Apple’s Supply Chain ‘Gearing-Up’ Literally!

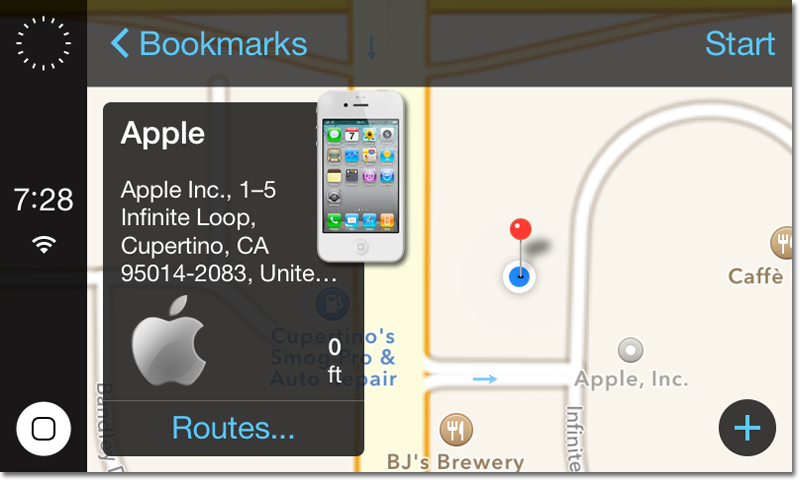

Nearly a year after it was announced, Apple is launching 'iOS In The Car' this week with Ferrari, Volvo and Mercedes-Benz (and possibly Tesla?).

Apple appears ready to introduce launch partners for its “iOS in the Car” initiative, according to a report in the Financial Times.

The piece claims Volvo, Mercedes-Benz and Ferrari - where Apple Senior Vice President Eddy Cue is a board member - will be Apple’s initial partners.

Though it does not mention iOS in the Car by name, the article claims drivers will be able to use Apple Maps for navigation on the car’s in-dash screen, as well as watch movies, listen to music, make calls and send text messages through the system with full Siri integration.

The FT says the announcement will be made at the Geneva Motor Show this week, one of the premier motor shows on the calendar.

The technology group will next week launch its first in-car operating system with Ferrari, Mercedes-Benz and Volvo as it attempts to take the lead in a fierce race to dominate tomorrow’s smart cars.

The deal marks the first time that Apple is embedding its software in devices other than its own branded products. The choice of the Ferrari, Volvo and Mercedes-Benz is seen to be in keeping with the US tech group’s high-end phones.

Apple executives have said in the past that iOS in the Car is “very important” to the company and is an essential “part of the ecosystem”.

At it’s WWDC keynote last year, Apple claimed it was working with a number of partners including Honda, Nissan, Chevrolet, Hyundai, and more, in addition to Ferrari, Volvo and Mercedes. It was reported earlier this year that iOS in the Car had been plagued by organizational and supply chain issues but, if the FT report is accurate, it would appear the project is quickly moving towards a public launch.

Source: MacRumors

TESLA may run APPLE iOS in CARS

Apple, the world’s most valuable technology firm, should buy Tesla, the pioneering electric-car company that’s defied the skeptics and become a new icon of Silicon Valley innovation. That was the idea floated late last year by a financial analyst who made headlines by suggesting that Apple “could reignite the U.S. auto industry” by helping to “accelerate” the global shift toward hybrid and electric vehicles.

It’s a notion that’s back in the news after the San Francisco Chronicle reported on Sunday that Apple’s top dealmaker, Adrian Perica, met with Tesla CEO Elon Musk at the Apple headquarters last year.

There’s no indication that an Apple deal to buy Tesla is in the works, but the prospect of a merger between the two companies has caught the interest of many tech watchers at a time of intense speculation about Apple’s next big move.

Related: Why Apple Could Win Big With Tesla’s Giant New Battery Factory

If the idea of Apple buying Tesla sounds far-fetched, that’s because it is. Apple has historically avoided doing large acquistions, preferring to grow from within and husband its cash. Unlike other tech giants such as Google, Microsoft and Yahoo, Apple has never done a $1 billion deal. It simply hasn’t needed to. Apple has grown into the world’s most famous tech company on the strength of its groundbreaking product vision, design, marketing and legions of die-hard fans willing to snap up the company’s latest gadgets.

But Apple is now in the midst of a multiyear transition as it enters its fourth decade. Apple’s growth rate is slowing, the company faces increased competition in the mobile market, and it hasn’t launched an entirely new product since the 2010 introduction of the iPad. It’s been 2½ years since Apple’s revered co-founder Steve Jobs died, and Wall Street analysts and consumers alike are eagerly awaiting Apple’s next breakthrough. Tim Cook, the company’s CEO, has been typically coy, but speculation has focused on a “smartwatch” device or next-generation TV product.

In his letter to Cook and Apple board chairman Art Levinson, London-based financial analyst Adnaan Ahmad, who works for German investment bank Berenberg, suggested that Apple should set its sights on the car business. “The auto industry is going through a technological discontinuity in its shift to hybrid and electric vehicles,” Ahmad wrote. “This is still in its very early innings. Apple needs know-how (technology, platform strategy and dealer network) in this space and hence I propose that you should buy Tesla.”

Ahmad said by acquiring Tesla, Apple could be “the catalyst to accelerate this shift as it has been in other industries that you have disrupted in the past” such as the mobile-phone and tablet markets. “Apple could reignite the U.S. auto industry and give it a competitive edge vs. the current Asian and European leaders, similar to what you have done in the smartphone and wireless space where the U.S. is now at the forefront of technological leadership after having been a laggard for over two decades,” he wrote.

Should Apple continue to focus primarily on refining its signature iPhone and iPad devices? Should the company branch out and try to disrupt a category like televisions, digital payments or wearable devices? What will drive Apple’s growth over the next five years and beyond?

It’s hard to imagine that an Apple union with Tesla could have been possible when Jobs was still alive.

Source: Free Thinking News

Related: Tesla’s Gigafactory Supply Chain Vertical Integration

More SC24/7 on “Apple”