New study by AlixPartners suggests that ocean carriers remain in fragile state

“Shippers had better mitigate risks this year by choosing a variety of ocean carriers and alliances,” says Esben Christensen, Managing Director at AlixPartners.

Hanjin Shipping Co.’s bankruptcy in 2016 sent shock waves through the industry, while Brexit and the new U.S. administration’s policies threaten to inject further uncertainty into the future of global trade. As a consequence, the outlook for global container carriers remains “rocky” at the outset of 2017, according to a new study by AlixPartners.

“Shippers had better mitigate risks this year by choosing a variety of ocean carriers and alliances,” says Esben Christensen, Managing Director at AlixPartners. In an interview with LM, the adds that shippers should avoid “coast concentration” in deployments.

Given the uncertain dockside labor picture, it’s always best to be prepared for potential disruptions,” he says.

Meanwhile, current “protectionist stances” could reverse policies that have supported the growth of containerization since the 1950s. Going into the important pricing season, companies need to do everything they can to retain the higher rates recently seen.

“The industry remains in the midst of major upheaval it’s experienced since the 2008 financial crisis. Carriers need to remain focused on eliminating costs from their core shipping business,” says Christensen. “While there has been good news recently in rates, the industry still needs to be prepared for continued struggles. The recent consolidation isn’t the cure all for the industry.”

Despite the distress the industry continues to experience, hope remains. Rate levels on major East-West trades improved—dramatically in some cases—in the fourth quarter of 2016. Carriers managed to sustain those higher rate levels because of an unusually early Chinese New Year, which should buoy financial results for the fourth quarter.

“Spot rates rose nicely after Hanjin ceased operations, particularly for eastbound transpacific trade lanes,” says Lian Hoon Lim, Managing Director at AlixPartners. “But the boost lasted only a few weeks and rates reverted to the habitual depressed levels we have seen.”

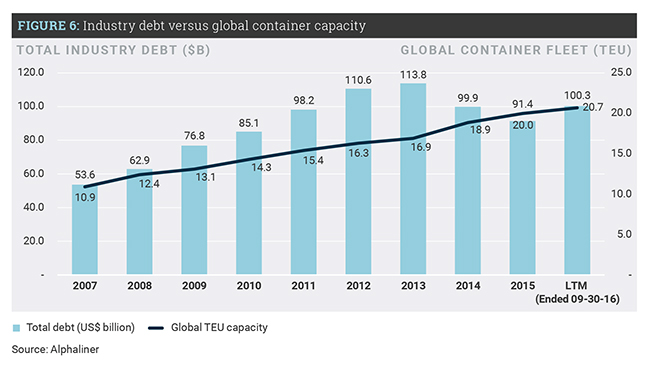

As the shipping industry plows through the doldrums, companies have been searching for solutions to their financial problems. Companies have slimmed operating expenses and reduced capital expenditures, slashing them to $12.4 billion in 2016 from $25.2 billion in 2011. But those efforts may not go far enough. Nearly every key financial indicator worsened from the previous year.

Operational cash flow as a percentage of revenue slowed to an anemic 6% through the last 12-month period ended September 30, 2016, which is still outpaced by capital expenditures. The industry’s total debt levels, driven by borrowing for M&A activity, have edged back up. Additionally, earnings before interest, taxes, and depreciation (EBIT) margins turned negative in Q3 2016 for the first time in the study’s sample period. This does not bode well for the 2017 calendar year, because the industry usually sees peak volumes during the third quarter.

Given the dire situation, it was only a matter of time before a bankruptcy occurred, and it was a big one—in fact, the biggest one since the United States Lines bankruptcy in 1986. Hanjin’s unravelling will likely have profound impacts on the market this year. In fact, spot rates for the eastbound transpacific trade lane, a focus of Hanjin’s network, have nearly doubled since the carrier declared bankruptcy.

“Carriers need to retire or scrap ships and reduce capacity in way they can,” says Christensen.

You can read the full 2017 Global Container Shipping Outlook Report here.