2015 Customs/Trade Update: Success is in the details

A spate of new, proposed, and pending free-trade agreements will create greater opportunities for U.S. shippers—but only those who know the rules. Analysts advise going over the small print before plunging in.

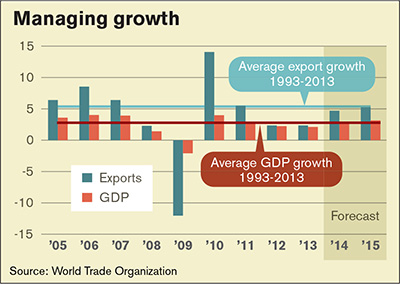

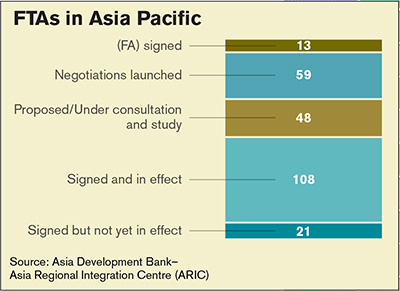

The proliferation of new Free Trade Agreements (FTAs) will attract more imports and give U.S. shippers more options as they attempt to penetrate ripe markets and strike up fresh sourcing relationships. And while much has been written about the demise of the World Trade Organization (WTO) as a negotiating forum, two announcements late last year indicate forward momentum, which may establish a new relevance for the organization, say trade experts.

The U.S. and India, for example, have pledged to resolve the standoff in the WTO on the implementation of the Bali trade facilitation package—a deal that was agreed to at the WTO Ministerial meeting in Bali, Indonesia, two years ago.

“That progress was thrown off track last July when India blocked it,” explains Terrence Stewart, head of the Washington, D.C., law firm Stewart and Stewart. “India’s stated concern was whether developing nations’ food security programs that violated existing WTO agricultural subsidy commitments would be free from challenge while a permanent solution to the issue of rights of developing countries as they relate to food security was negotiated and clarified,” he says.

Separately, as China hosted the 2014 Asia Pacific Economic Cooperation (APEC) meeting in Beijing last October, a breakthrough occurred in negotiations on the expansion of the Information Technology Agreement (ITA).

The initial ITA was reached in Singapore in 1996 as a sectoral agreement among 29 WTO Members, including the U.S., the EU, Japan and others who agreed to eliminate tariffs on specific products. “A new agreement, if reached with all of those participating in the talks, would result in the elimination of more than 200 tariff lines and would cover certain medical equipment, GPS devices, video game consoles, computer software and next generation semiconductors,” observes Stewart.

What looms ahead, analysts surmise, may well be signaling greater incentives for exchanging goods in a more open marketplace. Grand diplomatic overtures to outliers like Cuba, for example, even point to a new era for global commerce.

FTA primer

An FTA is an agreement between two or more nations to reduce trade barriers among themselves. Up to now, they have been very helpful to U.S. economic growth as stimulators for exports by opening up foreign markets and igniting import growth through reduction or removal of duties. The merchandize processing fee is exempt for many free-trade agreement, thereby increasing cost savings.

In a unilateral agreement, preferential treatment is allowed for goods coming into the U.S., but there is no reciprocity for U.S. products going into the beneficiary countries. Unilateral agreements include the Generalized System of Preferences (GSP), Caribbean Basin Economic Recovery Act (CBERA), Caribbean Basin Trade Partnership Act (CBTPA), Andean Trade Preference Act (ATPA), Andean Trade Preference Drug Eradication Act (ATPDEA), and the African Growth and Opportunity Act (AGOA).

Bilateral agreements provide reciprocal treatment for U.S. products exported to participating countries. The U.S. currently has bilateral free trade agreements with Israel, Jordan, Chile, Singapore, Australia, Morocco, Bahrain, Oman, Peru, Korea, Colombia, and Panama. There is also the North American Free Trade Agreement (NAFTA) with Canada and Mexico and the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) with Costa Rica, Honduras, El Salvador, Guatemala, Nicaragua, and Dominican Republic.

Korea is a significant player in this list since it’s the largest trading partner outside of the NAFTA partners with whom the U.S. has an agreement. The U.S. International Trade Commission estimates that the reduction of Korean tariffs and tariff-rate quotas on goods alone could add between $10 billion and $12 billion annually to the U.S. GDP and around $10 billion to annual merchandise exports to Korea.

However, trade analysts note that since complying with FTAs can be administratively burdensome, many companies don’t claim them, thereby losing out on the duty savings. So, while an importer should consider the overall savings by using an FTA both in duties and merchandise processing fees, they should also bear in mind the documentary responsibilities of proving compliance with the FTA.

“That seems obvious, but Customs clearance will also become more complex if certain immediate steps are not taken to ‘leverage’ these agreements,” says Angela Chamberlain, vice president of global trade content at Integration Point, a provider of global trade management and trade compliance solutions.

With limited resources to manage a single trade agreement, and no system in place to automate many of the tasks involved, some shippers may be in a poor position to maximize duty saving potential and fully incorporate free trade agreements into their sourcing strategy.

“Furthermore,” says Chamberlain, “shippers who fail to generate or apply for documentation required to move goods under an agreement may lose duty savings that could otherwise be easily captured. The same holds true if the shipper does not create the necessary audit trail when preference is claimed.”

Jane Taeger, director of compliance at Samuel Shapiro & Company, a Customs brokerage and freight forwarding firm, concurs, noting that this “paradigm” is leaving an untold amount of money on the table. “And with FTAs showing no sign of abatement, the time to change this is now,” she says. “A shipper who does not qualify their products is unable to pass on preference to any of their trading partners, who then become unable to benefit from lower prices and duties for goods that could have otherwise been imported under a FTA.”

Additionally, these trading partners will have a reduced capacity to qualify their products for their own customers as preferential origin was not available for the imported goods consumed in local manufacturing operations.

“In other words,” says Taeger, “it creates a ripple effect throughout the supply chains.”

Cautionary tale

Embarking upon an aggressive FTA strategy is not without associated risks, however.

Paul Rasmussen, U.S. trade expert and CEO of Zepol, an import/export data provider, observes that “Big Data” is helping Customs enforce brand counterfeiting cases much more efficiently now.

“In the past, a broker could claim that they did not know if certain shipments contained knock-offs of big brand goods,” says Rasmussen. “But there’s much more transparency in the supply chain these days. Brokers have to be extra vigilant in vetting all their shipping partners and third-parties before the U.S. Customs and Border Protection’s [CBP] comes after them.”

Indeed, the CBP’s “focused assessment” (FA) program—that became effective last November—represents a huge step forward in this regard.

Analysts note that it’s been more than a decade since such changes have been implemented.

The FA includes comprehensive risk-based audits of importers based on assessments of internal controls in an effort to determine whether shippers are sufficiently vigilant with voluntary compliance. The expected negative results include a greater paperwork burden for importers in requested entry documents, more targeted questions by CBP, and longer audit cycle times.

Positive actions include parameters and techniques that reflect changing U.S. and world economies, such as uniform government auditing standards, business practices, the consideration of material significance in making audit decisions, and greater flexibility by CBP to tailor audits to changing circumstances.

But analysts advise shippers to keep a checklist this year to avoid investigation. These include:

The development of documented policies and procedures such as an import manual and accompanying internal controls that demonstrate that the policies and procedures are being followed.

The identification of and demonstration of action on all possible and realized risks.

Continued monitoring and testing of internal controls by third party individuals and documentation of the results and any actions taken.

- Maintenance of internal import compliance personnel on a regular basis.

Prioritization is key

Beyond being able to identify and track the risks shippers must identify, a key element of risk management is prioritization, says Jennifer Wade, director of BPE Global, a trade consultancy.

“It can be tempting to allow every compliance delay or potential failure to become priority number one—especially as the quarter ends and during critical sales times,” says Wade. However, she warns that it’s imperative that shippers develop an approach to managing a trade compliance program that takes into account not just “who is screaming the loudest.”

When embarking upon New Year’s resolutions, says Wade, shippers should consider how to manage likelihood, impact, timing, and resources. “Shippers should first assign a ‘likelihood’ as to whether Customs will doubt the product descriptions,” she says. “Then they should consider the impact of non-compliance—just how bad will the penalty be?”

And timing is everything, Wade says. If the shipper is facing corporate audit, that becomes a key priority. On the other hand, a shipper might be able to address a classification issue if the date is not as urgent.

“Finally, shippers should evaluate the resources needed to fix the problem,” adds Wade. “The important thing is that they’re looking at your risks objectively, comparing them fairly, and considering both the timing of when they really need to get shipments out and what it will take to ‘remediate’ them.”

The ultimate goal for shippers in 2015, our analysts agree, is to maintain a reasonable threshold for risk and ensure strong compliance and a consistent supply chain.