What’s The Next Move for The West Coast Ports?

At this point agreeing to disagree ostensibly is the closest thing to progress at this point, and shippers are upset and considering permanent changes, should things not improve in a material way sooner than later.

While both sides are doing what they feel is best for their members, the impasse between the Pacific Maritime Association and the International Longshore Warehouse and Union is severely impacting West Coast port operations, and, to a larger extent, the supply chain in more than a few ways.

The impasse between the parties has been well-documented in both the trade and mainstream press, and at time that is no easy task, given the many starts and (mostly) stops this situation has seen.

As Logistics Management executive editor Patrick Burnson reported last week, the PMA announced on Friday that weekend vessel loading and unloading operations would be temporarily suspended last weekend, with yard, rail and gate operations continuing at terminal operators’ discretion. In light of what the PMA alleges are “ongoing union slowdowns” up and down the coast, it has brought port activity almost to a standstill.

With nearly 20,000 ILWU workers at 29 West Coast ports in California, Oregon and Washington front and center in what has become an untenable situation going back to last July, when the existing contract between the parties expired, it was hoped, at least early on, that things would get back to normal in terms of port operations, with a new contract coming together fairly quickly.

As it turns out, that has been anything but the case.

Instead, there has been a series of heated and increasing barbs through the media, which make neither side look better than the other and only succeed in continuing to make shippers wonder if moving cargo into and out of West Coast ports.

Prior to the PMA announcement late last week that weekend operations would be suspended, it made an “all-in” contract offer that it said would significantly increase compensation to ILWU members.

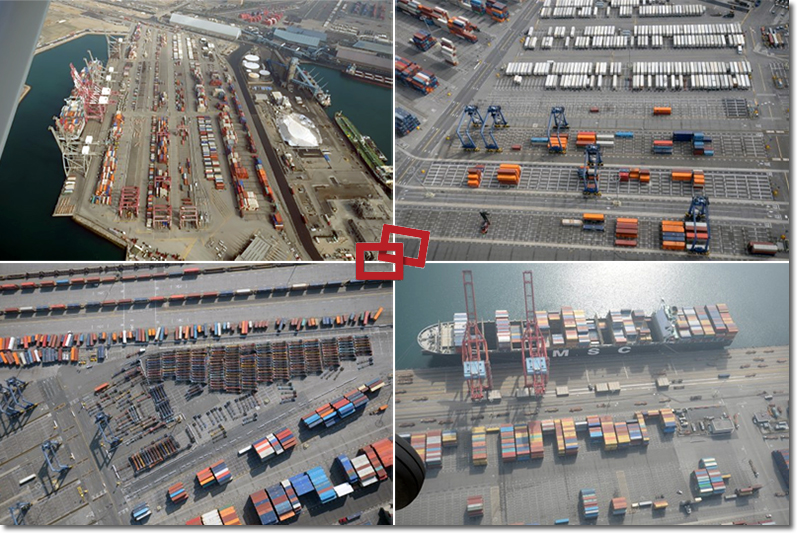

Aerial photos of ports that PMA doesn’t want you to see (slide show)

Full-time ILWU workers already earn an average of $147,000 per year, and would see their wages rise roughly 3 percent per year, along with fully paid health care that costs employers $35,000 per worker per year. The maximum ILWU pension would rise to $88,800 per year as part of the proposed five-year contract. PMA’s offer is designed to bring contract negotiations to a close after nearly nine months, and follows three months of severe ILWU slowdowns that have crippled productivity at major West Coast ports.

It is not clear at press time what ILWU’s reaction to this offer was, but on the more positive side, it did issue a statement earlier today, indicating they are back on the docks working.

“West coast ports re-opened Monday morning after employers closed the docks for two days, increasing delays for customers needing containers,” ILWU said. “The union remains focused on reaching a settlement as quickly as possible with employers. Talks to resolve the few remaining issues between the Longshore Union and Pacific Maritime Association are ongoing.”

But negotiations have been going on for literally months now and the impasse remains, even with a federal mediator on the scene in recent weeks.

A DHL customer bulletin issued yesterday does a very good job of summing up where things currently stand:

“Negotiations, which began between the two groups in May 2014, continue under the auspices of the Federal Mediation and Conciliation Services. Meanwhile, operating conditions at U.S. West Coast ports continue to deteriorate due to reduced productivity, terminal congestion and labor shortages. Ocean terminals have expanded restrictions on vessel operations from night side to now include weekend operations. This will contribute to the growing number of container vessels anchored off U.S. West Coast ports, now exceeding 40 vessels.”

According to a release on the PMA website, the PMA has provided the ILWU with its best offer that meets many of the demands of the ILWU in terms of health care, wage and pension increases and jurisdictional oversight over chassis maintenance and repair.

Furthermore, due to the congestion, the PMA has gone on record to state that the U.S. West Coast ports will be at gridlock within one to two weeks thereby setting up a timeline for a contractual agreement or the likelihood of a lockout. Uncertainty exists as to how the ILWU will react to the latest offer and recent actions of the PMA to expand restrictions to vessel operations to weekend shifts.

Regrettably under these circumstances, pick-up and delivery delays will continue, which may result in added cargo costs in the form of storage fees, longer wait time, higher delivery costs including container and chassis per diem fees.”

Not a pretty picture at all to say the least.

The Wall Street Journal reported last week that the PMA and ILWU have yet to settle differences on several issues, including wages, pensions, health-care benefits, arbitration process rules and operations.

The WSJ article cited an ILWU spokesperson explaining that “The PMA is playing a dangerous and unnecessary game of brinkmanship by idling vessels for two days in a not-too-disguised effort to intimidate the ILWU membership.” And it also noted that the ILWU’ circulated photos of empty yards at ports, with a comment from PMA President Robert McEllrath stating that “PMA is leaving ships at sea and claiming there’s no space on the docks, but there are acres of asphalt just waiting for the containers on those ships, and hundreds of longshore workers ready to unload them.”

At this point agreeing to disagree ostensibly is the closest thing to progress at this point.

Shippers are upset and considering permanent changes, should things not improve in a material way sooner than later.

National Retail Federation Vice President for Supply Chain spoke for all shippers impacted by the current predicament last week.

“The entire the supply chain – from agriculture to manufacturing and retail to transportation – have been dealing with the lack of a West Coast port contract for the last nine months,” he said in an NRF-issued statement. “Enough is enough. The escalating rhetoric, the threats, the dueling press releases and the inability to find common ground between the two sides are simply driving up the cost of products, jeopardizing American jobs and threatening the long term viability of businesses large and small. Our message to the ILWU and PMA: Stop holding the supply chain community hostage. Get back to the negotiating table, work with the federal mediator and agree on a new labor contract.”

Chuck Clowdis, Managing Director - Transportation, IHS Economics & Country Risk, echoed Gold’s sentiment, saying that ending the congestion and the costly slow-downs is in the best interest of the Country.

“The economy is still in a fragile recovery; the continuing disruptive delays as a result will take months of expensive recovery, he said. “Steamship lines and the entire supply chain, plus the Shippers and Buyers are all seeing their costs soar. It is time for serious discussions that lead to a quick resolution of differences and a concentrated effort by all parties to restore normalcy.”

Supply Chain Consultant Brooks Bentz explained said that part of the current dilemma has to do with port productivity

“The U.S. ports lag world leaders in productivity despite fairly significant investments in equipment and technology,” said Bentz. “I believe the PMA leadership has the best interests of everyone in mind in trying to reach an equitable agreement that will bring stability to these very critical operations. Long Beach is the only U.S. port to make the ‘Top-10’ globally.

Imagine the improvement that could be had by just moving to the mid-point of the pack.

Perhaps the focus needs to be there, on both sides of the aisle, and let the rest of it be an enabler, rather than the outcome of the more traditional wrestling matches that seem to arise consistently.

This situation continues to remain murky without a clear end in sight. Where it goes from here is hard to say obviously, but a positive outcome is long overdue in order to keep our nation’s supply chain healthy and productive, rather than just viewing it through the lens of unproductivity or something not getting better anytime soon.

Here’s to hoping a deal comes to fruition sooner than later.

Related: NRF to the ILWU & PMA: Stop Holding the Supply Chain Community Hostage

Article Topics

Pacific Maritime Association News & Resources

ILWU and PMA come to terms on a tentative new six-year labor deal With deadline way past due, now is the time for a West Coast port labor deal to be struck Report points to signs of optimism for a new ILWU-PMA deal Signs of progress appear to be made on PMA-ILWU negotiations POLA and POLB resume operations, following a brief ILWU work stoppage Industry stakeholders call on White House to aid in West Coast port labor talks ILWU and PMA come to terms on a tentative agreement for health benefits More Pacific Maritime AssociationLatest in Transportation

Talking Supply Chain: Doomsday never arrives for Baltimore bridge collapse impacts Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More TransportationAbout the Author