Walmart Online Ecommerce Sales Soar 69% as Retail Giant Pursues Amazon

Walmart's U.S. business is still showing signs of thriving, as evidenced by the company's fiscal first-quarter results, its U.S. ecommerce gross merchandise volume grew a whopping 69% fueled largely by more clicks and sales on Walmart.com.

Walmart's aggressive moves online and revamping of its network of stores helped it defy the gravity sinking the sales of other retailers, with the chain experiencing an uptick in sales at the start of the year.

The biggest retailer in the world has been aggressively chasing Amazon, bringing an array of specialized sites into its fold, and going tit for tat with the e-commerce giant when it comes to free shipping.

Those efforts appeared to bear fruit as Walmart saw a 63% increase in online sales during the quarter that ended April 30.

And its continuing efforts to make its stores more appealing, lining its aisles with fresh produce and more premium products also paid off, as Walmart said Thursday that it saw a 1.5% increase in traffic during a quarter when retail rivals like Macy's and Target saw sales slip.

Ecommerce growth at Walmart U.S. was strong as sales and GMV increased 63% and 69%, respectively, the majority of this growth was organic through Walmart.com.

Walmart's recent acquisition of Jet.com, its competitive free-shipping threshold of $35 and its overall lower prices relative to peers have allowed the traditionally- brick-and-mortar retailer to make gains online.

Read: Walmart’s E-Commerce Future under Marc Lore Starting to Come Together

Shares of Walmart's stock were climbing around 1 percent during premarket trading following this news.

Here's what the company reported vs. what the Street was expecting:

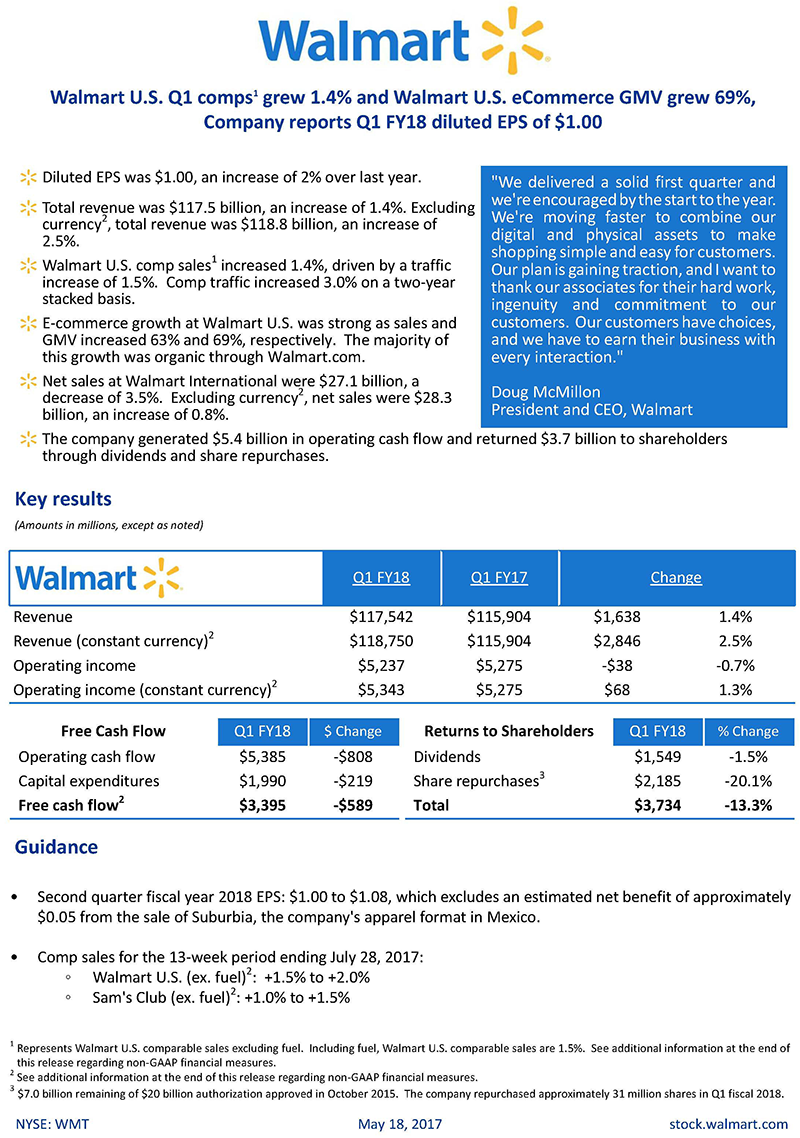

- Earnings per share: $1.00, excluding items, vs. expectations for 96 cents, according to Thomson Reuters analysts.

- Revenue: $117.5 billion vs. a forecast of $117.74 billion, analysts said.

- Same-store sales: 1.4 percent growth at U.S. stores, compared to an estimated 1.3 percent increase, according to FactSet.

Consolidated net income across all business segments fell to $3.04 billion, from $3.08 billion, due to an increase in the tax rate, Walmart said.

“We delivered a solid first quarter and we're encouraged by the start to the year,” Walmart CEO Doug McMillon said in a statement.

“We're moving faster to combine our digital and physical assets to make shopping simple and easy for customers. Our plan is gaining traction.”

Read: 3 Predictions for the Future of Retail from Walmart CEO Doug McMillon

Walmart said it now expects to earn between $1 and $1.08 per share during the second-quarter, excluding a net benefit from the sale of Suburbia, the retailer's apparel format in Mexico. Thomson Reuters analysts had forecast earnings of $1.07 a share.

With respect to its international locations, sales were $27.1 billion for the first quarter, a decrease of 3.5 percent. Walmart no longer reports an overarching global figure for its e-commerce growth, instead choosing to focus on the U.S. market. Its domestic online performance has been outpacing results overseas, the retailer has said.

For fiscal 2018, Walmart has said it expects to earn between $4.20 and $4.40 a share.

“Overall, [Walmart's] investments have resulted in positive comparable store sales trends and improving traffic,” Stifel analyst Mark Astrachan wrote in a note to clients prior to Thursday's earnings. “Walmart's success, along with broadly weakening brick and mortar shopping trends, has caused competing retailers to respond with their own pricing actions.”

Related Article: Amazon Sets Sights on Home Furnishings Market

Related Papers

The eCommerce Challenge

Most of today’s retailers and their supply chain advisors understand the shift in retail sales to the online channel but, for many years, the inclusion of gasoline, groceries, and automobile sales in U.S. retail sales numbers masked the true extent of eCommerce penetration. Download Now!

Global E-Commerce Logistics 2016

The report contains Transport Intelligence’s bespoke market size and forecasting data, as well as overviews of some of the world’s leading e-commerce businesses, such as Alibaba and Amazon. Download Now!

Amazon’s Move into Delivery Logistics

Many industry players and experts are waiting anxiously to see what innovations Amazon will come up with next – and above all, whether Amazon will enter into delivery logistics under its own banner. Download Now!

Amazon’s Stranglehold

This report aims to pull back Amazon’s cloak of invisibility, it shows how the company’s tightening grip is stifling competition, eroding jobs, and threatening communities - it presents new data; draws on interviews with dozens of manufacturers, retailers, and others. Download Now!

Chasing Amazon: Building a Dynamic Warehouse Network

Most of Amazon’s competitors are feverishly playing catch-up, and if your company is among them, reassessing your supply chain design, particularly pricing and quick delivery, is a good place to start. Download Now!

Article Topics

MonarchFx News & Resources

Using Third-Party Logistics Providers to Chase Amazon’s Ecommerce Fulfillment Proficiency Walmart Online Ecommerce Sales Soar 69% as Retail Giant Pursues Amazon Walmart Close to Acquiring Bonobos to Boost Online Cachet for About $300 Million ‘Substantial Doubt Exists’ for Sears’ Ability to Continue - Sears Today, Walmart Tomorrow? Walmart Launches “Store No. 8” Tech Incubator, Promises More Acquisitions Amazon Web Services Back Up After Earlier Outage Amazon Has Still to Conquer the Chinese Market More MonarchFxLatest in Supply Chain

Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds More Supply Chain