2015 State of Logistics Rail/Intermodal: Still on track, but not immune to challenges

Like any mode of freight transportation operating in a fluctuating economy and horrendous winter weather conditions, there are always bound to be challenges. Based on how things have played out over the last year, the railroad and intermodal sectors are clearly not immune to the ups and downs experienced on the nation’s highways.

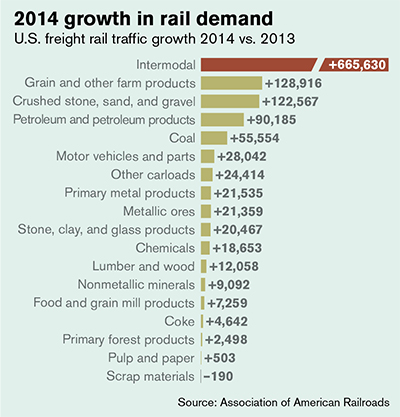

Recently, railroad volumes have been trending down, while intermodal has been picking up increased momentum—differing from the norm even though domestic intermodal volumes continue to gain steam.

Year-to-date numbers help to better exemplify the current environment on the rails. Domestic carload volumes are down 3 percent through the end of May, according to the Association of American Railroads (AAR) data. What’s more, weekly carload average for May, at 268,571, stands as the lowest weekly average going back to January 2013, and the second smallest for May since 2009.

Meanwhile, intermodal volumes, which are seeing a major benefit from increased freight flows due to the new West Coast port labor contract, remain firmly in pre-recession mode, with year-to-date volumes up 2 percent at 5,847,880 containers and trailers. Even though the difference is slight, it’s significant due to the fact that it marks the first time on record that monthly intermodal volumes eclipsed carload volumes.

John Gray, AAR’s senior vice president of policy and economics, recently noted that as the overall economy is replete with mixed signals, it has a direct correlation to the current state of railroad and intermodal volumes. He added that while the steep decline in coal carload volumes may be considered “surprising,” it also serves as a sign that the economy is not in a true “bounce back” mode on the heels of a difficult first quarter.

The well-documented service related issues have also been front and center as a driver in the decline of carload volumes—although those issues seem to be abating. But despite the various challenges the sectors have dealt with this year, there are also reasons for optimism as the calendar moves ahead in 2015.

All indications point to another record-setting year for North American Class I railroad capital expenditures for things like infrastructure, equipment, and bringing new employees on board, with the 2015 tally projected at $29 billion. And in what seems like an decades old issue, rail shippers are calling for various forms of rate relief or “re-regulation.”

While the reasons vary, the familiar rail shipper refrain is based on the thesis that there are multiple barriers to competitive access for captive shippers, such as improving the rate challenge process at the STB and getting relief from what shippers view as monopoly pricing power held by the railroads.

However, railroads don’t exactly see things through that lens. “The existing regulatory railroad environment has produced—for North American railroad shippers—a freight railroad system that is the envy of the world,” said a Class I industry executive. “It is not perfect, but to deprive the industry of our ability to earn our cost of capital could have a chilling effect on capital investments to support traffic growth.”