What’s Behind Macy’s Closing 100 Stores?

Macy's plan to shutter nearly 14 percent of its stores is the latest illustration of the gut-wrenching changes facing traditional retailers losing ever more ground to online rivals - is this the end of retail as we know it?

Macy’s Inc. announced 100 stores will be closing in response to six quarters of dropping sales.

In addition to the closures, the company plans to increase investment in its online operations as part of an overall plan to reinvent itself.

In the first quarter of this year, sales fell over 8 percent, followed by a 4 percent drop to $5.9 billion by the end of the second quarter.

According to Macy’s, the store closings will involve locations with about $1 billion in annual net sales volume and have experienced a significant decline in sales and profitability.

“Nearly all of the stores to be closed are cash flow positive today, but their volume and profitability in most cases have been declining steadily in recent years,” Macy’s said in a statement.

“We recognize that these locations do not yield an adequate return on investment and often do not represent a customer shopping experience that reflects our aspirations for the Macy’s brand.”

In the second quarter of 2015, shareholders received 64 cents per share in net income, while in the most recent quarter, which on ended July 30, income plummeted to three cents per share. Roughly $255 million, or 51 cents per share, was charged in the second quarter for the upcoming store closings.

Macy’s new strategy will focus attention on the best-performing stores. The company plans to invest in these locations by increasing the size of the staff as well as training programs. Vendor shops will be added and technology updated.

“We operate in a fast-changing world, and our company is moving forward decisively to build further on Macy’s heritage,” said Macy’s CEO Terry Lundgren.

“Whenever there’s been a setback in our company, we’ve been first in the industry to take a very aggressive stance at moving us forward.”

Macy’s is also exploring ways to monetize some of its flagship stores. The company is selling its Union Square men’s store in San Francisco and is looking at potential partners for joint ventures and other alliances.

Can Brands Sell Without Department Stores?

Coach announced this week plans to remove its bags from 250 department stores across North America as part of a move to reduce discounting and restore the brand’s association with luxury.

In June, Michael Kors had adopted a similar strategy and announced that it would be limiting products sold to department stores to preserve pricing and avoid aggressive discounts.

Coach - one of the top 10 brands in L2’s Specialty Retail Index - shows the same focus on brand perception throughout its digital strategy. In search, for example, it owns top search results for products it wants to be known for (handbags, watches) rather than investing across a variety of keywords. Its Instagram feed is more aspirational than accessible, with photos enlarging details of products (showcasing craftsmanship) and relaying milestones in Coach’s 75-year history.

And in May 2016, Coach (along with Michael Kors, Tiffany & Co., Tommy Hilfiger and Tory Burch) participated in the Met Gala and clothed several influencers who were able to generate buzz and social engagement around the brand.

But can brands like Coach translate their buzz to sales without the help of intermediaries such as department stores? It depends on their e-commerce capabilities, brick-and-mortar footprint, and how well they integrate the two. Based on L2 research, Coach is ahead of many of its peers in omnichannel features that drive online sales or store visits. The brand continuously updates local inventory status, facilitates in-store pickup of online buys, and has rolled out e-gifting.

Source: L2

In recent years, department stores have been struggling as competition gets more fierce from both online and off-price retailers. According to a report by Reuters, the spending patterns of consumers are also changing as they shell out money for cars and electronics instead of clothes.

Shopping malls, once ruled by stores like Macy’s, J.C. Penney, and Sears, are seeing fewer visitors as consumers see them as overpriced and inconvenient. With many U.S. malls on a downward slide, some analysts predict nearly 33 percent will be closed within the next few years.

In the past six years, Macy’s has closed 90 stores while opening only 13. Macy’s is not alone as other retailers continue to struggle. Young adult retailer Aeropostale filed for Chapter 11 bankruptcy protection in May. Sears has closed over 200 stores since 2014, and Kohl’s plans to close several stores this year.

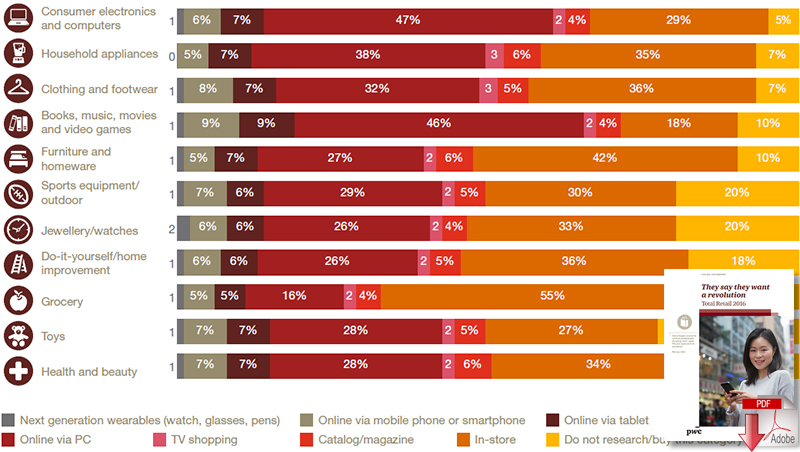

The Physical Store Is Still a Critical Step in the Purchase Journey

The decision by Macy’s to begin investing heavily in its internet operations must be fueled by other retailers who continue to thrive online. Amazon stock has skyrocketed 30 percent since February and profits keep rising, especially after promotional events like Amazon Prime Day.

Amazon has been quietly putting pressure on retailers that specialize in apparel and fashion as it pushes into the market once dominated by brick-and-mortar stores. Some industry experts believe the online giant will own almost 20 percent of the U.S. clothing market in four years.

Many shoppers are not seeing the purpose of going to all-inclusive stores like Macy’s, especially when Amazon or H&M have better options and an easier shopping experience. Unless Macy’s separates from its mall anchor persona, the company is likely to continue its drift into oblivion.

Representing about 14 percent of total stores, Macy’s has not disclosed the 100 locations that will be closing, but they are to take place in the first quarter of 2017.

Source: The Inquisitr News

Related: What is the Amazon Effect?