2016 Global Economy Likely to Remain Stalled

At this time last year our experts told us to expect a “gravity shift” toward economic centers in the East, but China’s sudden decline has changed all that, and it now appears that supply chains may remain in stasis worldwide.

The outlook for the global economy in 2016 is a mixed bag, with positive news for the U.S. economy and choppy forecasts for other parts of the world.

Economists at IHS Global Insight continue to forecast 3.0 percent global real GDP growth in 2016.

That growth, however, will not be felt across the global board as downward revisions to the forecasts for Brazil, Canada, Japan, Russia, and the United Kingdom are offset by an upward revision to U.S. growth.

“We expect some of the demand-side constraints on growth (deleveraging and austerity, weak trade growth, and the slowdown in China) to ease in the coming year,” says IHS Chief Economist Nariman Behravesh.

“Yet, the longer-term deceleration in the global economy will not reverse without aggressive policy actions to alleviate supply constraints.”

As for the United States, Behravesh says “the economy keeps chugging along,” while the Federal Reserve holds fire.

Second-quarter real GDP growth was revised up from 3.7 percent to 3.9 percent owing to more robust growth in domestic demand, including consumer spending, capital expenditures, and residential investment.

The need to work down elevated levels of inventories will restrain near-term growth.

“We expect that the Federal Reserve will raise interest rates at its December meeting - unless the job market loses more steam and/or there is a federal government shutdown,” says Behravesh.

Related: How Interest Rate Hike Could Impact Supply Chain Finance

Europe, meanwhile, is still on track for a modest acceleration in economic activity - with a potential upside from the refugee crisis.

The Eurozone economy is supported by monetary stimulus, a competitive euro, falling commodity prices, and pent-up demand.

The recent refugee crisis could turn out to be a positive supply shock, with an influx of more than 1.2 million people in 2015 - albeit with certain risks (see below).

Terrorism’s Potential Impact

The extraordinarily horrific events in Paris could certainly have a significant negative effect on consumer confidence - at least in the near term - primarily in France but also elsewhere in Europe, “as people in many other countries will be wondering if they could be the next to suffer such an atrocity,” says IHS Global Insight Chief European and UK Economist Howard Archer.

In a briefing with Supply Chain Management Review just after the attacks, Archer says it is likely to significantly hit Paris’ economy in the near term, and there could also be a “knock-on effect” elsewhere in France.

“There could also be an adverse impact on tourism in some European countries where people think attacks are most likely to occur - not just in France,” he says.

“As horrific as these events are - and these were truly awful - economic activity does tend to be pretty resilient.”

The UK, Spain, and France have all seen their economies a little damaged by terrorist atrocities in the past.

“At the end of the day,” Archer concludes, “people have to get on with their lives, and this involves economic activity continuing as normal - and that too is the best way of standing up to the terrorists.”

As a share of total population, Hungary, Austria, Sweden, and Germany will absorb the largest inflows. The increase in the labor force, and the additional spending to house and support the refugees, could add 0.1 percent to 0.2 percent to the annual growth rates of these countries.

In China, growth is likely to slow further before stabilizing. Third-quarter real GDP growth in China eased to 6.9 percent year on year from 7.0 percent in the first and second quarters. Investment has slowed across most categories, but especially in real estate, heavy industries, and resource industries. In contrast, investment in high-tech sectors and infrastructure grew by double digits. The continuing digestion of excesses in industrial capacity, housing inventory, and debt will further restrain domestic demand in 2016.

IHS Global Insight Senior Research Director Sara Johnson notes that in other large emerging markets India remains the bright spot in the gloom.

“With inflation receding, Indian households’ real purchasing power will continue to improve,” she says.

“Rising domestic demand and easing monetary policy will also boost investment. In contrast, the outlook for both Brazil and Russia has darkened. Brazil’s corruption scandal continues to spread beyond the energy industry, and a lack of cohesion between the executive branch and the National Congress makes it more difficult to fix public finances.”

The Russian recession has deepened and any turning point looks to be put off until early 2017 at best, adds Johnson. Domestic demand has been squeezed by a credit crunch and a renewed burst of inflation as lower oil prices weakened the ruble.

“The global outlook is something of a good news/bad news story,” she says. “The good news is that the (known) threats to global growth will likely not kill the expansion. The bad news is that any acceleration could easily get delayed another year.”

Modal Slump

The Stifel Logistics Confidence Index fell into a fifth consecutive month of decline in October. Significantly, the index has now fallen beneath the neutral 50 point mark for the first time since January 2013, with confidence in both the sea freight and air freight markets plummeting.

The logistics situation for air freight was especially bad, declining by 3.2 points to 45.7. The same trends that influenced last month’s decline are persisting, with weak emerging market growth, China’s financial crisis, and the Chinese shift toward domestic consumption all influencing the trajectory of the index.

While also demonstrating a month on month decline, the six-month outlook for both air and sea freight fell at a lesser rate than that recorded in the September Index, falling by 1.8 points. Nonetheless, the total was 10.4 points lower than at the same point last year, and 9.9 points lower than in October 2013. Sea freight was down more significantly than air, falling 2.1 points to 50.8. This total was 13.9 points lower than that recorded in October 2014.

According to Drewry Maritime Research, the ocean carrier industry continues to be plagued by overcapacity, with Drewry’s director of container shipping research stating that this crisis “will worsen next year,” adding, “were it not for the recent fall in bunker prices, shipping lines would be losing money.”

On the positive side of this month’s results, a noteworthy trend depicted within the index was the encouraging performance of all shipments on routes from Europe to the U.S. A growth trend was visible within both air freight and sea freight, and for the present and expected situations.

It is arguable that the driving force behind this is the weaker valuation of the euro, which has encouraged exports across the Atlantic. For example, Richard Grieveson of the Economist Intelligence Unit lent some weight to this assertion by stating: “the U.S., non-Eurozone EU, and Spain have been key in driving exports” for Germany, even as the country’s industrial orders declined in August.

The International Air Transport Association (IATA) observes that air freight volumes were flat in August, with marginal volume gains of 0.2 percent year on year. IATA researchers noted a perceived pause in the downward trend of global trade volumes in explaining the reason for this respite. Within the survey results however, there was no such let-up in the decline.

All lanes were down for the month, with the exception of Europe to U.S., which was up by 1.9 points to 56.3. Europe to Asia noted the biggest fall, down 5.7 points to 39.0, followed by Asia to Europe, which decreased 4.9 points to 42.6. U.S. to Europe declined 3.5 points to 46.1.

For the six-month outlook, the expected situation index for total air freight also decreased, by 1.5 points to 52.7. Again, the Europe to U.S. lane was the only one bucking the downward trend, gaining 2.6 points to 60.9. By contrast, U.S. to Europe witnessed the greatest fall, declining 3.8 points to 49.0. Asia to Europe fell 2.4 points to 51.4, while Europe to Asia lost 2.1 points, amounting to 49.7.

For the present situation, the sea freight index fell further beneath the neutral mark of 50, declining 2.9 points to 46.9. All lanes noted declines in October, with the exception of Europe to U.S., which rose 4.4 points to 52.0 for the month.

This saw the lane rebound somewhat, after successive declines in August and September, though it remained beneath the previous year’s total for October.

Among the other trade lanes, Asia to Europe noted the steepest decline, falling 7.0 points to 47.1. Meanwhile, Europe to Asia fell by 5.1 points to 43.6, and U.S. to Europe lost 2.4 points to total 45.8.

The expected situation index for sea freight decreased 2.1 points to 50.8. Again, Europe to U.S. grew - by 0.8 points to 56.7 - meaning that this lane noted gains across the board.

This was in stark contrast to the other lanes. The greatest decline was recorded in U.S. to Europe, which fell 3.2 points to 46.9. Europe to Asia fell by 2.7 points to 49.8, while Asia to Europe noted a similar contraction of 2.6 points, amounting to 50.2.

Currency Concerns

Each month, respondents to the Stifel Logistics Confidence Index survey are asked a unique, “one-off question,” explains John Manners-Bell, CEO of Transport Intelligence, a London-based think tank.

The October one-off question was based around the impact of currency movements on the re-shoring or near-shoring of manufacturing. Specifically, participants were asked whether or not the decline in the euro versus other world currencies has made near-shoring or re-shoring more attractive.

While 36 percent of respondents believed that it has, the largest response group was “unsure,” with 40 percent of the sample selecting this option. The remaining 24 percent thought that the euro’s decline did not make re-shoring or near-shoring more attractive.

Moore Stephens International Limited - a global accountancy and consulting network also headquartered in London - recently conducted a “Shipping Confidence Survey,” which points to a positive reversal of sentiment. According to Richard Greiner, Moore Stephens partner at Shipping Industry Group, it is encouraging to see a graph moving in the right direction.

“Perversely, the main reason for the improved level of confidence revealed by our latest survey may be the same as that which saw the industry’s perceived fortunes equaling a seven-year low in May of this year,” he says. “Volatility works both ways.”

He notes that the World Trade Organization’s global volume forecast represents a rise from 2.8 percent in 2015 to 4.0 percent in 2016. Again, that is good news for shipping. World trade carried by sea is also on the increase and, despite the current difficult economic climate, the longer-term outlook for the industry remains positive as emerging economies continue to increase their requirements for seaborne goods and raw materials.

“So the long-term outlook for shipping offers encouragement to existing and new investors alike,” says Greiner. “Those who are not attracted by the longer-term prospects, meanwhile, will undoubtedly exit the industry - and in the process may help solve some of its problems.”

Deloitte 2016 United States Economic Forecast

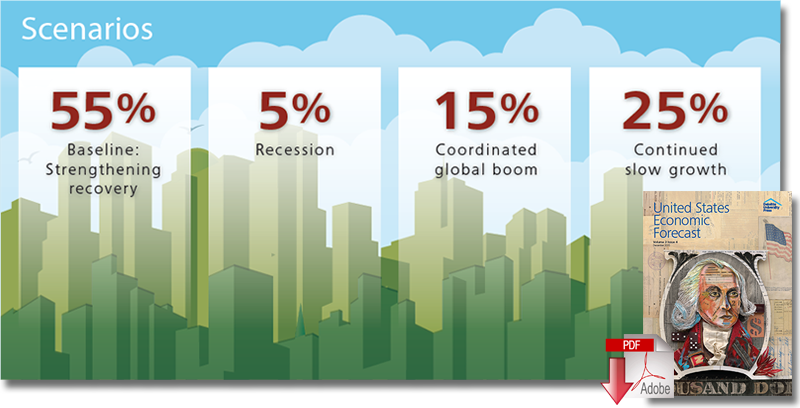

Scenarios

There are plenty of reasons why actual economic growth might be better or worse than Deloitte’s forecasted baseline. Our forecast, therefore, includes four different scenarios to illustrate possible future paths of the US economy. Deloitte’s economic forecasting team places subjective probabilities on each of the four scenarios.

The baseline (55 percent probability): The most likely outcome for the economy is a burst of mildly faster growth as risks from abroad and at home subside. Continued improvement in the labor market and growing demand from abroad increase demands on US producers, and the continued low cost of capital and low oil prices add to the pressure to build capacity. Growing business investment cements the recovery and, as hiring picks up, the labor force participation rate of younger cohorts will begin to rise. The large amount of slack will prevent rising demand from translating into inflation, despite relatively accommodative Fed policy.

Recession (5 percent): China’s economy finally reflects financial problems that have been evident for several years. Volatility in Europe increases, and so does market valuation of the riskiness of euro assets, adding to the panic. This then affects several US financial institutions that find themselves long on euro- and China-related assets at the wrong time. The result is a global financial panic. East Asian growth sputters while Europe plunges back into recession. Capital flows into the United States to avoid risk in Europe and Asia, and the US dollar appreciates. The combination of low foreign demand and financial panic throws the US economy into recession. Timely Fed action offsets the financial crisis after several months, leading to relatively fast growth during the recovery.

Continued slow growth (25 percent): Weak economic conditions abroad, incomplete fixes to the financial system, and a mismatch between labor needs and the skills of the labor force slow US economic growth to 2 percent for the foreseeable future. As the long-term unemployed become essentially unemployable, the labor force participation rate remains low and wages begin to rise. The hoped-for improvement in competitiveness from domestic energy production proves to be less impressive than expected. Incipient signs of inflation cause the Fed to raise interest rates to prevent inflation from getting out of hand.

Coordinated global boom (15 percent): Terrorism and refugee problems prove to be only minor obstacles for European economies, and the continent starts recovering quickly. Emerging markets also pick up momentum as financial problems are resolved in China, and India and Brazil start to adopt more reforms. Capital flows out of the United States and into Europe and the developing world, which causes the dollar to depreciate, further enhancing US exports. Lower energy prices in the United States make the country even more competitive. At home, the resolution of budget issues at both the federal and state levels allows more money to flow into infrastructure investment, creating short-term demand and long-term productivity growth.

Source & Graphics: Deloitte University Press | DUPress.com

Download the Paper: Deloitte 2016 United States Economic Forecast

Article Topics

Deloitte News & Resources

MHI Report: Investment increases as supply chains become more tech-forward and human-centric Global Trade Tensions, Material Shortages Not Expected to Ease in 2024 Blockchain in Supply Chain Continues to Mature Supply Chains Struggle to Access Reliable Emissions Data from Suppliers State of the industry: MHI releases annual report at ProMat 2023 MHI and Deloitte launch 2023 Annual Industry Report survey How Amazon Is Preparing For Fully-Electric Drone Delivery More DeloitteLatest in Supply Chain

Trucking Industry Pushes Back on Government’s Electric Mandates Senators Take Aim at Amazon with Warehouse Worker Protection Act Maersk Sees Silver Lining in Red Sea Shipping Challenges Happy Returns Partners With Shein and Forever 21 to Simplify Returns Baltimore Opens 45-Foot Deep Channel Following Bridge Collapse El Paso Border Delays Cost Juarez $32 Million Per Day in Economic Losses Ranking the World’s 10 Biggest Supply Chains More Supply ChainAbout the Author