Los Angeles facilitated $290 billion in trade during 2014.

California’s third largest container gateway – the Port of Oakland – is also celebrating the arrival of the Benjamin Franklin, although it will not be fully loaded by the time it arrives at this destination, it makes viable case that other mega vessels will soon be making scheduled calls.

“Nothing this big has ever been seen in our country,” said Port of Oakland Executive Director Chris Lytle. “There’s no doubt others will follow suit and we’re gratified that Oakland is one of the only ports in the U.S. ready to receive them.”

As noted in a recent report, Oakland has invested in new cranes to accommodate mega ship cargo loading and discharge. A key question, though, will be how longshore labor responds to the challenge.

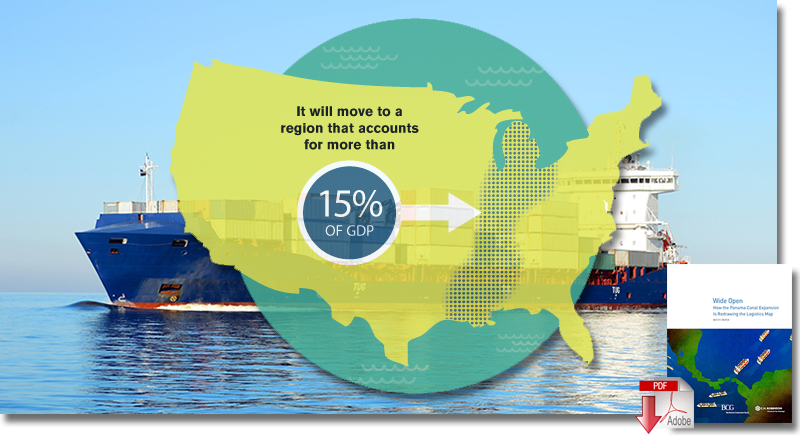

East, West Coast Ports Battle for U.S. Region After Panama Canal Expansion

You might think that shippers along the East Coast will be the biggest beneficiaries of fierce competition between the East and West Coast ports.

In fact, the battleground on which ports compete for customers will likely expand and move several hundred miles west, toward Chicago and Memphis. It will take in other metropolitan areas like Detroit and Columbus, and encompass a newly contested region that accounts for more than 15% of the U.S. GDP.

In this area, shippers will often be able to route containers through East Coast ports to inland destinations at costs that are either lower or comparable to the costs they would incur by using West Coast ports.

Of course, cost isn’t the only factor - overall shipping time, flexibility, and reliability matter, too.

Which ports stand to gain and lose the most in this scenario?

Advantaged

- New York-New Jersey port and the southeastern ports of Norfolk, Savannah, and Charleston. These ports are located relatively close to the battleground region and near rail routes to major markets. They stand to see the greatest advantage from the Panama Canal expansion.

- Houston and New Orleans-Gulfport. While not major container ports today, both are likely to grow as they upgrade and are able to serve the fast-growing greater Gulf Coast region.

Neutral or Unclear

- Baltimore, Miami, and other East Coast ports. These ports will probably see similar traffic levels to those before canal expansion. They serve regional markets and are unlikely to receive large volumes of cargo headed to the battleground region.

- Oakland and the Seattle-Tacoma ports on the West Coast. Both of these clusters have strong local markets. Seattle-Tacoma is generally the best complex to serve the Pacific Northwest, playing a unique role in providing access to the upper Midwest via rail.

Disadvantaged

- Los Angeles-Long Beach. This complex is well positioned to handle traffic to major population centers and will always be the fastest option for reaching a large share of the U.S., but the recent labor dispute here may motivate shippers to reduce their dependence on the West Coast.

Download: How the Panama Canal Expansion Is Redrawing the Logistics Map

Article Topics

C.H. Robinson News & Resources

Q&A: Mike Burkhart on the Recent Nearshoring Push Into Mexico Q&A: Mike Burkhart, VP of Mexico, C.H. Robinson C.H. Robinson introduces new touchless appointments technology offering C.H. Robinson President & CEO Bozeman provides overview of key logistics trends and themes at SMC3 JumpStart 2024 C.H. Robinson touts its progress on eBOL adoption by LTL carriers and shippers Retailers Pivot Supply Chain Strategy, Seek Red Sea Alternatives C.H. Robinson announces executive hire to run new Program Management Office More C.H. RobinsonLatest in Transportation

Why Grocery Shoppers are Leaving Stores and Buying Their Food Online Unlocking Efficiency: Navigating Sea Freight Logistics in Supply Chain Management Is There a Next Generation of Truckers? Data Reveals Grim Outlook A Look at Baltimore’s Key Bridge Collapse—One Month Later Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season UPS Struggles in First Quarter With Steep Earnings Decline More TransportationAbout the Author