American Manufacturing is Not In a Recession

There's been rampant noise over the last few months concerning the precipitous decline of the American manufacturing sector, this noise is much ado about nothing.

The ISM Manufacturing index has been below 50 for two straight quarters, signaling a recession.

This has led economists to call doom and gloom on the sector, even citing it as an indicator of a broader recession, as it was for both of the last two.

This noise, says Tim Quinlan and Sarah House at Wells Fargo, is much ado about nothing.

“Despite the litany of negative news for manufacturing, our analysis of the four key variables makes clear that these challenges do not amount to a manufacturing recession,” the economists wrote in a note to clients.

“On that basis the rampant concerns about a manufacturing led recession are overblown, at least at this point, in our view.”

Quinlan and House attributed much of the weakness to 3 commonly cited factors: the stronger dollar, weak foreign demand, and plunging commodity prices.

While the economists noted the headwinds, they took the National Bureau of Economic Research‘s official definition and broke out 4 factors that would signal an industry-wide recession. They found each measure comes just shy of total calamity.

4 simple reasons American manufacturing is not in recession

- Industrial production is still increasing. Despite what you may have heard, the manufacturing sector is still producing more than a year ago. While it may only be 1% growth in recent months, said the economists, there is a precedent for weaker growth rebounding.

- Employment is going lower, but it’s not impacting activity. Quinlan and House do admit that manufacturing employment “paints a slightly more anemic picture of manufacturing activity.” However, they point to the fact that manufacturing growth has been that way for nearly 3 decades and the stable productivity of the sector. This indicates the continuation of a structural shift rather than a new warning sign.

- Income for manufacturing workers is doing better than the last expansion. The amount of money that workers have been making this cycle is actually a very positive trend. “In the prior expansion between 2002 and 2008, manufacturing workers saw real income decline on trend throughout that period,” wrote Quinlan and House. “In contrast, real income in manufacturing has generally improved in the six years since the economy turned in 2009.”

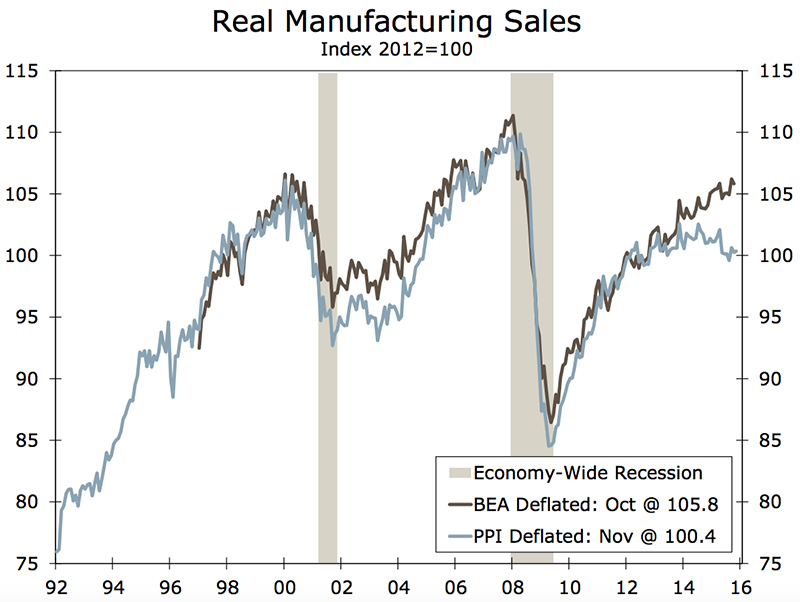

- Real sales looks like there’s still room to run. This measure has the most headline pain, as shipments have fallen around 4% year-over-year for the past four months. On the other hand, looking at it in dollars sold, and adjusted for inflation, said Quinlan and House, it is actually flat. This indicates more of a mid-cycle slowdown than a recessionary collapse.

In addition, said the economists, the idea that a slowdown signals a broader economic recession is overblown.

While it did indicate a recession in 2001 and 2009, it also had a precipitous decline in the mid-1980s and 2003 during the middle of cycles.

The economists said it was analogous to the old quip about an economist that correctly called 5 of the last 3 recessions.

Either way, they concluded, using their adjusted measure, manufacturing hasn’t qualified for recession in its own right.

“Periods of flat manufacturing activity have not always been followed by an industry recession,” they wrote. “As we saw in 1993, 1996, 1998 and 2012-13, growth resumed after pausing mid-cycle.”

So yes, it looks bad. But according to Quinlan and House, it’s not that bad.

Source: Business Insider

Related: U.S. Manufacturing Activity Hits 6-Year Low

Article Topics

Deloitte News & Resources

MHI Report: Investment increases as supply chains become more tech-forward and human-centric Global Trade Tensions, Material Shortages Not Expected to Ease in 2024 Blockchain in Supply Chain Continues to Mature Supply Chains Struggle to Access Reliable Emissions Data from Suppliers State of the industry: MHI releases annual report at ProMat 2023 MHI and Deloitte launch 2023 Annual Industry Report survey How Amazon Is Preparing For Fully-Electric Drone Delivery More DeloitteLatest in Business

A Look at Baltimore’s Key Bridge Collapse—One Month Later European Parliament Passes New Law Requiring Supply Chain Accountability Baltimore Continues Bridge Recovery With Opening of New Channel How Shippers Can Prep for Hurricane Season Apple Accused of Multiple Human Rights Violations South Korea Finally Overtakes China in Goods Exported to U.S. UPS Struggles in First Quarter With Steep Earnings Decline More Business