State of Logistics 2022: Less than Truckload (LTL)

E-commerce demand, limited capacity equals another great year.

The $83 Billion Less-Than-Truckload (LTL) sector is booming, thanks to demand from the active e-commerce sector, better pricing strategies and an effective lid on capacity because of expenses associated with building costly hub-and-spoke networks.

“We’re seeing much of the same things in 2022 that we saw in 2021,” says Satish Jindel, president of SJ Consulting, a firm that closely tracks the LTL sector.

However, there’s one significant difference for shippers, Jindel warns: “We’re looking at carriers taking perhaps high-single digit percentage rate increases instead of high single digits. Carriers have learned that they’re not giving their services away. After a look at first-quarter LTL results, they all had wonderful first quarters.”

Yellow Transportation, which controls 10% of the LTL market, is the worst-performing carrier in the sector. But even Yellow is marching toward profitability. It narrowed its first quarter operation loss to $27.6 million, compared with a $63.3 million operating loss in the 2021 opening quarter.

ArcBest, parent of No. 7 LTL carrier ABF Freight System, enjoyed $94.9 million operating income in the first quarter compared with $32.2 million in the 2021 first quarter. Old Dominion Freight Line, the sector’s perennial profit leader, saw its first quarter operating income zoom to $405.5 million, up from $240 million in the 2021 first quarter. Similarly, Saia enjoyed first quarter operating income of $103 million, up from $43.7 million in the 2021 first quarter.

“Overall, volumes are up and they’re getting price increases,” explains Jindel. “Capacity, or the ability to add drivers, is limited. If these carriers are smart, they’ll manage it by not adding drivers.”

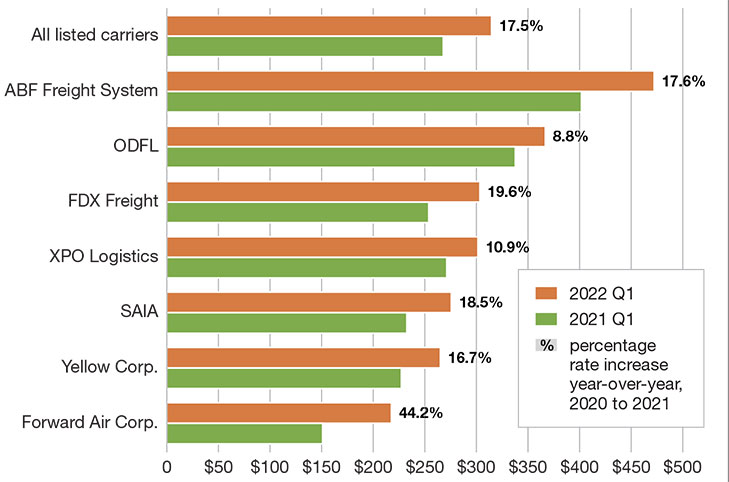

The chart produced exclusively for LM by SJ Consulting (to the right) shows the best reflection of recent developments in LTL. It shows revenue per shipment hundredweight for seven large publicly held LTL carriers enjoying a 17.5% increase in the first quarter of this year compared to the first quarter of 2021.

“Looking ahead, demand for LTL capacity still appears to be strong, with inventory levels remaining below normal and a manufacturing sector playing catch up from supply chain disruptions and a tight labor market,” said Yellow CEO Darren Hawkins on a recent conference call with analysts.

It’s been so bullish in the LTL sector that even Teamsters-covered carriers such as Yellow are actively recruiting from in-house driver training schools to meet growing demand from shippers. Yellow hopes to reach its internal goal of training 1,000 new drivers this year.

There are some bearish indicators, however. Trucking demand is “near freight recession levels,” according to Bank of America. Its bearish report indicates shippers have not been this pessimistic since June 2020 when pandemic lockdowns sent freight

volumes into a historic decline.

The Institute for Supply Management barometer of American factories fell 1.7 points to 55.4% in April as the industrial side of the economy grew at the slowest clip in 18 months. That reflects broad supply and labor shortages and intense inflationary pressures.

Less-than-truckload revenue ($) per shipment

(excluding FSC)