Walmart’s Ecommerce Growth Declines - Shares Tumble

Walmart is getting bruised in its battle with online leader Amazon, and the world's largest retailer yesterday reported a smaller-than-expected fourth-quarter profit as it wrestled with slower ecommerce sales during the busiest time of the year.

As reported by Bloomberg, Walmart Inc. fell the most in more than two years after delivering a disappointing annual profit forecast, sparking fears that its bid to catch up with Amazon.com Inc. online is losing momentum.

Read: Walmart’s Ecommerce Future under Marc Lore Starting to Come Together

The world’s largest retailer expects earnings of $4.75 to $5 a share this fiscal year, excluding some items, compared with an average Wall Street estimate of $5.13.

Though Walmart’s sales last quarter topped projections, the results reflected a slowdown in online orders - a key metric in its battle to fend off Amazon.com Inc.

Read: Walmart’s “Last Ten Miles” – Quicker and Cheaper Than Amazon

“We were a bit lower than plan” in e-commerce, Walmart's executive vice president and chief financial officer Brett Biggs said in an interview.

“We had a few operational issues from an inventory replenishment perspective,” he said, declining to provide specifics.

The shares fell as much as 9.5 percent to $94.80 in New York Tuesday, the biggest intraday decline since October 2015. They had gained 6.1 percent this year through Friday’s close.

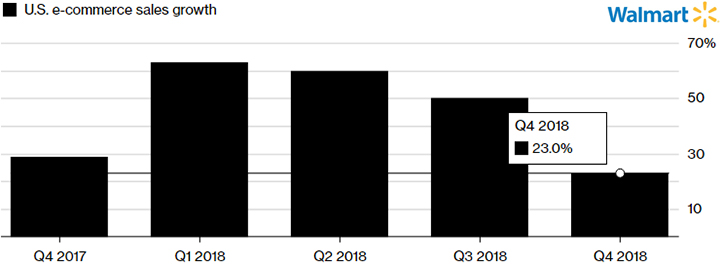

Digital Downshift

Walmart's online expansion decelerated in its latest quarter

Source: Walmart | Note: Fiscal year ends Jan. 31

Walmart can’t afford to lose ground as rival Amazon poaches shoppers and pushes into new arenas like health care, which has prompted a scramble for consolidation including the union of CVS Health and insurer Aetna Inc.

Yesterday, grocer Albertsons Cos. said it would buy the part of drug-store chain Rite Aid Corp. that isn’t being sold to Walgreens Boots Alliance Inc. Insurer Humana Inc. and drug-plan administrator Express Scripts Holding Co. could also be potential takeout targets, according to analysts.

“There’s a lot of retail consolidation happening, and it will continue to happen,” Biggs said. “Health care is really important to us. If there are ways to serve our customers better, we will look at that.”

Read the Article: The Supply Chain Link Both Walmart & Amazon Are Missing - The ‘Perfect Order’

Online Sales

At the same time, Walmart Chief Executive Officer Doug McMillon is trying to convert the company’s brick-and-mortar shoppers into online customers, who spend almost twice as much overall and seek out higher-priced items.

At Walmart’s U.S. eCommerce unit, sales rose 23 percent last quarter. That’s less than half the pace of previous periods.

The Bentonville, Arkansas-based company had been getting a tailwind from its acquisition of Jet.com, an online upstart that it bought in 2016. Still, the company maintained its full-year forecast for online sales growth of about 40 percent.

The company needs to widen its e-commerce base, especially among younger and professional demographics, said Neil Saunders, managing director of research firm GlobalData Retail.

“They do not associate Walmart with online or they default to Amazon,” he said in a note.

“This is a tough nut for Walmart to crack, and one that it can only break by more heavily marketing its services and proposition.” Neil Saunders, GlobalData Retail

Related: Using Your Logistics Expertise as a Competitive Weapon When It Comes To Ecommerce

Related Resources

Ecommerce Logistics Leader Series New!

Co-written by Adrian Gonzalez and Mike Glodziak, this ecommerce logistics leader series describes how you can get to market faster, by leveraging your existing network, resources, and relationships to their fullest potential as well as how you can use logistics as a competitive weapon. Download Now!

International Transportation: Price Matters, But At What Cost?

This ebook is a comprehensive guide to international transportation, that will help logistics managers better evaluate and plan their; supply chain strategy, logistics infrastructure, and risk mitigation strategy. Download Now!

Keeping Up with the Retail Consumer

6 supply chain disciplines retailers must master - developed by Adrian Gonzalez, founder and president of Adelante SCM and LEGACY Supply Chain Services, with a foreword from Rick Blasgen, president and CEO, CSCMP. Download Now!

Rapidly Improve the Performance of Your Warehouse

The Rapid Performance Evaluation identifies opportunities and potential improvements in every aspect of warehouse operations; performance, productivity, service, quality, and systems. Download Now!

Creating Superior Customer Experiences through an Optimized Supply Chain

This paper describes in detail the Jagged Peak ACES model and how it can be used as a methodology for measuring each element of the order lifecycle and its impact on customer experience. Download Now!

Why Outsource Your Direct-to-Customer eCommerce Channel?

To better focus on their core competencies, more and more manufacturers recognize that outsourcing is an effective and economical way to manage their direct-to-customer (D2C) eCommerce channel. Download Now!

More LEGACY Supply Chain Services Resources

Article Topics

LEGACY Supply Chain Services News & Resources

Outsourcing eCommerce Fulfillment to a 3PL Rapidly Improve the Performance of Your Warehouse Logistics 20 Warehouse & Distribution Center Best Practices for Your Supply Chain Warehouse Contingency Planning Template 7 Last Mile Logistics Delivery & Ecommerce Trends You Don’t Want to Overlook Increase Inventory Visibility across Your Supply Chain and Optimize Omni-Channel Fulfillment Omni-Channel Logistics Leaders: Top 5 Inventory Insights More LEGACY Supply Chain ServicesLatest in Business

Ranking the Top 20 Women in Supply Chain TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process U.S. Manufacturing Gains Momentum After Another Strong Month More Business