IFR Report ‘World Robotics R&D Programs’ Looks at How Asia, Europe, and the U.S. Invest

The IFR updated its report on governmental priorities as they strive to be competitive through robotics.

Countries around the world are investing in robotics to support their economies. What research and development programs are governments in Asia, Europe, and U.S. funding today? The International Federation of Robotics, or IFR, today published its research in the 2023 update of “World Robotics R&D Programs.”

“The third version of 'World Robotics R&D Programs' covers the latest funding developments including updates in 2022,” stated Jong-Oh Park, vice chairman of the IFR Research Committee and a member of the organization's executive board.

The study found that that the most advanced nations in terms of annual installations of industrial robots—China, Japan, the U.S., South Korea, and Germany, plus the European Union—have very different R&D strategies.

Governments drive robotics R&D programs in Asia

In China, the 14th Five-Year Plan for Robot Industry Development, released by the Ministry of Industry and Information Technology (MIIT) in Beijing on Dec, 21, 2021, focused on promoting innovation. The goal is to make China a global leader for robot technology and industrial advancement, noted the IFR.

Robotics is listed in China's plans for eight key industries for the next five years. In order to implement national science and technology innovation arrangements, the key special program “Intelligent Robots” was launched under the National Key R&D Plan on April 23, 2022, with a funding of $43.5 million (U.S.).

The IFR's recent statistical yearbook World Robotics said that China has reached a robot density of 322 units per 10,000 workers in the manufacturing industry. The country ranked fifth worldwide in 2021, compared with 20th (at 140 units) in 2018.

In Japan, the New Robot Strategy aims to make the country the world's No. 1 robot innovation hub. The Japanese government provided more than $930.5 million in support in 2022, said the IFR.

Key sectors for Japan are manufacturing ($77.8 million), nursing and medical ($55 million), infrastructure ($643.2 million), and agriculture ($66.2 million). The action plan for manufacturing and service includes projects such as autonomous driving, advanced air mobility, and the development of integrated technologies that will be the core of next-generation artificial intelligence and robots.

Japan's government allocated a budget of $440 million to robotics-related projects in the Moonshot Research and Development Program over a period of five years from 2020 to 2025. According to the IFR's World Robotics, Japan is the world's No. 1 industrial robot manufacturer, delivering 45% of the global supply in 2021.

The Third Basic Plan on Intelligent Robots of South Korea is pushing to develop robotics as a core industry in the fourth industrial revolution, or Industry 4.0. The Korean government allocated $172.2 million in funding for the 2022 Implementation Plan for the Intelligent Robot.

From 2022 to 2024, a total of $7.41 million is planned in funding for the Full-Scale Test Platform Project for Special-Purpose Manned or Unmanned Aerial Vehicles. World Robotics reported an all-time high of 1,000 industrial robots per 10,000 employees in 2021. This makes Korea the country with the highest robot density worldwide.

Europe promotes innovation, values, says IFR

Horizon Europe is the European Union’s key research and innovation framework program with a budget of $94.3 billion (U.S.) for 2021 through 2027, said the International Federation of Robotics. Its top targets include strengthening the EU’s scientific and technological bases and boosting Europe’s innovation capacity, competitiveness, and jobs.

Horizon Europe also has a stated goal of as delivering on citizens’ priorities and sustaining socio-economic models and values, said the IFR. The European Commission provided total funding of $198.5 million for the robotics-related work program for 2021 to 2022.

Germany's High-Tech Strategy 2025 (HTS) is the fourth edition of that country's R&D and innovation program. The German government plans to provide around $69 million annually until 2026 for a total budget of $345 million for five years.

As part of the HTS 2025 mission, the program “Shaping technology for the people” was launched. This program aims to use technological change in society as a whole and in the world of work for the benefit of people. Research topics include digital assistance systems such as data glasses, human-robot-collaboration, and exoskeletons to support employees in their physical work.

HTS also seeks to develop systems for the more flexible organization of work processes or the support of mobile work. According to World Robotics, Germany is the largest robot market in Europe. Its robot density ranks in fourth place worldwide, with 397 units per 10,000 employees.

The U.S. seeks to build on existing programs

The U.S. government launched the National Robotics Initiative (NRI) to support fundamental robotics R&D, said the International Federation of Robotics.

The NRI-3.0 program, announced in February 2021, seeks research on integrated robot systems and builds upon the previous NRI programs. The U.S. government funded the NRI-3.0 with $14 million in 2021.

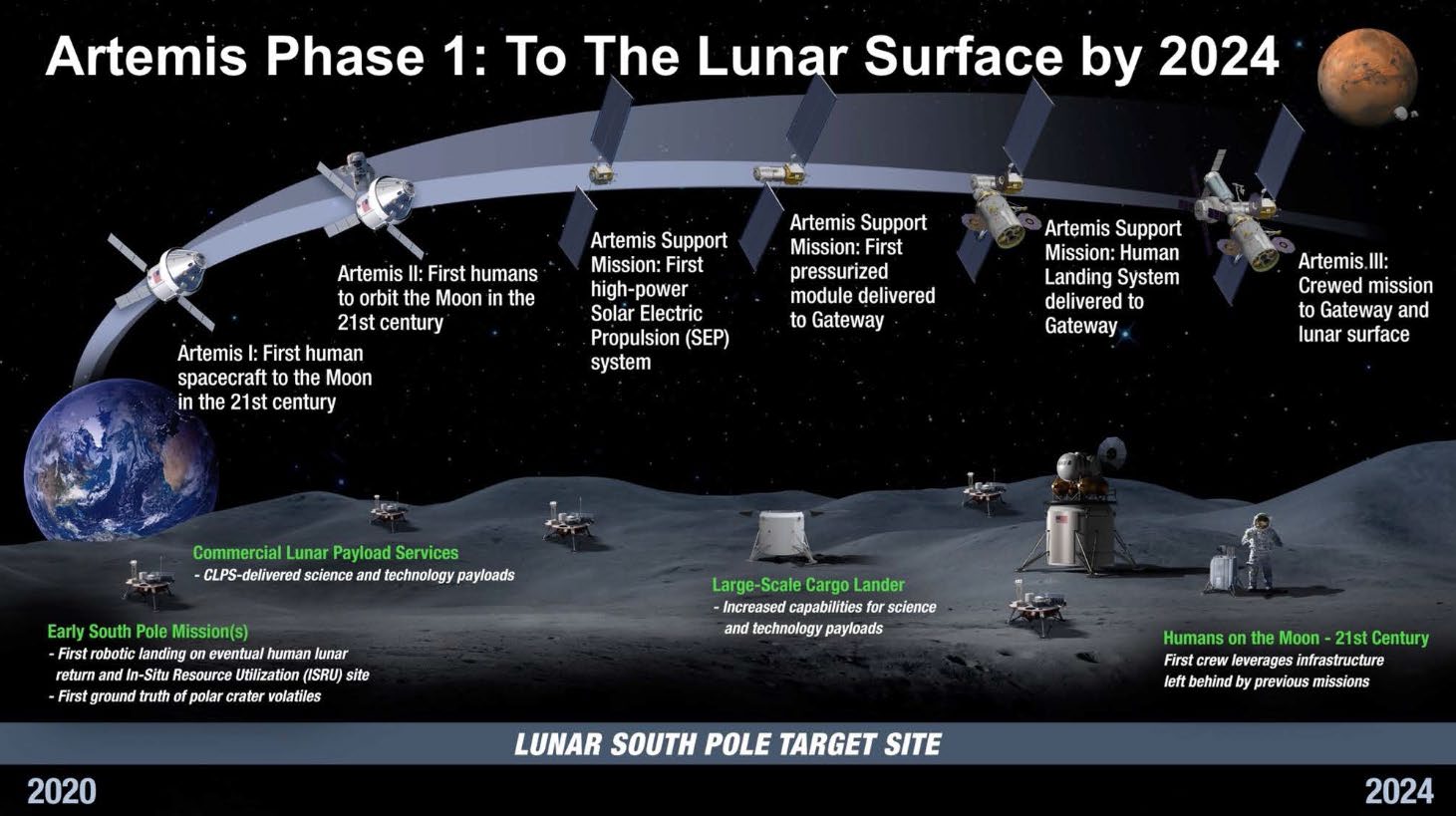

While the U.S. leaves much to private enterprise, it encourages collaboration among academics, industry, government, non-profit, and other organizations, noted the IFR. For example, NASA's “Moon to Mars” project highlights objectives to establish a long-term presence in the vicinity of and on the moon.

The project targets technology R&D to “significantly increase the performance of robots to collaboratively support deep space human exploration and science missions,” said the report.

For the Artemis lunar program, the U.S. government is planning to allocate $35 billion from 2020 to 2024. The IFR's World Robotics said that robot density in the U.S. rose from 255 units in 2020 to 274 units in 2021. The country ranks ninth in the world. As for annual installations of industrial robots, the U.S. takes third position, said the IFR.

The full and updated “World Robotics R&D Programs” is available for download from the IFR with registration.

Article Topics

IFR News & Resources

IFR: Global industrial robot sales doubled over the past five years IFR report: Japan delivers 52% of global industrial robot supply IFR predicts 15% annual growth for robots Global robotics sales set new recordLatest in Supply Chain

Maersk Opens New 90,000-Square-Foot Airfreight Gateway in Miami GXO and Conair Open Maryland’s Largest Distribution Center Shipping Dispute Heats Up: Peloton vs. Flexport Robots are Enhancing Human Workers, Not Replacing Them Why Companies are Pushing for a Quieter Warehouse Union Pacific’s Speedy New Service Connects Southern California and Chicago Talking Supply Chain: Achieving cost savings through better procurement More Supply Chain