Logistics managers gain new insight on U.S. ports thanks to Descartes Datamyne

Since ports are often a focus point of micro and macroeconomic changes, fluctuations in volume and commodities are a key indicator of industry developments

More evidence of the digitialization of the ocean cargo supply chain surfaced recently with the release of research compiled by Descartes Datamyne.

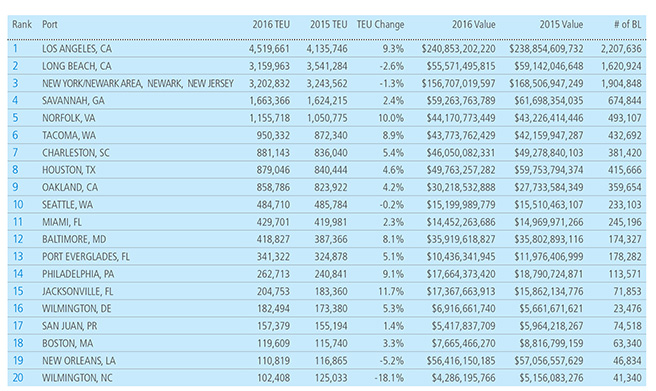

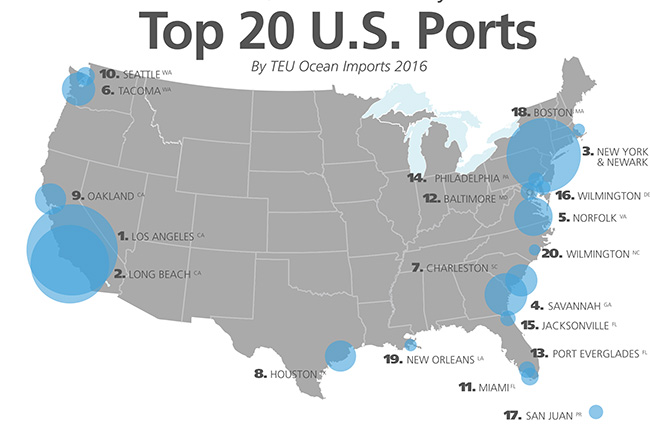

The company’s searchable trade database – covering the global commerce of 230 markets across 5 continents – provides supply chain managers with fresh news on domestics ocean cargo gateway trends and productivity in its U.S. Port Report, listing top 20 payers in import throughput.

Brendan R. McCahill, the Senior Vice President of Trade Data Content at Descartes Datamyne told SCMR—a sister publication— in an interview that the “granular nature” of the information can be leveraged in several was by stakeholders.

“Shippers entering contract negotiations can see where specific commodities are headed, and which ports are providing the best intermodal connections,” he says. “NVOs and the carriers themselves are seeking the same information on their partners and competitiors.”

Since ports are often a focus point of micro and macroeconomic changes, fluctuations in volume and commodities are a key indicator of industry developments, note spokesmen. This report reveals the top 20 U.S. ocean ports ranked by inbound twenty-foot equivalent units (TEUs) and key products imported through each port by Harmonized System (HS) code as well as Bill of Landing (BOL) shipment counts and values.

According to spokesmen, keeping “a pulse on port volume trends” is critical for evaluating changing demand and determining where goods should cross borders. With fluctuating labor trends, larger ocean vessels and ever-changing logistics technology, the top U.S. ports have had to adapt to stay competitive and meet changing volume demands year over year.

Brendan observed that other trends were unveiled in recent research suggesting that “the cold chain” is having an impact on vessel calls.

“The Port of Baltimore has really benefitted by this,” he says, “as have the smaller ports of Philadelphia and Wilmington.”

Another conclusion drawn by this study suggest that the newly-widened Panama Canal may continue to divert freight from the West Coast to the East Coast.

“We are also looking at how the new carrier alliances will change the volume picture,” he says. “It’s still too early to tell where the capacity will shift, and there’s a great deal of dynamism in the marketplace now.”

The U.S. ports data in this report has been gathered by Descartes Datamyne from bills of lading (BoL) that document inbound ocean shipments and are filed with U.S. Customs Automated Commercial Environment (ACE). Twenty- foot Equivilant Units (TEU) volumes reported are derived from bills of lading, as released by U.S. Customs, excluding empty containers and shipments with freight remaining on board (FROB). The value of imports is as reported by U.S. Census.