Global Kuehne + Nagel Indicators Signal Cooling Down of Global Economy

Analysts added that the data indicates that trade disputes are beginning to hit the real economy. Exports of the emerging markets are shrinking at a higher pace.

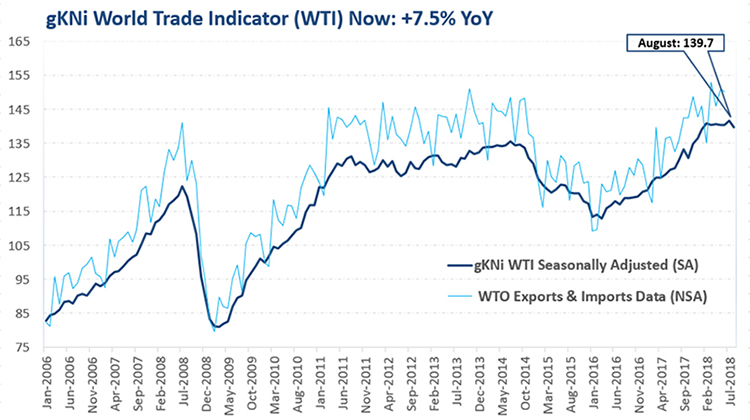

World trade has been cooling off recently, and the downturn will likely accelerate in September, say analysts for Global Kuehne + Nagel Indicators (gKNi).

The gKNi World Trade Indicator registered 139.7 points at the end of August, 1.3% lower compared to the previous month and 7.5% higher than in August 2017. Analysts added that the data indicates that trade disputes are beginning to hit the real economy. Exports of the emerging markets are shrinking at a higher pace.

After good July data, world trade in August is disappointing. Looking ahead, the sharpest slowdown is expected in the emerging markets, which are most exposed to any impact “from rising trade tensions,” said João Monteiro, Managing Director at LogIndex AG and Head New Business Kuehne + Nagel Group.

Hans-Peter Arnold, a spokesman for LogIndex AG, told SCMR in an interview that his group monitors the activity level of the main seaports, which account for more than half of global maritime trade. “Our container throughput index was up +0.3% in August (Month-over-Month) compared to -0.2% MoM in July,” he said.

“For September we still see an increase, albeit very slightly.” With the exception of Japan, there is an increase in all regions (European ports are not included in the sample). Overall, we are now up +3.6% from the previous year.

By way of comparison, container capacity on the oceans rose by +5.6%. “Recently, we have seen strong growth in twenty-foot equivalent (TEU) throughput in the United States,” added Hans-Peter Arnold. This represent 6.5% YoY jump (in August), Singapore increased by 8.3%, Hong Kong by +6.4%, China by +3.0%, and Japan is down -1.7%.

The report includes some selected trends of major ports: Shanghai (+5.0% YoY), Guangzhou (+5.1 YoY), Shenzhen (-3.1% YoY), New York & New Jersey (+4.7% YoY inbound, +6.9% YoY outbound).